Remote Deposit Slip Dort Federal Credit Union Form

What is the Remote Deposit Slip for Dort Federal Credit Union

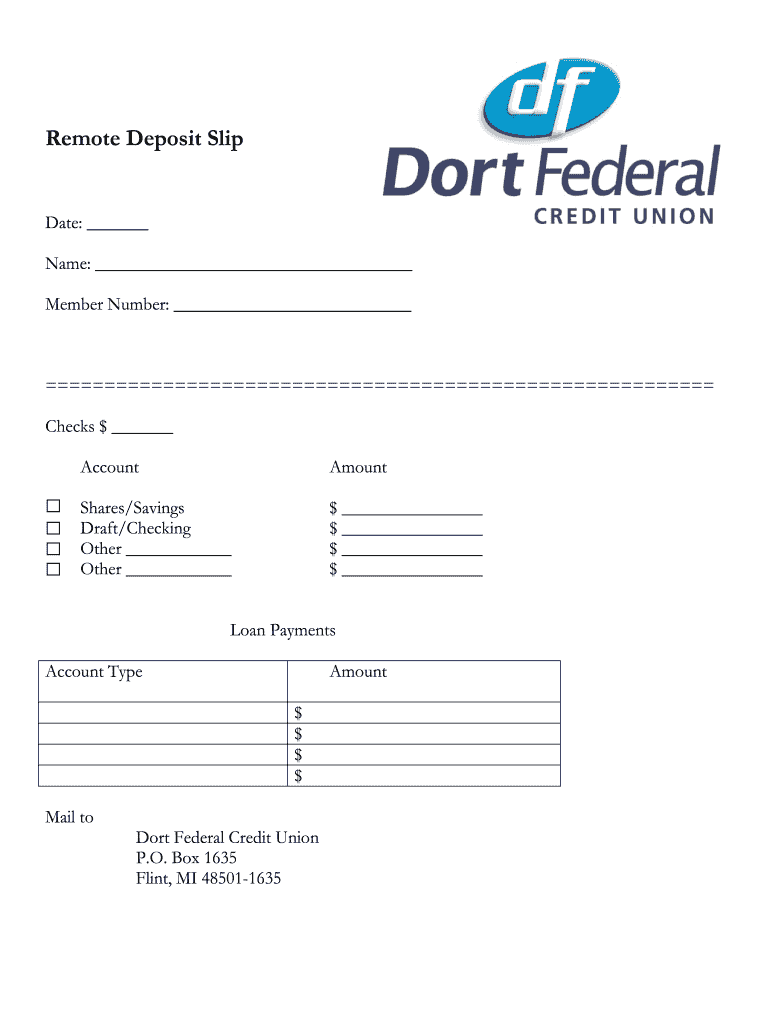

The Remote Deposit Slip for Dort Federal Credit Union is a specific document that allows members to deposit checks electronically using their mobile devices or computers. This slip is essential for ensuring that deposits are processed accurately and securely. It includes vital information such as the member's account number, the amount of the deposit, and the signature of the account holder. Utilizing this slip streamlines the deposit process, making it more convenient for members who prefer online banking.

How to Use the Remote Deposit Slip for Dort Federal Credit Union

Using the Remote Deposit Slip involves several straightforward steps. First, members need to access their Dort Federal Credit Union online banking account or mobile app. Once logged in, they can navigate to the remote deposit feature. After selecting the option to deposit a check, members should fill out the required fields on the remote deposit slip, including the amount and account details. Finally, they can take a photo of the check and submit the slip electronically. This method ensures that funds are deposited quickly and securely.

Steps to Complete the Remote Deposit Slip for Dort Federal Credit Union

Completing the Remote Deposit Slip is a simple process that can be done in a few easy steps:

- Log into your Dort Federal Credit Union online banking account or mobile app.

- Select the remote deposit option from the menu.

- Enter the amount of the check you wish to deposit.

- Fill in your account information as required.

- Photograph the front and back of the check, ensuring all details are clear.

- Review the information for accuracy and submit the slip.

Following these steps ensures that your deposit is processed without any issues.

Legal Use of the Remote Deposit Slip for Dort Federal Credit Union

The Remote Deposit Slip is legally binding when completed according to Dort Federal Credit Union's guidelines. For the deposit to be valid, the member must ensure that the check being deposited is endorsed correctly. This includes signing the back of the check and writing "For Mobile Deposit Only" along with the account number. Compliance with these requirements protects both the member and the credit union, ensuring that the transaction is legitimate and traceable.

Key Elements of the Remote Deposit Slip for Dort Federal Credit Union

Several key elements are essential for the Remote Deposit Slip to be valid and effective:

- Account Number: The member's unique account number to ensure the funds are deposited into the correct account.

- Deposit Amount: The total amount of the check being deposited.

- Signature: The account holder's signature, which verifies their consent for the transaction.

- Date: The date of the deposit, which is crucial for record-keeping.

Ensuring that all these elements are accurately filled out is vital for a successful deposit.

Quick guide on how to complete remote deposit slip dort federal credit union

Prepare Remote Deposit Slip Dort Federal Credit Union with ease on any device

Web-based document management has become widely embraced by both businesses and individuals. It offers a superb eco-friendly substitute to traditional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow equips you with all the resources needed to create, alter, and eSign your documents quickly and without delays. Manage Remote Deposit Slip Dort Federal Credit Union on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to alter and eSign Remote Deposit Slip Dort Federal Credit Union effortlessly

- Find Remote Deposit Slip Dort Federal Credit Union and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you select. Modify and eSign Remote Deposit Slip Dort Federal Credit Union and ensure excellent communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the remote deposit slip dort federal credit union

The best way to create an eSignature for a PDF file in the online mode

The best way to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your smartphone

The way to generate an eSignature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF document on Android

People also ask

-

What is a dort routing number?

A dort routing number is a unique nine-digit number used to identify financial institutions in the United States. It is crucial for processing various financial transactions, such as wire transfers and direct deposits. Knowing your dort routing number can help streamline your banking operations.

-

How can I find my dort routing number?

You can find your dort routing number on your checks or by logging into your bank's online banking portal. Additionally, your bank's customer service can provide you with this information. It’s essential to ensure you have the correct dort routing number for accurate transactions.

-

Is there a cost associated with using the dort routing number feature?

Using your dort routing number for transactions is typically free; however, some banks may charge fees for certain types of transactions. Make sure to check with your financial institution for any potential fees. Utilizing the dort routing number efficiently can save you both time and money.

-

What features does airSlate SignNow offer regarding document eSigning?

airSlate SignNow allows for seamless document eSigning along with features such as document templates, collaborative workflows, and status tracking. These features help streamline your document workflow while ensuring that all parties have the correct dort routing number, if required for payments or verifications. It’s designed to make the signing process efficient and fully digital.

-

Can airSlate SignNow integrate with my existing software for managing the dort routing number?

Yes, airSlate SignNow offers integrations with various software solutions, including accounting and financial management tools that handle routing numbers. This integration helps maintain accuracy and efficiency in managing financial transactions that require the dort routing number. You can easily synchronize your documents and information across platforms.

-

What are the benefits of using airSlate SignNow for eSigning documents?

Using airSlate SignNow provides several benefits, including enhanced security, easy-to-manage workflows, and quick turnaround times for document signing. With the ability to easily use your dort routing number when needed, it simplifies processes like payment verifications and contract signing. This ultimately results in greater efficiency for your business.

-

Is airSlate SignNow suitable for small businesses needing to manage dort routing numbers?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small businesses. It provides an affordable and user-friendly solution to manage documents while allowing you to incorporate your dort routing number as needed for transactions. This is particularly beneficial for smaller enterprises seeking streamlined operational processes.

Get more for Remote Deposit Slip Dort Federal Credit Union

Find out other Remote Deposit Slip Dort Federal Credit Union

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement