Form 9325 2014

What is the Form 9325

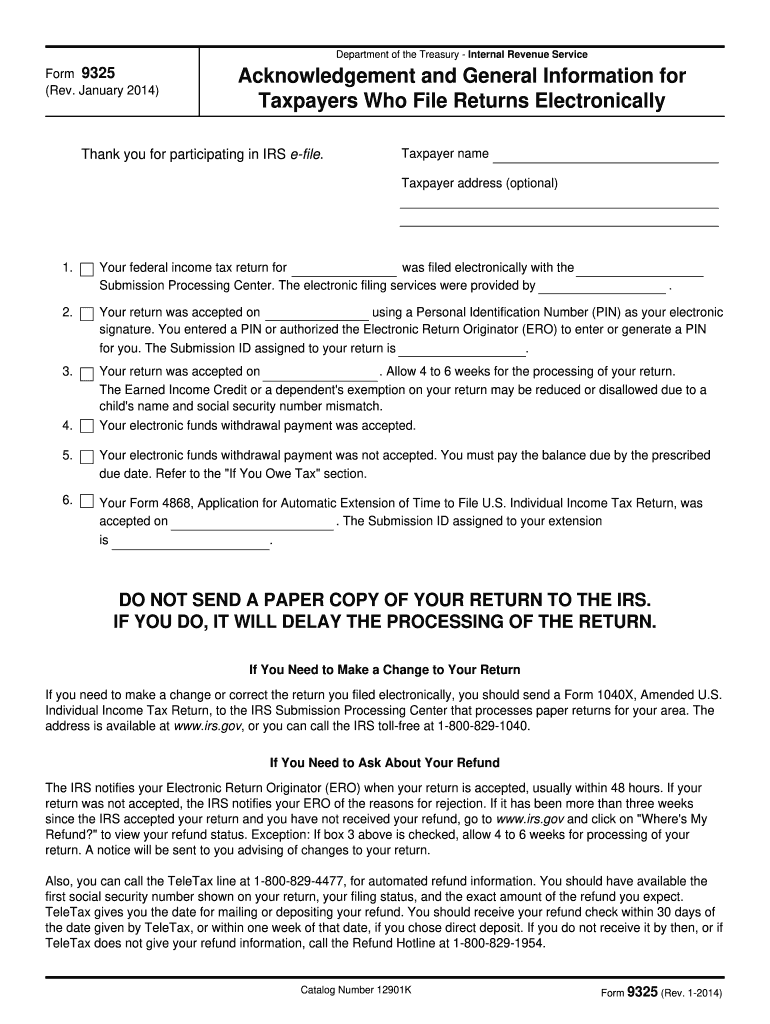

The Form 9325 is a document used by taxpayers in the United States to confirm the submission of their tax returns. It serves as a notification to the Internal Revenue Service (IRS) that a tax return has been filed and includes essential details about the return. This form is particularly useful for individuals and businesses who want to ensure their filings are acknowledged by the IRS, providing a record of submission for future reference.

How to use the Form 9325

To effectively use the Form 9325, taxpayers should fill it out accurately with the required information, including the type of return filed, the tax year, and the date of submission. After completing the form, it should be submitted alongside the tax return or provided as a separate notification to the IRS. This ensures that the IRS has a clear record of the filing and can process the return accordingly.

Steps to complete the Form 9325

Completing the Form 9325 involves several straightforward steps:

- Gather necessary information, including your tax identification number and details of the tax return.

- Fill out the form with accurate data, ensuring all fields are completed.

- Review the form for any errors or omissions.

- Submit the form along with your tax return or as a standalone document to the IRS.

Following these steps helps ensure that your submission is processed without delays.

Legal use of the Form 9325

The legal use of the Form 9325 is governed by IRS regulations, which stipulate that it must be used to confirm the filing of tax returns. This form is recognized as a valid document for establishing a taxpayer's compliance with federal tax laws. Properly completing and submitting the form can protect taxpayers from potential penalties associated with late or unfiled returns.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Form 9325. Generally, tax returns must be filed by April 15 of each year for individual taxpayers. However, if an extension is filed, the deadline may be extended to October 15. Taxpayers should ensure that the Form 9325 is submitted in accordance with these deadlines to avoid any issues with the IRS.

Form Submission Methods (Online / Mail / In-Person)

The Form 9325 can be submitted through various methods, depending on how the tax return is filed:

- Online: If filing electronically, the Form 9325 can often be submitted as part of the electronic filing process.

- Mail: For paper filings, the form should be mailed to the appropriate IRS address along with the tax return.

- In-Person: Taxpayers can also deliver the form in person at their local IRS office, although this method is less common.

Choosing the right submission method can help ensure timely processing of the tax return and confirmation of submission.

Quick guide on how to complete form 9325 2014

Prepare Form 9325 effortlessly on any device

Digital document management has gained popularity among companies and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without any hold-ups. Manage Form 9325 on any device using airSlate SignNow's Android or iOS applications and streamline your document-based processes today.

How to modify and eSign Form 9325 with ease

- Find Form 9325 and click Get Form to initiate.

- Make use of the tools we provide to complete your document.

- Mark relevant sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for these tasks.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to finalize your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Stop worrying about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Alter and eSign Form 9325 to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 9325 2014

Create this form in 5 minutes!

How to create an eSignature for the form 9325 2014

The way to make an electronic signature for your PDF in the online mode

The way to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The way to make an eSignature right from your smart phone

The way to generate an electronic signature for a PDF on iOS devices

The way to make an eSignature for a PDF on Android OS

People also ask

-

What is Form 9325 and why is it important?

Form 9325 is an essential document used by businesses to confirm the electronic submission of tax returns. It serves as a record of submission for tax professionals and businesses. Understanding how to properly use Form 9325 can facilitate smoother communication with the IRS and help ensure compliance.

-

How can airSlate SignNow help with completing Form 9325?

airSlate SignNow provides a user-friendly platform that simplifies the process of filling out and signing Form 9325. You can easily create, edit, and eSign the form, ensuring accuracy and compliance. With airSlate SignNow, you can also streamlining document management for your tax-related submissions.

-

Is there a cost associated with using airSlate SignNow for Form 9325?

Yes, airSlate SignNow offers various pricing plans that are designed to be cost-effective. Plans cater to different business sizes and needs, allowing you to choose one that fits your budget while using Form 9325 effectively. You can also take advantage of a free trial to explore features before committing.

-

What features of airSlate SignNow enhance the use of Form 9325?

Key features of airSlate SignNow include advanced eSigning capabilities, document tracking, and templates for Form 9325. These features offer enhanced efficiency, security, and ease of access for managing documents. Additionally, you can collaborate with team members in real-time, ensuring that Form 9325 is completed accurately.

-

Can I integrate other applications with airSlate SignNow for processing Form 9325?

Absolutely! airSlate SignNow offers seamless integrations with various applications which enhance the workflow for Form 9325. You can connect with CRMs, cloud storage solutions, and other productivity tools. This makes it easier to manage your documents and stay organized.

-

How secure is airSlate SignNow when handling Form 9325?

Security is a top priority for airSlate SignNow. When using Form 9325, you can trust that your documents are encrypted and stored safely. The platform adheres to industry-leading security protocols to protect sensitive information and ensure compliance.

-

Is there customer support available for assistance with Form 9325?

Yes, airSlate SignNow provides dedicated customer support to assist you with any queries related to Form 9325. Whether you need help with technical issues or have questions about features, the support team is available to ensure you have a smooth experience. You can signNow them via chat, email, or phone.

Get more for Form 9325

- Quitclaim deed from corporation to llc georgia form

- Quitclaim deed from corporation to corporation georgia form

- Warranty deed from corporation to corporation georgia form

- Divorce maiden name form

- Georgia decree divorce form

- Quitclaim deed from corporation to two individuals georgia form

- Warranty deed from corporation to two individuals georgia form

- Ga trust 497303623 form

Find out other Form 9325

- eSign Utah Hold Harmless (Indemnity) Agreement Myself

- eSign Wyoming Toll Manufacturing Agreement Later

- eSign Texas Photo Licensing Agreement Online

- How To eSign Connecticut Quitclaim Deed

- How To eSign Florida Quitclaim Deed

- Can I eSign Kentucky Quitclaim Deed

- eSign Maine Quitclaim Deed Free

- How Do I eSign New York Quitclaim Deed

- eSign New Hampshire Warranty Deed Fast

- eSign Hawaii Postnuptial Agreement Template Later

- eSign Kentucky Postnuptial Agreement Template Online

- eSign Maryland Postnuptial Agreement Template Mobile

- How Can I eSign Pennsylvania Postnuptial Agreement Template

- eSign Hawaii Prenuptial Agreement Template Secure

- eSign Michigan Prenuptial Agreement Template Simple

- eSign North Dakota Prenuptial Agreement Template Safe

- eSign Ohio Prenuptial Agreement Template Fast

- eSign Utah Prenuptial Agreement Template Easy

- eSign Utah Divorce Settlement Agreement Template Online

- eSign Vermont Child Custody Agreement Template Secure