Hair Stylist Tax Deduction Worksheet Form

What is the Hair Stylist Tax Deduction Worksheet

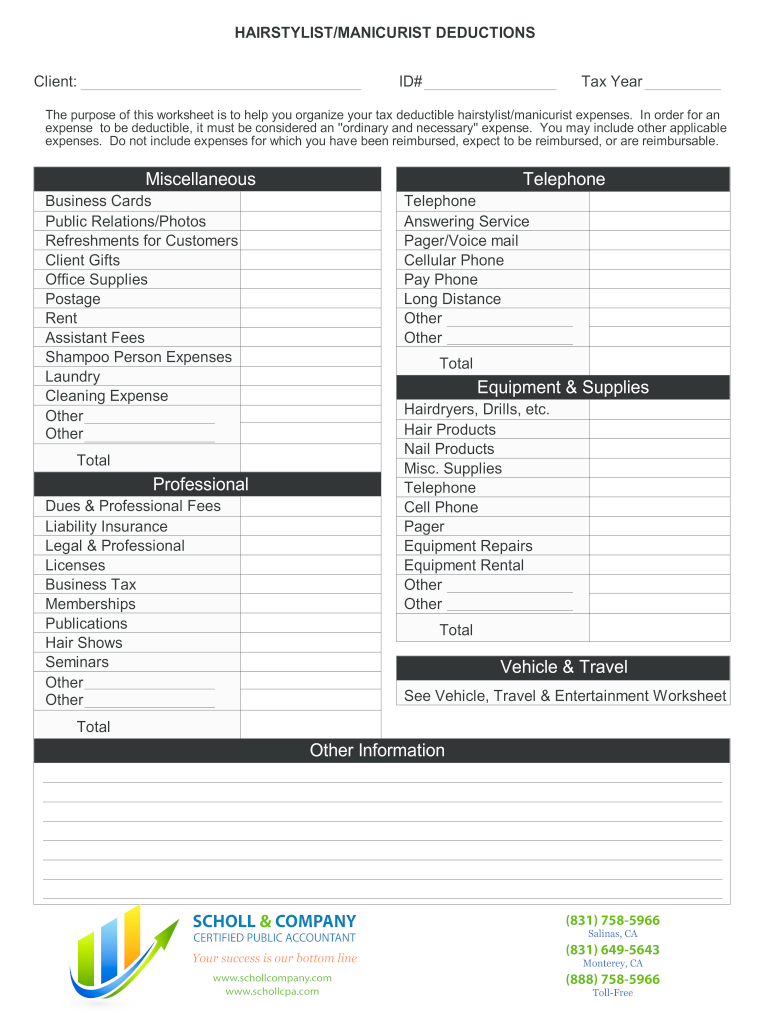

The Hair Stylist Tax Deduction Worksheet is a specialized document designed for self-employed hair stylists to track and calculate their tax deductions. This worksheet helps hairstylists itemize their business expenses, ensuring they maximize their eligible write-offs. It includes various categories such as supplies, equipment, and operating expenses, allowing users to maintain accurate records for tax filing purposes. By using this worksheet, hair stylists can simplify their tax preparation process and ensure compliance with IRS regulations.

How to use the Hair Stylist Tax Deduction Worksheet

Using the Hair Stylist Tax Deduction Worksheet involves several straightforward steps. First, gather all relevant receipts and invoices related to your business expenses. Next, categorize these expenses according to the sections outlined in the worksheet, such as supplies, advertising, and professional development. Fill in the worksheet with the total amounts for each category. Finally, sum the total deductions to determine your overall write-offs for the tax year. This organized approach not only aids in accurate reporting but also helps in identifying potential deductions that may have been overlooked.

Steps to complete the Hair Stylist Tax Deduction Worksheet

Completing the Hair Stylist Tax Deduction Worksheet can be broken down into a few essential steps:

- Collect all receipts and financial documents related to your hairstyling business.

- Review the categories listed on the worksheet, such as tools, products, and travel expenses.

- Input the amounts spent in each category, ensuring accuracy and completeness.

- Calculate the total deductions by summing all the amounts entered.

- Keep a copy of the completed worksheet for your records and future reference.

Legal use of the Hair Stylist Tax Deduction Worksheet

The Hair Stylist Tax Deduction Worksheet is legally recognized as a valid tool for documenting business expenses. To ensure its legal standing, it is crucial to maintain accurate records and receipts that support the entries made on the worksheet. This documentation can be essential in case of an audit by the IRS. Additionally, using the worksheet in compliance with IRS guidelines helps protect against potential penalties for incorrect reporting.

IRS Guidelines

The IRS provides specific guidelines regarding tax deductions for self-employed individuals, including hair stylists. It is important to familiarize yourself with these guidelines to ensure compliance. Key points include understanding which expenses are deductible, maintaining proper documentation, and adhering to filing deadlines. The IRS also offers resources and publications that detail allowable deductions, helping hairstylists navigate the complexities of tax reporting.

Required Documents

To effectively complete the Hair Stylist Tax Deduction Worksheet, several documents are necessary. These include:

- Receipts for all business-related purchases, such as tools and products.

- Invoices from suppliers or service providers.

- Bank statements and credit card statements showing business transactions.

- Any relevant contracts or agreements that pertain to your services.

Having these documents organized will facilitate a smoother completion of the worksheet and ensure accuracy in reporting.

Quick guide on how to complete hair stylist tax deduction worksheet

Effortlessly prepare Hair Stylist Tax Deduction Worksheet on any device

Digital document handling has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow offers all the features you require to create, edit, and eSign your documents swiftly, without delays. Manage Hair Stylist Tax Deduction Worksheet on any device using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to edit and eSign Hair Stylist Tax Deduction Worksheet with ease

- Locate Hair Stylist Tax Deduction Worksheet and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with features specifically designed by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which only takes a few seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, and errors that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your choosing. Edit and eSign Hair Stylist Tax Deduction Worksheet and guarantee outstanding communication throughout every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the hair stylist tax deduction worksheet

How to generate an electronic signature for a PDF in the online mode

How to generate an electronic signature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The best way to generate an eSignature straight from your smart phone

How to make an eSignature for a PDF on iOS devices

The best way to generate an eSignature for a PDF document on Android OS

People also ask

-

What is the hair stylist tax deduction worksheet PDF?

The hair stylist tax deduction worksheet PDF is a comprehensive document designed to help stylists track eligible business expenses throughout the year. It allows hair stylists to maximize their tax deductions by providing a detailed format for expense documentation, ensuring compliance with IRS regulations.

-

How can airSlate SignNow help with the hair stylist tax deduction worksheet PDF?

With airSlate SignNow, you can easily eSign and share your hair stylist tax deduction worksheet PDF, streamlining the process of filing your taxes. Our platform allows for secure collaboration and storage, making sure your important tax documents are organized and accessible whenever you need them.

-

Is there a cost associated with using the hair stylist tax deduction worksheet PDF?

While the hair stylist tax deduction worksheet PDF itself may be available for free through various sources, using airSlate SignNow to manage and eSign your documents may involve a subscription fee. However, this investment ensures you benefit from a secure, user-friendly experience that saves you time and reduces stress during tax season.

-

What features does airSlate SignNow offer for managing the hair stylist tax deduction worksheet PDF?

airSlate SignNow offers a variety of features for managing your hair stylist tax deduction worksheet PDF, including secure eSigning, document templates, and cloud storage. These features ensure that your documents are not only organized but also legally binding, facilitating a smoother tax preparation process.

-

Can I customize the hair stylist tax deduction worksheet PDF with airSlate SignNow?

Yes, airSlate SignNow allows you to customize your hair stylist tax deduction worksheet PDF to suit your specific needs. You can add your business logo, tailor fields to capture the unique expenses you incur, and create a personalized document that works best for your unique tax situation.

-

What are the advantages of using airSlate SignNow over other solutions for the hair stylist tax deduction worksheet PDF?

airSlate SignNow stands out by offering a user-friendly interface, robust security features, and excellent customer support. Unlike other solutions, it allows for easy eSigning of your hair stylist tax deduction worksheet PDF, helping you stay organized and compliant with tax laws without any hassle.

-

Are there integration options available for the hair stylist tax deduction worksheet PDF with airSlate SignNow?

Absolutely! airSlate SignNow offers integration options with various business tools, allowing you to seamlessly incorporate your hair stylist tax deduction worksheet PDF into your existing workflow. This flexibility means you can sync your documents with accounting software, ensuring all your financial records are in one place.

Get more for Hair Stylist Tax Deduction Worksheet

Find out other Hair Stylist Tax Deduction Worksheet

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement