Uniform Residential Loan Application First Education Federal Credit 2004-2026

What is the Uniform Residential Loan Application?

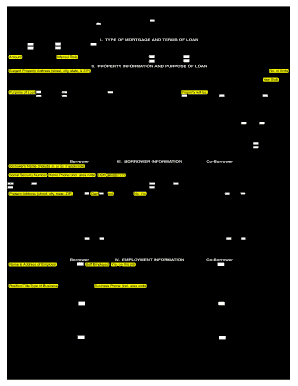

The Uniform Residential Loan Application (URLA), often referred to as the Freddie Fannie application, is a standardized form used by lenders to evaluate the creditworthiness of borrowers seeking a mortgage. This form collects essential information about the borrower, the property being purchased, and the financial details necessary for processing the loan. It is designed to streamline the mortgage application process, ensuring consistency and compliance across various lending institutions.

Key elements of the Uniform Residential Loan Application

Understanding the key elements of the URLA is crucial for applicants. The form typically includes sections that require personal information, such as:

- Borrower’s name, address, and contact details

- Employment history and income verification

- Assets and liabilities, including bank accounts and debts

- Property details, including the type and address of the property

- Loan details, such as the amount requested and purpose of the loan

Each of these elements plays a vital role in determining the applicant's eligibility for a mortgage loan.

Steps to complete the Uniform Residential Loan Application

Completing the URLA involves several steps that ensure all necessary information is accurately provided. Here’s a simple guide:

- Gather all required documents, including proof of income, tax returns, and asset statements.

- Fill out personal information accurately, ensuring that names and addresses match official documents.

- Provide detailed employment and income information, including your job title and duration of employment.

- List all assets and liabilities to give a complete financial picture.

- Review the completed application for accuracy before submission.

Following these steps can help streamline the application process and reduce the likelihood of delays.

Legal use of the Uniform Residential Loan Application

The URLA is legally binding once signed, which means that all information provided must be truthful and accurate. Misrepresentation or omission of information can lead to serious consequences, including loan denial or legal repercussions. It is essential for borrowers to understand that the lender may verify all details provided in the application.

Form Submission Methods

The URLA can be submitted through various methods, depending on the lender’s preferences. Common submission methods include:

- Online submission through the lender’s secure portal

- Mailing a hard copy of the completed application

- In-person submission at the lender’s office

Choosing the right submission method can facilitate a smoother application process.

Eligibility Criteria

Eligibility for a mortgage loan via the URLA is determined by several factors, including:

- Credit score: Lenders typically require a minimum score for approval.

- Income stability: A consistent income history is crucial.

- Debt-to-income ratio: This ratio helps lenders assess the borrower’s ability to repay the loan.

- Down payment: The size of the down payment can affect loan approval and terms.

Understanding these criteria can help applicants prepare effectively for their mortgage application.

Quick guide on how to complete uniform residential loan application first education federal credit

Prepare Uniform Residential Loan Application First Education Federal Credit effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to locate the correct form and safely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly with no delays. Manage Uniform Residential Loan Application First Education Federal Credit on any platform using airSlate SignNow's Android or iOS applications and streamline any document-based process today.

How to modify and electronically sign Uniform Residential Loan Application First Education Federal Credit with ease

- Locate Uniform Residential Loan Application First Education Federal Credit and click Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Highlight pertinent sections of the documents or obscure sensitive information using tools available through airSlate SignNow specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Uniform Residential Loan Application First Education Federal Credit to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the uniform residential loan application first education federal credit

How to generate an eSignature for a PDF in the online mode

How to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The best way to make an eSignature right from your smart phone

The best way to create an eSignature for a PDF on iOS devices

The best way to make an eSignature for a PDF on Android OS

People also ask

-

What is the Freddie Fannie application process?

The Freddie Fannie application process involves submitting the required documents to secure a mortgage or refinance a loan through Freddie Mac or Fannie Mae. By utilizing the airSlate SignNow platform, you can easily eSign and manage the necessary paperwork online, making the application process smoother and more efficient.

-

How does airSlate SignNow enhance the Freddie Fannie application experience?

airSlate SignNow enhances the Freddie Fannie application experience by providing an intuitive platform for eSigning documents and tracking their status. With features designed to save time and reduce errors, users can confidently manage their application on a secure platform, streamlining communications with lenders and agents.

-

What are the pricing options for using airSlate SignNow for my Freddie Fannie application?

airSlate SignNow offers flexible pricing plans tailored to fit various business needs, ensuring that you can find a budget-friendly option for your Freddie Fannie application. The pricing includes essential features like document management and eSignature capabilities, allowing users to maximize efficiency without breaking the bank.

-

Are there any integrations available with airSlate SignNow for the Freddie Fannie application?

Yes, airSlate SignNow integrates seamlessly with a variety of platforms and tools, making it easier to incorporate into your existing workflow for the Freddie Fannie application. Whether you're using CRM systems, cloud storage, or other business applications, SignNow ensures that you can share and sign documents effortlessly.

-

Can airSlate SignNow help with the documentation required for Freddie Fannie applications?

Absolutely! airSlate SignNow can assist you in managing and organizing all the necessary documentation required for Freddie Fannie applications. With the ability to upload, eSign, and automate document workflows, you can ensure that all paperwork is correctly completed and submitted on time.

-

Is airSlate SignNow secure for handling Freddie Fannie applications?

Yes, airSlate SignNow prioritizes security, making it a trusted choice for handling Freddie Fannie applications. The platform employs advanced encryption and compliance measures to protect sensitive information, ensuring that your documents are safe during the entire signing process.

-

What benefits does airSlate SignNow offer for my Freddie Fannie application?

The primary benefits of using airSlate SignNow for your Freddie Fannie application include increased efficiency, reduced paperwork, and enhanced collaboration. By streamlining the eSigning process and providing real-time tracking, you can expedite approvals and minimize delays in your application.

Get more for Uniform Residential Loan Application First Education Federal Credit

Find out other Uniform Residential Loan Application First Education Federal Credit

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation