Federal Direct Consolidation Loan Application and Promissory Note William D Ford Federal Direct Loan Program 2016-2026

What is the Federal Direct Consolidation Loan Application and Promissory Note William D Ford Federal Direct Loan Program

The Federal Direct Consolidation Loan Application and Promissory Note William D Ford Federal Direct Loan Program is designed to help borrowers consolidate their federal student loans into a single loan. This program allows individuals to combine multiple federal loans, simplifying repayment by reducing the number of monthly payments. The consolidation loan typically comes with a fixed interest rate, which is calculated based on the weighted average of the interest rates of the loans being consolidated. This program is particularly beneficial for those seeking to manage their student loan debt more effectively.

Steps to Complete the Federal Direct Consolidation Loan Application and Promissory Note William D Ford Federal Direct Loan Program

Completing the Federal Direct Consolidation Loan Application and Promissory Note involves several key steps:

- Gather all necessary information about your existing federal loans, including loan balances and servicer details.

- Visit the official Federal Student Aid website to access the application form.

- Fill out the application form accurately, ensuring all required fields are completed.

- Review the terms and conditions of the consolidation loan, including the interest rate and repayment options.

- Sign the promissory note electronically or print it for manual signing, depending on your preference.

- Submit the completed application and promissory note to the loan servicer for processing.

Legal Use of the Federal Direct Consolidation Loan Application and Promissory Note William D Ford Federal Direct Loan Program

The legal use of the Federal Direct Consolidation Loan Application and Promissory Note is governed by federal laws that ensure the validity of electronic signatures and documents. Under the ESIGN Act and UETA, electronic signatures are recognized as legally binding, provided that the signer has consented to use electronic records. This means that when you electronically sign the application and promissory note, it holds the same legal weight as a handwritten signature, ensuring that your consolidation loan agreement is enforceable.

Eligibility Criteria for the Federal Direct Consolidation Loan Application and Promissory Note William D Ford Federal Direct Loan Program

To qualify for the Federal Direct Consolidation Loan, borrowers must meet specific eligibility criteria:

- You must have at least one federal student loan that is eligible for consolidation.

- Loans must be in repayment status, in grace period, or in deferment.

- Borrowers should not be in default on any federal loans, or if they are, they must have made satisfactory repayment arrangements.

- Only federal loans can be consolidated; private loans are not eligible.

How to Obtain the Federal Direct Consolidation Loan Application and Promissory Note William D Ford Federal Direct Loan Program

Obtaining the Federal Direct Consolidation Loan Application and Promissory Note is a straightforward process. Borrowers can access the application online through the Federal Student Aid website. Here, you will find the necessary forms and instructions to guide you through the application process. Additionally, you can contact your loan servicer for assistance or clarification regarding the application and any specific requirements you may need to fulfill.

Key Elements of the Federal Direct Consolidation Loan Application and Promissory Note William D Ford Federal Direct Loan Program

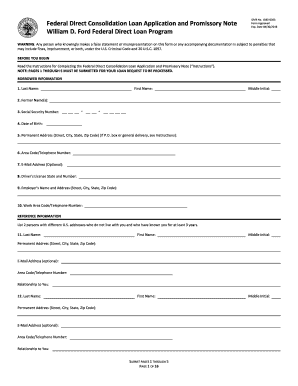

The key elements of the Federal Direct Consolidation Loan Application and Promissory Note include:

- Borrower information, including personal details and loan servicer information.

- A detailed list of the loans being consolidated, including their balances and interest rates.

- Terms of the consolidation loan, such as the fixed interest rate and repayment plans.

- Signatures from the borrower and any required co-signers, if applicable.

Quick guide on how to complete federal direct consolidation loan application and promissory note william d ford federal direct loan program

Effortlessly prepare Federal Direct Consolidation Loan Application And Promissory Note William D Ford Federal Direct Loan Program on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as an excellent environmentally-friendly substitute for traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents quickly without delays. Handle Federal Direct Consolidation Loan Application And Promissory Note William D Ford Federal Direct Loan Program on any device with airSlate SignNow apps for Android or iOS and enhance any document-related task today.

How to edit and electronically sign Federal Direct Consolidation Loan Application And Promissory Note William D Ford Federal Direct Loan Program with ease

- Obtain Federal Direct Consolidation Loan Application And Promissory Note William D Ford Federal Direct Loan Program and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or mask sensitive data using the tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which only takes seconds and carries the same legal validity as a conventional ink signature.

- Review the information and click the Done button to save your changes.

- Choose your method of delivering the form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Federal Direct Consolidation Loan Application And Promissory Note William D Ford Federal Direct Loan Program and ensure effective communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct federal direct consolidation loan application and promissory note william d ford federal direct loan program

Create this form in 5 minutes!

How to create an eSignature for the federal direct consolidation loan application and promissory note william d ford federal direct loan program

How to generate an eSignature for your Federal Direct Consolidation Loan Application And Promissory Note William D Ford Federal Direct Loan Program online

How to generate an eSignature for the Federal Direct Consolidation Loan Application And Promissory Note William D Ford Federal Direct Loan Program in Chrome

How to create an eSignature for signing the Federal Direct Consolidation Loan Application And Promissory Note William D Ford Federal Direct Loan Program in Gmail

How to generate an electronic signature for the Federal Direct Consolidation Loan Application And Promissory Note William D Ford Federal Direct Loan Program from your smart phone

How to create an electronic signature for the Federal Direct Consolidation Loan Application And Promissory Note William D Ford Federal Direct Loan Program on iOS

How to create an eSignature for the Federal Direct Consolidation Loan Application And Promissory Note William D Ford Federal Direct Loan Program on Android OS

People also ask

-

What is the William D Ford loan program?

The William D Ford loan program, commonly known as the William D Ford Federal Direct Loan Program, offers federal loans to students and parents to help cover educational expenses. This program includes various loan types, like Direct Subsidized and Unsubsidized loans, designed to make education accessible and affordable. Understanding the features of the William D Ford loan can help you make informed decisions about financing your education.

-

How can I apply for a William D Ford loan?

To apply for a William D Ford loan, you must complete the Free Application for Federal Student Aid (FAFSA). This form collects essential information necessary to determine your eligibility for federal student aid, including the William D Ford loan. Once your FAFSA is processed, your school will provide you with further details on the loan amounts and terms you can qualify for.

-

What are the repayment terms for a William D Ford loan?

Repayment terms for a William D Ford loan can vary based on the type of loan and when you begin repayment. Typically, borrowers are given a grace period of six months after graduation or dropping below half-time enrollment before they must begin repaying their loans. Various repayment plans are available, allowing flexibility to choose a plan that best suits your financial situation.

-

What are the benefits of the William D Ford loan?

One primary benefit of the William D Ford loan is the potential for lower interest rates compared to private loans, making education financing more affordable. Additionally, it offers flexible repayment options and eligibility for loan forgiveness programs for qualifying professions. These advantages make the William D Ford loan an appealing choice for many students seeking financial aid.

-

Can I consolidate my William D Ford loan with other student loans?

Yes, borrowers can consolidate their William D Ford loans with other federal and possibly private loans through a Direct Consolidation Loan. Consolidation simplifies repayment by combining multiple loans into one, which can also lead to a lower monthly payment. However, it's essential to understand how consolidation can impact interest rates and loan benefits before proceeding.

-

Are there any fees associated with the William D Ford loan?

The William D Ford loan generally does not come with hefty fees, as federal loans are designed to be low-cost options for students. However, borrowers should be aware of interest rates and possible origination fees that may apply. Understanding these costs upfront can help you budget better for your educational expenses.

-

What happens if I can’t repay my William D Ford loan?

If you find yourself struggling to repay your William D Ford loan, you should contact your loan servicer immediately to discuss your options. You may be able to switch to a different repayment plan, defer your loans, or request forbearance temporarily. Ignoring the loan can lead to serious consequences, including damage to your credit score, so it's crucial to seek help early.

Get more for Federal Direct Consolidation Loan Application And Promissory Note William D Ford Federal Direct Loan Program

- Agent producer agreement and agent guidelines gohealth vmo form

- Longs stay business form 1066pdf travco holidays

- Notification winner district 62 toastmasters form

- Amateur softball association notice of background check and form

- Linden little league how to sponsor form

- Player verification form

- Il secretary of state natural disaster disclosure statement 2015 form

- At in the matter of the estate of alaska court system form

Find out other Federal Direct Consolidation Loan Application And Promissory Note William D Ford Federal Direct Loan Program

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later

- How Can I eSign North Carolina lease agreement

- eSign Montana Lease agreement form Computer

- Can I eSign New Hampshire Lease agreement form

- How To eSign West Virginia Lease agreement contract

- Help Me With eSign New Mexico Lease agreement form