Florida Customer Credit Application Marjam 2017

What is the Florida Customer Credit Application Marjam

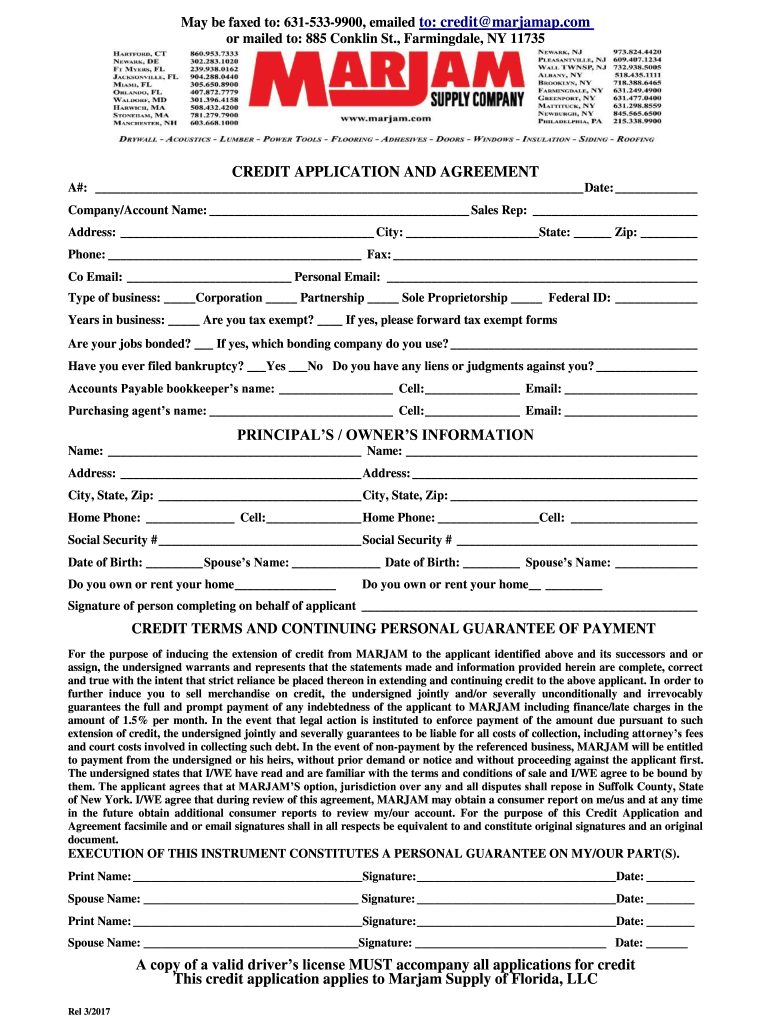

The Florida Customer Credit Application Marjam is a specific form used by businesses and individuals to apply for credit with Marjam, a supplier in the construction industry. This application is essential for establishing a credit account, allowing customers to purchase materials and services on credit terms. The form collects vital information about the applicant, including business details, financial history, and references, which help Marjam assess the creditworthiness of the applicant.

Steps to complete the Florida Customer Credit Application Marjam

Completing the Florida Customer Credit Application Marjam involves several straightforward steps:

- Gather necessary information, including your business name, address, and contact details.

- Provide financial information, such as annual revenue and banking details.

- List trade references that can vouch for your credit history.

- Review the application for accuracy and completeness.

- Sign the application electronically or manually, ensuring that all required signatures are included.

- Submit the application through the designated method, whether online or via mail.

Legal use of the Florida Customer Credit Application Marjam

The Florida Customer Credit Application Marjam is legally binding when completed correctly. To ensure its validity, the application must meet specific legal requirements, including obtaining proper signatures and adhering to eSignature regulations. Utilizing a reliable platform like signNow can help maintain compliance with laws such as the ESIGN Act and UETA, which govern electronic signatures in the United States.

Key elements of the Florida Customer Credit Application Marjam

Several key elements are crucial to the Florida Customer Credit Application Marjam:

- Applicant Information: Details about the individual or business applying for credit.

- Financial Information: Data regarding income, expenses, and existing debts.

- Trade References: Contacts who can provide insights into the applicant's credit history.

- Signature Section: A place for the applicant to sign and date the application, confirming its accuracy.

How to use the Florida Customer Credit Application Marjam

Using the Florida Customer Credit Application Marjam is a straightforward process. Begin by accessing the form, either online or in print. Fill out the required fields with accurate information, ensuring that all data is current and complete. After completing the form, review it for any errors or omissions. Once verified, submit the application through the preferred method, allowing Marjam to process your request for credit.

Eligibility Criteria for the Florida Customer Credit Application Marjam

To be eligible for the Florida Customer Credit Application Marjam, applicants typically need to meet certain criteria. These may include:

- Being a registered business entity in Florida.

- Providing accurate financial information and trade references.

- Demonstrating a history of responsible credit use.

Meeting these criteria helps ensure a smoother application process and increases the likelihood of credit approval.

Quick guide on how to complete florida customer credit application marjam

Prepare Florida Customer Credit Application Marjam effortlessly on any device

Digital document management has gained traction with organizations and individuals alike. It offers an ideal environmentally friendly substitute to traditional printed and signed forms, as you can locate the right template and securely store it online. airSlate SignNow equips you with all the necessary tools to generate, alter, and electronically sign your documents swiftly without any hold-ups. Manage Florida Customer Credit Application Marjam on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to alter and eSign Florida Customer Credit Application Marjam with minimal effort

- Obtain Florida Customer Credit Application Marjam and click Get Form to begin.

- Utilize the resources we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information using the tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or disorganized files, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from the device of your choice. Edit and eSign Florida Customer Credit Application Marjam and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct florida customer credit application marjam

Create this form in 5 minutes!

How to create an eSignature for the florida customer credit application marjam

The best way to generate an eSignature for your PDF document online

The best way to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

How to create an electronic signature right from your smart phone

How to create an electronic signature for a PDF document on iOS

How to create an electronic signature for a PDF on Android OS

People also ask

-

What is the Florida Customer Credit Application Marjam?

The Florida Customer Credit Application Marjam is a specialized form designed to streamline the credit application process for customers in Florida. It allows businesses to gather essential information efficiently while ensuring compliance with local regulations. By using this application, companies can improve their onboarding speed and enhance customer experience.

-

How does the Florida Customer Credit Application Marjam benefit my business?

Utilizing the Florida Customer Credit Application Marjam can signNowly reduce the time and effort involved in processing credit applications. This form helps in collecting necessary customer details accurately, which reduces errors and speeds up approval times. The effective management of customer credit applications enhances overall operational efficiency.

-

What features are included in the Florida Customer Credit Application Marjam?

The Florida Customer Credit Application Marjam includes user-friendly fields for customer information, digital signature capabilities, and secure document storage. Users can easily customize the application to suit their business needs while ensuring data security and compliance. It’s designed to facilitate a straightforward and efficient credit application process.

-

Is the Florida Customer Credit Application Marjam cost-effective?

Yes, the Florida Customer Credit Application Marjam is a cost-effective solution for businesses looking to streamline their credit applications. By reducing the need for paper processes and manual data entry, companies can save on operational costs. The purchase of this software is justified by its ability to enhance productivity and minimize errors.

-

Can I integrate the Florida Customer Credit Application Marjam with other software?

Absolutely! The Florida Customer Credit Application Marjam can seamlessly integrate with various business tools such as CRM systems, accounting software, and other document management solutions. This integration ensures that all customer data is synchronized across platforms, enhancing workflow efficiency and information accuracy.

-

How secure is the Florida Customer Credit Application Marjam?

The Florida Customer Credit Application Marjam is designed with robust security features to protect sensitive customer information. This includes encryption, secure cloud storage, and compliance with industry standards for data protection. Users can confidently manage their credit applications knowing that customer data is safeguarded.

-

What is the turnaround time for processing applications using the Florida Customer Credit Application Marjam?

The turnaround time for processing applications with the Florida Customer Credit Application Marjam varies depending on the business's internal processes but is signNowly reduced compared to traditional methods. With automated data collection and electronic signatures, businesses can expect faster approvals, often within the same day. This enables quicker customer onboarding.

Get more for Florida Customer Credit Application Marjam

Find out other Florida Customer Credit Application Marjam

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form