Credit Reference Request Form

What is the credit reference request?

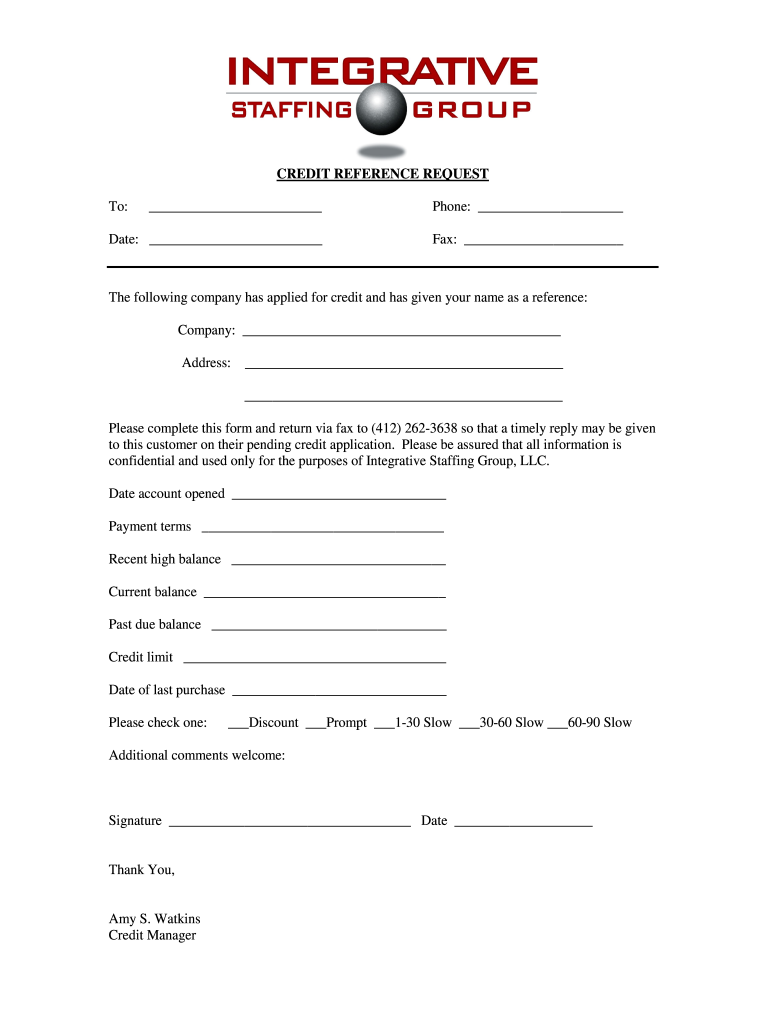

A credit reference request is a formal document used by individuals or businesses to obtain information about a person's or entity's creditworthiness. This form typically includes details such as the applicant's name, address, and social security number or tax identification number. It may also require the names of creditors or financial institutions that can provide information about the applicant's credit history. The primary purpose of this request is to facilitate the assessment of credit risk when applying for loans, leases, or other financial services.

How to complete the credit reference request

Filling out a credit reference request involves several key steps. First, gather all necessary information, including personal identification details and the names of references. Next, clearly state the purpose of the request, ensuring that it aligns with the requirements of the institution requesting the information. It is essential to provide accurate and complete details to avoid delays. Once the form is filled out, review it for any errors before submitting it to the relevant parties, either electronically or via mail.

Key elements of the credit reference request

When creating a credit reference request, certain elements are crucial for its effectiveness. These include:

- Applicant Information: Full name, address, and contact details.

- Reference Details: Names and contact information of individuals or institutions providing the credit reference.

- Purpose of Request: A clear statement explaining why the credit reference is needed.

- Signature: The applicant's signature, which authorizes the release of credit information.

Including these elements ensures that the request is comprehensive and meets the expectations of the institutions involved.

Legal use of the credit reference request

The legal use of a credit reference request is governed by various laws and regulations that protect consumer rights. In the United States, the Fair Credit Reporting Act (FCRA) outlines the requirements for obtaining and using credit information. It mandates that individuals must provide consent before their credit information can be shared. Additionally, institutions must ensure that they handle personal data securely and responsibly, maintaining compliance with applicable privacy laws.

Examples of using the credit reference request

Credit reference requests are commonly used in various scenarios, such as:

- Loan Applications: Lenders often require a credit reference to assess the risk of lending money.

- Rental Agreements: Landlords may request credit references to evaluate potential tenants' financial reliability.

- Business Partnerships: Companies may seek credit references to ensure that potential partners have a solid financial background.

These examples illustrate the importance of credit reference requests in making informed financial decisions.

Steps to obtain the credit reference request

To obtain a credit reference request, follow these steps:

- Identify the Need: Determine the purpose of the credit reference request, such as applying for a loan or rental agreement.

- Contact Relevant Institutions: Reach out to banks, credit unions, or financial institutions that can provide the necessary forms.

- Fill Out the Form: Complete the credit reference request form accurately, ensuring all required information is included.

- Submit the Request: Send the completed form to the appropriate institution, either electronically or by mail.

Following these steps can help streamline the process of obtaining a credit reference.

Quick guide on how to complete credit reference request 100350381

Complete Credit Reference Request effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents rapidly without delays. Manage Credit Reference Request on any platform with airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

How to modify and electronically sign Credit Reference Request with ease

- Obtain Credit Reference Request and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or downloading it to your computer.

Put an end to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Credit Reference Request and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the credit reference request 100350381

The best way to create an eSignature for a PDF document online

The best way to create an eSignature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The way to generate an electronic signature straight from your smart phone

The way to generate an eSignature for a PDF document on iOS

The way to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is a credit reference template and how can it benefit my business?

A credit reference template is a standardized document used to provide information about a borrower's creditworthiness. By utilizing a credit reference template, your business can streamline the process of assessing potential clients, improve the consistency of information provided, and enhance communication between parties.

-

How much does it cost to use airSlate SignNow's credit reference template?

airSlate SignNow offers competitive pricing plans that include access to customizable templates like the credit reference template. Pricing can vary based on the features you choose, so it's advisable to check our pricing page for the most accurate information and to find a plan that fits your needs.

-

Can I customize the credit reference template in airSlate SignNow?

Yes, the credit reference template available in airSlate SignNow is fully customizable. You can modify the template to include specific fields, terms, and conditions that are relevant to your business, ensuring that it meets your unique requirements.

-

Is it easy to integrate the credit reference template with other software?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, allowing you to easily incorporate the credit reference template into your existing workflows. This helps in managing documents efficiently without disrupting your current processes.

-

What features does airSlate SignNow provide for the credit reference template?

airSlate SignNow enhances the credit reference template with features such as eSigning, document tracking, and secure storage. These features help you manage the entire document lifecycle efficiently, ensuring transparency and accountability throughout the process.

-

How does the credit reference template enhance the document signing experience?

The credit reference template improves the document signing experience by allowing for quick and efficient eSigning directly within the platform. This reduces turnaround time, enhances user satisfaction, and fosters a more professional relationship with your clients.

-

What security measures does airSlate SignNow take for the credit reference template?

Security is a top priority at airSlate SignNow. When using the credit reference template, you can be assured of strong encryption, secure access controls, and compliance with industry standards to protect your sensitive information and maintain client trust.

Get more for Credit Reference Request

- Validity power attorney form

- Colorado exclusive right to buy contract for all property types form

- Colorado exclusive right to sell listing contract for all types of properties form

- Property deed trust form

- Colorado workers compensation form

- Colorado revocation form

- Connecticut construction contract cost plus or fixed fee form

- Bylaws 481379310 form

Find out other Credit Reference Request

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer