Tads Form

What is the Tads Form

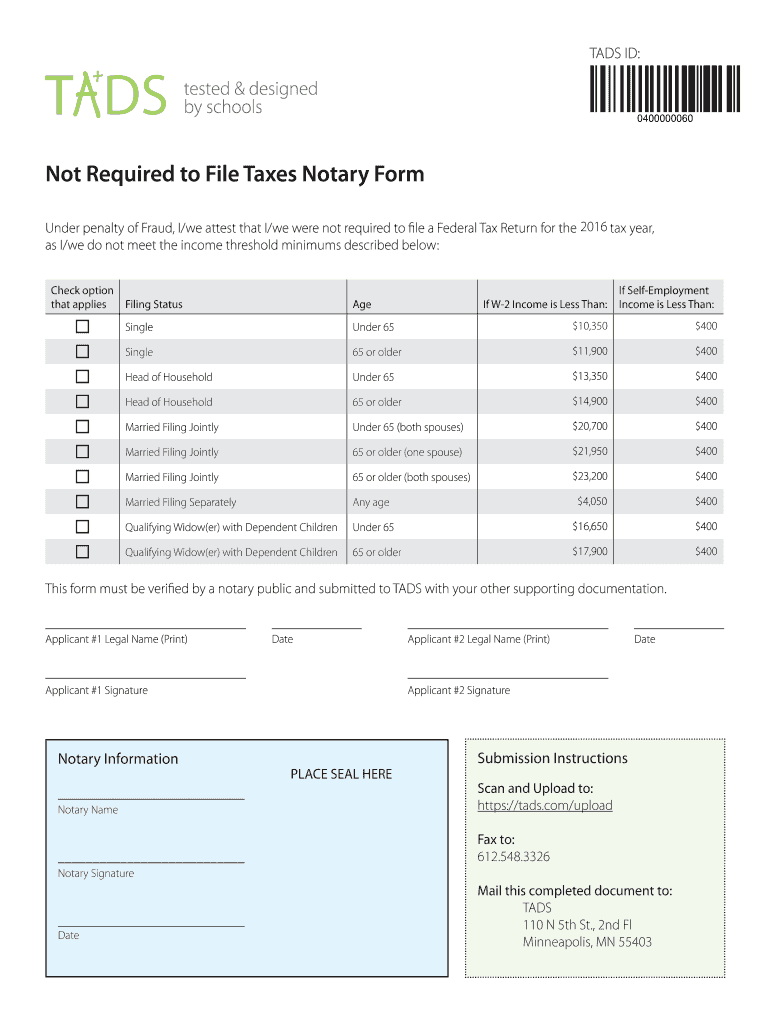

The Tads form, commonly referred to as the Tads taxes form, is an essential document used for various tax-related purposes in the United States. This form is primarily utilized by individuals and businesses to report income, deductions, and credits to the Internal Revenue Service (IRS). Understanding the function and requirements of the Tads form is crucial for accurate tax filing and compliance with federal regulations.

How to use the Tads Form

Using the Tads form involves several steps to ensure proper completion and submission. First, gather all necessary financial documents, including income statements and receipts for deductions. Next, fill out the Tads form accurately, ensuring that all information is complete and correct. After completing the form, review it for any errors before submitting it to the appropriate tax authority. Utilizing digital tools can streamline this process, allowing for easy editing and secure submission.

Steps to complete the Tads Form

Completing the Tads form requires careful attention to detail. Follow these steps for successful completion:

- Gather all relevant financial documents.

- Download or access the Tads form online.

- Fill in personal information, including name, address, and Social Security number.

- Report income sources as required.

- List any applicable deductions and credits.

- Review the completed form for accuracy.

- Submit the form electronically or by mail, depending on your preference.

Legal use of the Tads Form

The Tads form is legally recognized when completed and submitted according to IRS guidelines. To ensure its legal validity, it must be signed and dated by the taxpayer. Additionally, electronic signatures are acceptable under the ESIGN and UETA acts, provided that the signer has consented to use electronic records. Compliance with these regulations is essential for the form to be considered legally binding.

Filing Deadlines / Important Dates

Filing deadlines for the Tads form vary depending on the specific tax year and the taxpayer's situation. Generally, individual taxpayers must submit their forms by April fifteenth of each year. However, extensions may be available under certain circumstances. It is important to stay informed about any changes to deadlines to avoid penalties and ensure timely filing.

Required Documents

To complete the Tads form accurately, certain documents are necessary. These typically include:

- W-2 forms from employers.

- 1099 forms for additional income.

- Receipts for deductible expenses.

- Previous year’s tax return for reference.

- Any relevant financial statements.

Form Submission Methods (Online / Mail / In-Person)

The Tads form can be submitted through various methods, offering flexibility to taxpayers. Online submission is the most efficient, allowing for immediate processing and confirmation. Alternatively, forms can be mailed to the appropriate tax office or submitted in person at designated locations. Each method has its own requirements and timelines, so it is important to choose the one that best suits your needs.

Quick guide on how to complete tads form

Prepare Tads Form effortlessly on any device

Web-based document management has gained traction among organizations and individuals. It offers an ideal environmentally friendly substitute to conventional printed and signed papers since you can access the right template and securely keep it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage Tads Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to modify and eSign Tads Form with ease

- Find Tads Form and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant parts of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign Tads Form and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tads form

The best way to generate an eSignature for a PDF file online

The best way to generate an eSignature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

How to create an eSignature right from your mobile device

How to create an eSignature for a PDF file on iOS

How to create an eSignature for a PDF on Android devices

People also ask

-

What is a tads form and how does it work with airSlate SignNow?

A tads form is a digital document used for collecting information in a structured format. With airSlate SignNow, you can easily create, send, and eSign tads forms, streamlining your workflow and ensuring that all data is captured accurately and securely.

-

Are there any costs associated with using tads forms on airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that include the use of tads forms. You can choose a subscription that best fits your business needs, with options for unlimited usage and additional features available at higher tiers.

-

Can I customize my tads form using airSlate SignNow?

Absolutely! airSlate SignNow allows you to fully customize your tads forms by adding different fields, logos, and branding elements. This ensures that your forms align with your company’s identity while providing the necessary information structure.

-

What are the main benefits of using tads forms with airSlate SignNow?

Using tads forms with airSlate SignNow enhances efficiency by enabling quick data collection and electronic signatures. This not only reduces paper usage but also expedites the entire document management process, allowing your team to focus on more important tasks.

-

How do I integrate tads forms with other applications using airSlate SignNow?

airSlate SignNow offers various integration options, allowing you to connect your tads forms with popular applications like Google Drive, Dropbox, and CRM systems. This integration helps streamline data transfer and keeps all your documents in sync across platforms.

-

Are tads forms secure when using airSlate SignNow?

Yes, tads forms created with airSlate SignNow are highly secure. The platform complies with industry standards for data protection, including encryption and strict access controls, ensuring your documents and data remain safe throughout the signing process.

-

Is there a mobile app for managing tads forms through airSlate SignNow?

Yes, airSlate SignNow has a user-friendly mobile app that allows you to manage tads forms on the go. You can easily create, send, and eSign documents directly from your mobile device, providing flexibility and convenience for busy professionals.

Get more for Tads Form

- Idaho assignment of deed of trust by corporate mortgage holder form

- Idaho notice of default in payment of rent as warning prior to demand to pay or terminate for residential property form

- Idaho notice of creditors form

- Idaho waiver of accounting form

- Idaho revocation of living trust form

- Easement form sample

- Durable power attorney form printable

- Idaho satisfaction release or cancellation of deed of trust by corporation form

Find out other Tads Form

- How Do I eSign Nevada Business Insurance Quotation Form

- eSign New Mexico Business Insurance Quotation Form Computer

- eSign Tennessee Business Insurance Quotation Form Computer

- How To eSign Maine Church Directory Form

- How To eSign New Hampshire Church Donation Giving Form

- eSign North Dakota Award Nomination Form Free

- eSignature Mississippi Demand for Extension of Payment Date Secure

- Can I eSign Oklahoma Online Donation Form

- How Can I Electronic signature North Dakota Claim

- How Do I eSignature Virginia Notice to Stop Credit Charge

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement