2013-2026 Form

What is the When Form 2290 Taxes Are DueInternal Revenue Service IRS gov

The When Form 2290 is a tax form required by the Internal Revenue Service (IRS) for heavy vehicle use tax. This form is specifically designed for individuals and businesses that operate vehicles with a gross weight of 55,000 pounds or more. The tax is due annually, and the form must be filed to report the number of vehicles and the amount of tax owed. Understanding this form is essential for compliance with federal tax regulations and to avoid potential penalties.

How to use the When Form 2290 Taxes Are DueInternal Revenue Service IRS gov

Using the When Form 2290 involves several key steps. First, gather all necessary information regarding your heavy vehicles, including their weight and identification details. Next, you can fill out the form either electronically or by hand. If you choose to file electronically, ensure you use a compliant eSignature platform to maintain the legal validity of your submission. After completing the form, submit it to the IRS along with any payment due for the heavy vehicle use tax.

Filing Deadlines / Important Dates

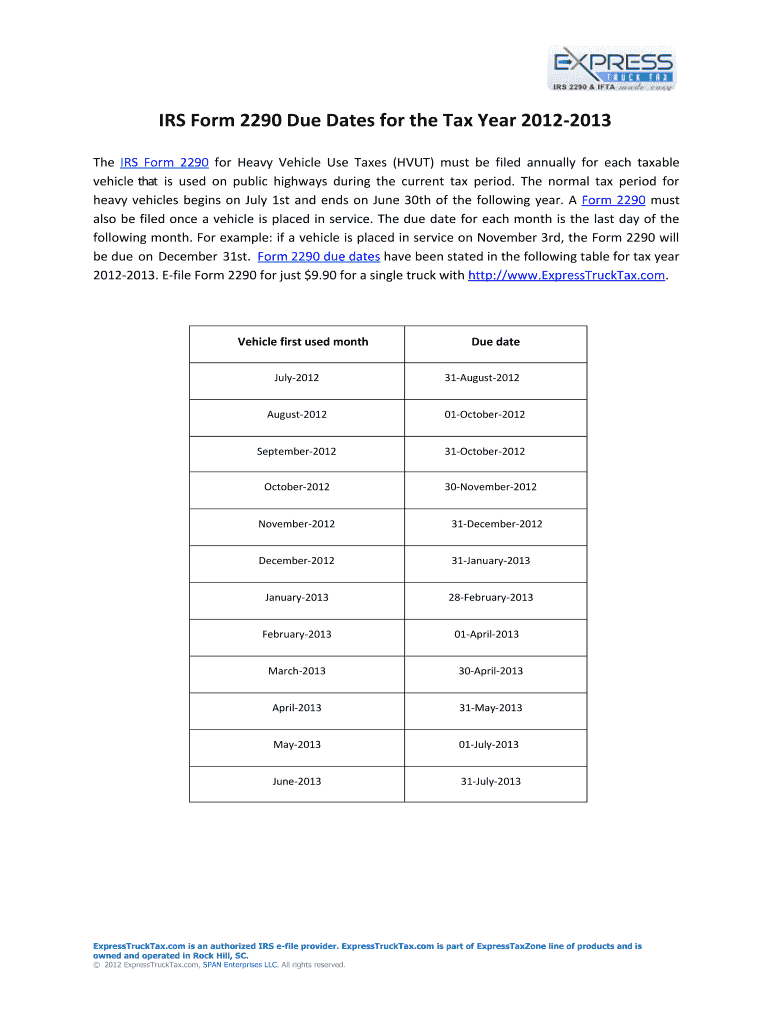

Filing deadlines for the When Form 2290 are crucial for compliance. Typically, the form must be filed by the last day of the month following the month in which you first use your vehicle on public highways. For most taxpayers, this means the form is due by August 31 each year. It is important to stay informed about these deadlines to avoid late fees and penalties.

Penalties for Non-Compliance

Failing to file the When Form 2290 on time can result in significant penalties. The IRS imposes a penalty of up to 5% of the total tax due for each month the form is late, up to a maximum of 25%. Additionally, if you do not pay the tax owed, interest will accrue on the unpaid balance. Understanding these penalties highlights the importance of timely and accurate filing.

Required Documents

To complete the When Form 2290, you will need several documents. These typically include your vehicle identification number (VIN), gross weight of the vehicle, and any previous tax records if applicable. Having this information readily available can streamline the process of filling out the form and ensure accuracy in your submission.

Steps to complete the When Form 2290 Taxes Are DueInternal Revenue Service IRS gov

Completing the When Form 2290 involves a series of straightforward steps:

- Gather necessary vehicle information, including VIN and weight.

- Choose a method for filing: electronically or by mail.

- If filing electronically, select a compliant eSignature platform.

- Fill out the form accurately, ensuring all details are correct.

- Submit the form by the deadline along with any payment due.

Quick guide on how to complete when form 2290 taxes are dueinternal revenue service irsgov

Prepare [SKS] easily on any device

Online document management has gained traction among businesses and individuals. It offers a perfect environmentally friendly substitute for conventional printed and signed papers, as you can obtain the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without interruptions. Manage [SKS] on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign [SKS] effortlessly

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing additional document copies. airSlate SignNow takes care of all your needs in document management in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct when form 2290 taxes are dueinternal revenue service irsgov

Related searches to When Form 2290 Taxes Are DueInternal Revenue Service IRS gov

Create this form in 5 minutes!

How to create an eSignature for the when form 2290 taxes are dueinternal revenue service irsgov

How to create an electronic signature for your PDF in the online mode

How to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

How to create an eSignature straight from your smart phone

How to create an electronic signature for a PDF on iOS devices

How to create an eSignature for a PDF document on Android OS

People also ask

-

What is Form 2290 and who needs to file it?

Form 2290 is used by heavy vehicle operators to pay road use tax to the Internal Revenue Service. Businesses with vehicles weighing 55,000 pounds or more are required to file this form. It's essential to know 'When Form 2290 Taxes Are DueInternal Revenue Service IRS gov' to avoid penalties.

-

When are Form 2290 Taxes Due?

Form 2290 Taxes are generally due on the last day of the month following the month of first use of the vehicle. It’s crucial to keep track of these deadlines to ensure compliance with the Internal Revenue Service. Knowing 'When Form 2290 Taxes Are DueInternal Revenue Service IRS gov' is key for timely submissions.

-

What happens if I miss the Form 2290 deadline?

If you miss the Form 2290 deadline, you may incur late fees and penalties imposed by the Internal Revenue Service. Filing late can affect your ability to operate your vehicle legally on public highways. Staying informed about 'When Form 2290 Taxes Are DueInternal Revenue Service IRS gov' can help prevent these issues.

-

How can airSlate SignNow assist with Form 2290?

airSlate SignNow offers a user-friendly solution for eSigning and sending Form 2290 documents, making it easier to manage your tax filings. Our platform streamlines the process and ensures compliance with the Internal Revenue Service requirements. Knowing 'When Form 2290 Taxes Are DueInternal Revenue Service IRS gov' allows you to plan your submissions efficiently.

-

Are there any costs associated with using airSlate SignNow for Form 2290?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, ensuring a cost-effective solution for eSigning Form 2290. Our plans include features that can simplify document handling and enhance compliance. Being aware of 'When Form 2290 Taxes Are DueInternal Revenue Service IRS gov' can help you budget your tax responsibilities effectively.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely, airSlate SignNow integrates seamlessly with popular accounting and tax software to streamline your document management process. This integration ensures that you don’t miss important deadlines, such as 'When Form 2290 Taxes Are DueInternal Revenue Service IRS gov.' Simplifying your workflow adds to your operational efficiency.

-

What documents do I need to file Form 2290?

To file Form 2290 effectively, you will need your vehicle identification number (VIN) and information about the total gross weight of your vehicle. Having these documents ready can expedite your submission. Also, being informed about 'When Form 2290 Taxes Are DueInternal Revenue Service IRS gov' can help you prepare in advance.

Get more for When Form 2290 Taxes Are DueInternal Revenue Service IRS gov

Find out other When Form 2290 Taxes Are DueInternal Revenue Service IRS gov

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document