Life Insurance Needs Worksheet Form

What is the Life Insurance Needs Worksheet

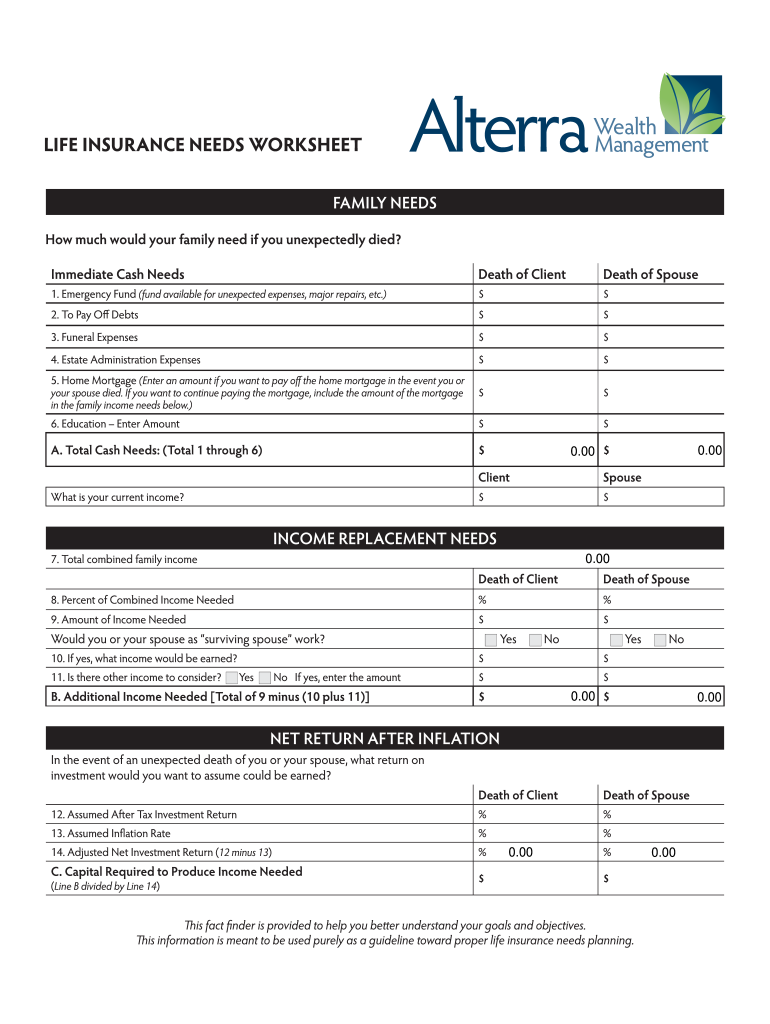

The Life Insurance Needs Worksheet is a valuable tool designed to help individuals assess their insurance requirements throughout different stages of life. It facilitates a comprehensive evaluation of financial obligations, dependents, and future goals, ensuring that individuals can determine the appropriate amount of life insurance coverage needed. By analyzing personal circumstances, such as income, debts, and family needs, users can create a tailored insurance plan that aligns with their specific situations.

How to use the Life Insurance Needs Worksheet

Using the Life Insurance Needs Worksheet involves several straightforward steps. First, gather relevant financial information, including income, expenses, and existing insurance policies. Next, evaluate your dependents' needs, considering factors such as education costs, living expenses, and any outstanding debts. Fill out the worksheet by inputting this information, which will help calculate the total coverage required. Finally, review the results to make informed decisions about the type and amount of life insurance that best suits your needs.

Steps to complete the Life Insurance Needs Worksheet

Completing the Life Insurance Needs Worksheet can be broken down into a few essential steps:

- Collect financial documents, including income statements and debt records.

- Identify dependents and their financial needs, such as education and living expenses.

- Assess current life insurance coverage and any gaps in protection.

- Input the gathered information into the worksheet to calculate the necessary coverage.

- Review the findings and adjust coverage recommendations as needed.

Key elements of the Life Insurance Needs Worksheet

The Life Insurance Needs Worksheet includes several key elements that contribute to a thorough analysis. Important components typically encompass:

- Current income and potential future earnings.

- Outstanding debts, such as mortgages and loans.

- Future financial obligations, including education costs for children.

- Existing life insurance policies and their coverage amounts.

- Long-term financial goals, such as retirement planning.

Legal use of the Life Insurance Needs Worksheet

When utilizing the Life Insurance Needs Worksheet, it is essential to understand its legal implications. The worksheet itself does not constitute a legally binding document; however, the information derived from it can inform decisions that have significant legal and financial consequences. Ensuring accuracy in the worksheet can help avoid potential disputes regarding coverage amounts and beneficiaries in the event of a claim.

Examples of using the Life Insurance Needs Worksheet

There are various scenarios in which individuals can effectively use the Life Insurance Needs Worksheet. For example, a young couple with a mortgage and children may use it to determine how much coverage is necessary to protect their family’s financial future. Alternatively, a single professional may assess their needs to ensure sufficient coverage for any debts and future goals, such as starting a business. Each situation highlights the worksheet's adaptability to different life stages and financial circumstances.

Quick guide on how to complete life insurance needs worksheet

Complete Life Insurance Needs Worksheet effortlessly on any device

Digital document management has become increasingly favored by both businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Manage Life Insurance Needs Worksheet on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign Life Insurance Needs Worksheet with ease

- Obtain Life Insurance Needs Worksheet and then select Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes just moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Life Insurance Needs Worksheet and ensure excellent communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the life insurance needs worksheet

The way to create an electronic signature for a PDF in the online mode

The way to create an electronic signature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The best way to make an eSignature right from your smart phone

The best way to create an eSignature for a PDF on iOS devices

The best way to make an eSignature for a PDF on Android OS

People also ask

-

What is the purpose of the 'insurance needs through life worksheet answers'?

The 'insurance needs through life worksheet answers' helps individuals evaluate their insurance requirements based on personal circumstances and financial goals. By filling out this worksheet, users can gain insights into the amount and types of coverage they may need to protect their loved ones and assets.

-

How does airSlate SignNow facilitate document signing for insurance worksheets?

airSlate SignNow offers an intuitive platform that simplifies eSigning for your insurance needs through life worksheet answers. With our easy-to-use interface, clients can quickly fill out, sign, and send documents electronically, saving time and ensuring accuracy in the process.

-

Is there a cost associated with using the 'insurance needs through life worksheet answers' feature?

Yes, using airSlate SignNow to complete and sign the 'insurance needs through life worksheet answers' involves a subscription fee. However, our pricing is designed to be cost-effective, offering different plans to accommodate various business sizes and usage needs.

-

What benefits does airSlate SignNow provide for insurance professionals?

airSlate SignNow streamlines workflow for insurance professionals by providing tools to manage the 'insurance needs through life worksheet answers' efficiently. Key benefits include automated reminders for clients, secure document storage, and quick access to signed forms, enhancing productivity and client satisfaction.

-

Can I integrate airSlate SignNow with other tools I use?

Absolutely! airSlate SignNow supports various integrations with popular applications such as CRMs and productivity tools, allowing for seamless workflow management. This helps users efficiently handle their 'insurance needs through life worksheet answers' alongside other business processes.

-

How secure is information provided in the 'insurance needs through life worksheet answers'?

Security is a top priority at airSlate SignNow. All information shared during the completion of the 'insurance needs through life worksheet answers' is encrypted, ensuring that sensitive data remains confidential and protected from unauthorized access.

-

Can I access previous versions of my completed worksheets?

Yes, airSlate SignNow maintains a version history for all documents, including your 'insurance needs through life worksheet answers.' This feature allows you to revisit and review past entries, making it easier to track changes or updates in your insurance requirements.

Get more for Life Insurance Needs Worksheet

- Notice of intent to foreclose form

- Contract agreement home form

- Child care agreement form

- Booth rental form

- Consultant self employed 481377736 form

- Asbestos disclosure form

- Employment agreement with a security investigator personal protection and or overseas force protection officer form

- Between sale form

Find out other Life Insurance Needs Worksheet

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself