W 8eci Fillable Form 2000

What is the W-8ECI Fillable Form

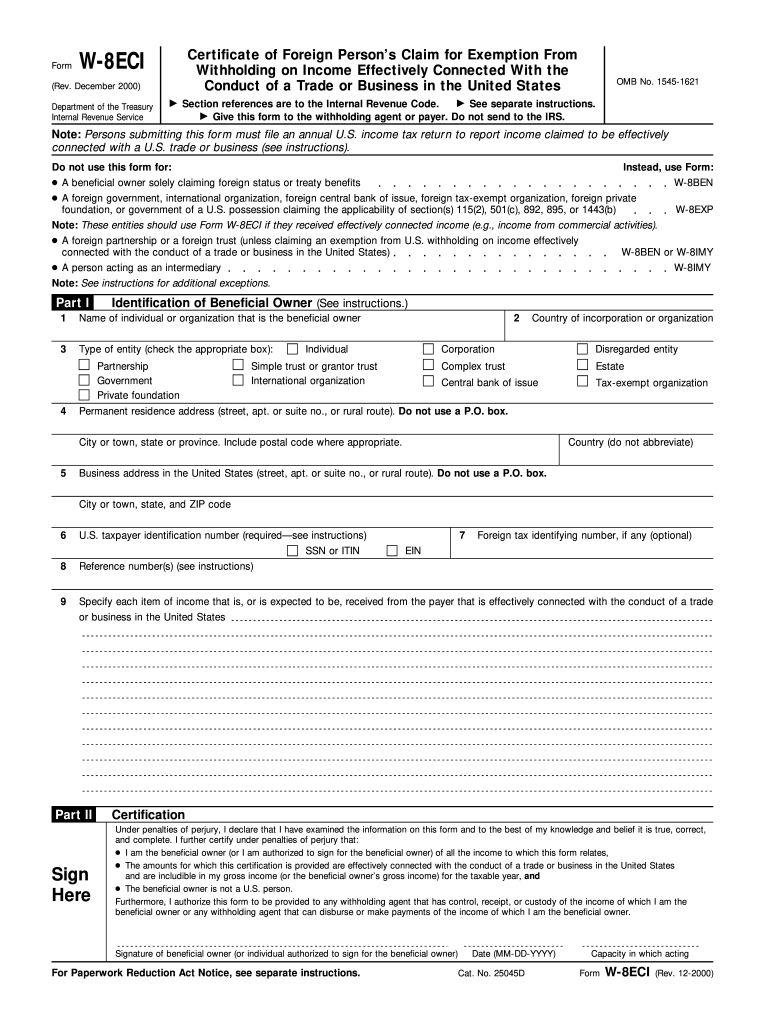

The W-8ECI Fillable Form is a tax document used by foreign individuals and entities to certify that income received from U.S. sources is effectively connected with a trade or business in the United States. This form is essential for foreign persons to claim a reduction or exemption from U.S. withholding tax on income that is effectively connected with a U.S. trade or business. By submitting this form, individuals and entities can ensure compliance with U.S. tax regulations while minimizing their tax liabilities.

How to use the W-8ECI Fillable Form

Using the W-8ECI Fillable Form involves several steps to ensure accurate completion and submission. First, obtain the form from the IRS website or a trusted source. Next, fill in the required information, including your name, country of citizenship, and the type of income you are reporting. Ensure that all details are accurate to avoid delays in processing. After completing the form, it must be signed and dated before submission. Keep a copy for your records, as it may be required for future reference.

Steps to complete the W-8ECI Fillable Form

Completing the W-8ECI Fillable Form requires careful attention to detail. Follow these steps:

- Download the W-8ECI Fillable Form from a reliable source.

- Provide your full name and address, ensuring that the information matches your official documents.

- Indicate your country of citizenship and the type of income you are receiving.

- Include your taxpayer identification number (if applicable) and any other required identification.

- Sign and date the form to validate your submission.

- Submit the completed form to the withholding agent or payor, retaining a copy for your records.

Legal use of the W-8ECI Fillable Form

The W-8ECI Fillable Form is legally binding when completed correctly and submitted to the appropriate parties. It serves to establish that the income is effectively connected with a U.S. trade or business, which can significantly impact tax obligations. Compliance with IRS regulations is crucial to avoid penalties or issues with tax authorities. Ensure that the form is updated as needed, especially if there are changes in your status or the type of income received.

Filing Deadlines / Important Dates

Filing deadlines for the W-8ECI Fillable Form depend on the nature of the income and the relationship with the withholding agent. Generally, it should be submitted before the payment is made to ensure that the correct amount of tax is withheld. It is advisable to check with the IRS or a tax professional for specific deadlines related to your situation, as timely submission can prevent unnecessary withholding and potential tax liabilities.

Who Issues the Form

The W-8ECI Fillable Form is issued by the Internal Revenue Service (IRS) in the United States. It is specifically designed for foreign individuals and entities to report income that is effectively connected with a U.S. trade or business. The IRS provides guidelines and resources to assist in the proper completion and submission of this form, ensuring compliance with U.S. tax laws.

Quick guide on how to complete w 8eci fillable form 2000

Effortlessly Prepare W 8eci Fillable Form on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as a perfect environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and eSign your documents quickly and without holdups. Handle W 8eci Fillable Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest method to modify and eSign W 8eci Fillable Form effortlessly

- Find W 8eci Fillable Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional handwritten signature.

- Review all information and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about missing or lost files, tedious document searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Alter and eSign W 8eci Fillable Form while ensuring excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct w 8eci fillable form 2000

Create this form in 5 minutes!

How to create an eSignature for the w 8eci fillable form 2000

The best way to create an electronic signature for your PDF document in the online mode

The best way to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your mobile device

The way to create an electronic signature for a PDF document on iOS devices

The way to generate an electronic signature for a PDF on Android devices

People also ask

-

What is the W 8eci Fillable Form and why do I need it?

The W 8eci Fillable Form is a document used by foreign individuals and entities to signNow their foreign status and claim a reduced withholding rate on income received from U.S. sources. Utilizing this form ensures that you comply with IRS regulations, thus avoiding unnecessary tax withholdings.

-

How can I fill out the W 8eci Fillable Form using airSlate SignNow?

Filling out the W 8eci Fillable Form with airSlate SignNow is straightforward. Our platform provides an easy-to-use editor that allows you to fill in the required information directly in the document, ensuring it is completed accurately and efficiently.

-

Is the W 8eci Fillable Form free to use on airSlate SignNow?

While airSlate SignNow offers a free trial, the use of the W 8eci Fillable Form may depend on the chosen subscription plan. To enjoy the full range of features, including advanced functionalities, consider reviewing our pricing options on the website.

-

Can I save and edit the W 8eci Fillable Form on airSlate SignNow?

Yes, airSlate SignNow allows you to save and edit the W 8eci Fillable Form at your convenience. You can revisit your document to make necessary changes or updates any time before finalizing and sending it for signature.

-

What are the benefits of using airSlate SignNow for the W 8eci Fillable Form?

Using airSlate SignNow for the W 8eci Fillable Form comes with several benefits, including ease of use, secure storage, and the ability to track document status in real-time. This streamlined process enhances efficiency and ensures timely submission to the IRS.

-

Does airSlate SignNow offer integrations for the W 8eci Fillable Form?

Yes, airSlate SignNow provides seamless integrations with various applications and tools, making it easier to manage your W 8eci Fillable Form alongside your other essential business processes. These integrations improve workflow and enhance productivity.

-

How do I ensure the W 8eci Fillable Form is legally valid when using airSlate SignNow?

To ensure the W 8eci Fillable Form is legally valid, airSlate SignNow employs advanced encryption and compliance measures that adhere to legal standards. After completing the form, you can easily obtain electronic signatures that are recognized legally.

Get more for W 8eci Fillable Form

- 60 day notice 497306185 form

- 7 day notice to terminate week to week lease from landlord to tenant illinois form

- 30 day notice to terminate lease greater than week to week less than year to year from landlord to tenant illinois form

- 5 day notice 497306188 form

- Assignment of mortgage by individual mortgage holder illinois form

- Assignment of mortgage by corporate mortgage holder illinois form

- Notice of default in payment of rent as warning prior to demand to pay or terminate for residential property illinois form

- Notice of default in payment of rent as warning prior to demand to pay or terminate for nonresidential or commercial property 497306193 form

Find out other W 8eci Fillable Form

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy