Federal Direct Consolidation Loan Application and Promissory Note Loanconsolidation Ed 2010

What is the Federal Direct Consolidation Loan Application and Promissory Note Loanconsolidation Ed

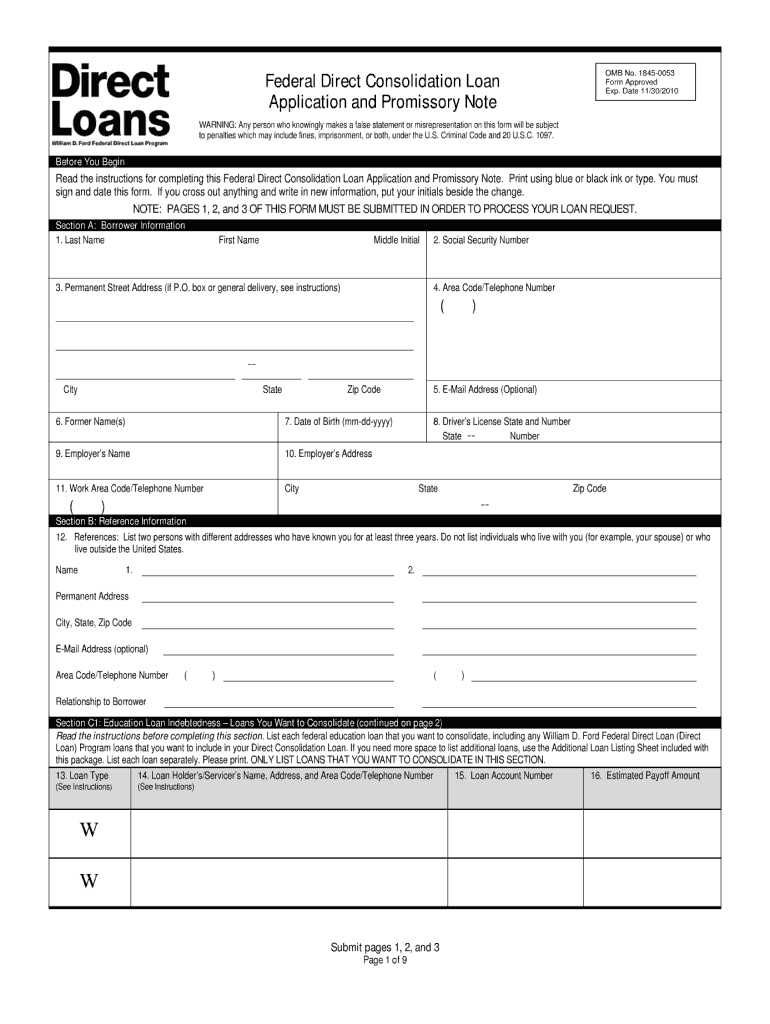

The Federal Direct Consolidation Loan Application and Promissory Note Loanconsolidation Ed is a crucial document for borrowers looking to consolidate their federal student loans into a single loan. This application allows individuals to combine multiple federal loans into one, simplifying repayment by offering a single monthly payment. The promissory note serves as a legal agreement between the borrower and the U.S. Department of Education, outlining the terms and conditions of the consolidated loan. Understanding this form is essential for managing student loan debt effectively.

Steps to complete the Federal Direct Consolidation Loan Application and Promissory Note Loanconsolidation Ed

Completing the Federal Direct Consolidation Loan Application involves several important steps to ensure accuracy and compliance. First, gather all necessary information about your existing federal loans, including loan balances and servicer details. Next, visit the Federal Student Aid website to access the online application. Fill out the required fields, providing personal information, loan details, and any requested documentation. Review your application carefully for errors before submitting it electronically. Once submitted, you will receive a confirmation, and the processing of your application will begin.

How to use the Federal Direct Consolidation Loan Application and Promissory Note Loanconsolidation Ed

Using the Federal Direct Consolidation Loan Application is straightforward. Begin by accessing the application through the official Federal Student Aid website. Follow the prompts to enter your information accurately. The application will guide you through each section, ensuring you provide all necessary details. After completing the application, you will be required to sign the promissory note electronically, which confirms your agreement to the loan terms. Ensure you keep a copy of the signed document for your records.

Legal use of the Federal Direct Consolidation Loan Application and Promissory Note Loanconsolidation Ed

The legal use of the Federal Direct Consolidation Loan Application and Promissory Note is governed by federal regulations. This form must be filled out accurately and honestly, as providing false information can lead to serious legal consequences. The electronic signature on the promissory note is legally binding, provided it complies with the Electronic Signatures in Global and National Commerce (ESIGN) Act. This ensures that the document is valid and enforceable in a court of law, protecting both the borrower and the lender.

Eligibility Criteria

To be eligible for the Federal Direct Consolidation Loan, borrowers must meet specific criteria. Only federal student loans are eligible for consolidation, which includes Direct Loans, Stafford Loans, and PLUS Loans. Borrowers should not be in default on their loans unless they are willing to make arrangements to bring the loans out of default before applying. Additionally, borrowers must be enrolled in a repayment plan or have completed their grace period. Understanding these criteria is essential for a successful application process.

Required Documents

When applying for the Federal Direct Consolidation Loan, certain documents are necessary to support your application. These typically include your Social Security number, details about your existing federal loans, and any relevant income information. It may also be helpful to have your loan servicer's contact information on hand. Having these documents ready will streamline the application process and help ensure that all required information is submitted accurately.

Quick guide on how to complete federal direct consolidation loan application and promissory note loanconsolidation ed

Accomplish Federal Direct Consolidation Loan Application And Promissory Note Loanconsolidation Ed seamlessly on any gadget

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without interruptions. Manage Federal Direct Consolidation Loan Application And Promissory Note Loanconsolidation Ed on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest method to modify and electronically sign Federal Direct Consolidation Loan Application And Promissory Note Loanconsolidation Ed with ease

- Locate Federal Direct Consolidation Loan Application And Promissory Note Loanconsolidation Ed and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as an ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of sharing your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Federal Direct Consolidation Loan Application And Promissory Note Loanconsolidation Ed and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct federal direct consolidation loan application and promissory note loanconsolidation ed

Create this form in 5 minutes!

How to create an eSignature for the federal direct consolidation loan application and promissory note loanconsolidation ed

The way to create an electronic signature for a PDF file in the online mode

The way to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

How to make an eSignature from your smartphone

The best way to create an eSignature for a PDF file on iOS devices

How to make an eSignature for a PDF file on Android

People also ask

-

What is the Federal Direct Consolidation Loan Application And Promissory Note Loanconsolidation Ed?

The Federal Direct Consolidation Loan Application And Promissory Note Loanconsolidation Ed is a program that allows borrowers to consolidate their federal student loans into a single loan. This can simplify payments and may lead to lower monthly payments or extended repayment terms. By using airSlate SignNow, you can easily complete and sign your application online.

-

How does the Federal Direct Consolidation Loan Application And Promissory Note Loanconsolidation Ed benefit borrowers?

This consolidation program helps borrowers streamline their loan repayment process by combining multiple federal loans into one. This can provide more manageable monthly payments and may offer access to different repayment plans or forgiveness programs. Additionally, using airSlate SignNow makes submitting your application easy and efficient.

-

What documents do I need to complete the Federal Direct Consolidation Loan Application And Promissory Note Loanconsolidation Ed?

To complete the Federal Direct Consolidation Loan Application And Promissory Note Loanconsolidation Ed, you will typically need to provide information about your current federal loans, your income, and financial obligations. Having your existing loan details at hand will help make the application process smoother. With airSlate SignNow, you can upload necessary documents securely.

-

Is there a fee to apply for the Federal Direct Consolidation Loan Application And Promissory Note Loanconsolidation Ed?

There are no fees associated with applying for the Federal Direct Consolidation Loan Application And Promissory Note Loanconsolidation Ed through the federal program. However, using services like airSlate SignNow may come with a low-cost subscription, which is a worthwhile investment for the simplicity and efficiency it provides in managing your paperwork.

-

Can I customize my repayment plan after completing the Federal Direct Consolidation Loan Application And Promissory Note Loanconsolidation Ed?

Yes, after your application for the Federal Direct Consolidation Loan Application And Promissory Note Loanconsolidation Ed is approved, you can choose from various repayment plans to suit your financial situation. This flexibility allows you to select the most appropriate plan, whether it's a standard, graduated, or income-driven repayment option. AirSlate SignNow makes it easy to manage any changes electronically.

-

How long does the approval process take for the Federal Direct Consolidation Loan Application And Promissory Note Loanconsolidation Ed?

The approval time for the Federal Direct Consolidation Loan Application And Promissory Note Loanconsolidation Ed can vary but generally takes 30 to 60 days. Factors influencing the timeline may include the number of loans being consolidated and the accuracy of the submitted documentation. Using airSlate SignNow can speed up the process by ensuring that all documents are properly completed and submitted.

-

What features does airSlate SignNow offer for the Federal Direct Consolidation Loan Application And Promissory Note Loanconsolidation Ed?

AirSlate SignNow offers features like electronic signatures, document tracking, and secure cloud storage, making it ideal for managing the Federal Direct Consolidation Loan Application And Promissory Note Loanconsolidation Ed. These features enhance your experience by ensuring that your application is completed accurately and submitted efficiently, improving overall user satisfaction.

Get more for Federal Direct Consolidation Loan Application And Promissory Note Loanconsolidation Ed

- Letter from landlord to tenant for failure to keep all plumbing fixtures in the dwelling unit as clean as their condition form

- Letter from landlord to tenant for failure to use electrical plumbing sanitary heating ventilating air conditioning and other form

- Letter from landlord to tenant as notice to tenant of tenants disturbance of neighbors peaceful enjoyment to remedy or lease form

- Letter from landlord to tenant as notice to tenant to inform landlord of tenants knowledge of condition causing damage to

- Alaska about law form

- Letter from tenant to landlord containing notice to landlord to withdraw improper rent increase due to violation of rent form

- Letter from tenant to landlord about insufficient notice of rent increase alaska form

- Letter from tenant to landlord containing notice to landlord to withdraw improper rent increase during lease alaska form

Find out other Federal Direct Consolidation Loan Application And Promissory Note Loanconsolidation Ed

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format