Irs Form 211 2007

What is the Irs Form 211

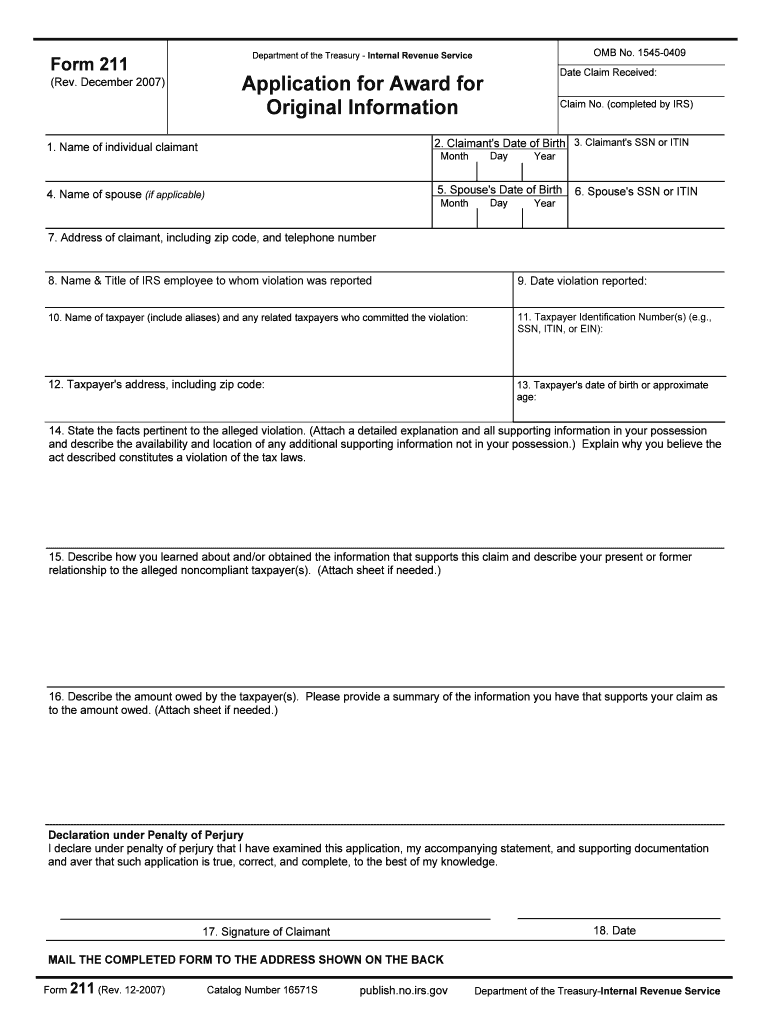

The IRS Form 211 is a document used by individuals to report information related to claims for rewards for information regarding violations of internal revenue laws. This form is essential for whistleblowers who provide actionable information to the IRS, potentially leading to the recovery of taxes owed to the government. By completing this form, individuals can apply for a reward based on the amount of tax collected as a result of their information.

How to use the Irs Form 211

Using the IRS Form 211 involves several key steps. First, gather all necessary information about the tax violation, including details about the taxpayer and the nature of the violation. Next, complete the form accurately, ensuring that all sections are filled out, including your personal information and the specifics of the tax issue. Finally, submit the completed form to the IRS, following the instructions provided for submission methods.

Steps to complete the Irs Form 211

Completing the IRS Form 211 requires careful attention to detail. Follow these steps:

- Gather Information: Collect all relevant details about the tax violation.

- Fill Out the Form: Provide your personal information and details of the violation.

- Review: Double-check all entries for accuracy and completeness.

- Submit: Send the form to the IRS according to the provided guidelines.

Legal use of the Irs Form 211

The IRS Form 211 is legally binding when used correctly. It is crucial for whistleblowers to understand that providing false information can lead to penalties. The information submitted must be truthful and based on credible evidence of tax violations. The IRS uses this form to assess the validity of claims and determine eligibility for rewards, making it essential to adhere to legal standards throughout the process.

Key elements of the Irs Form 211

Several key elements must be included in the IRS Form 211 for it to be valid:

- Personal Information: Your name, address, and contact details.

- Details of the Violation: Specifics about the taxpayer and the nature of the tax issue.

- Supporting Evidence: Any documentation that supports your claim.

- Signature: Your signature certifying the accuracy of the information provided.

Filing Deadlines / Important Dates

While there are no specific deadlines for submitting the IRS Form 211, timely submission is encouraged to ensure that claims are processed efficiently. It is advisable to submit the form as soon as possible after obtaining information about a tax violation to maximize the potential reward. Keeping track of any changes in IRS guidelines regarding submission timelines is also important.

Quick guide on how to complete irs form 211 2007

Effortlessly Prepare Irs Form 211 on Any Device

Web-based document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, enabling you to access the correct form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents swiftly without delays. Handle Irs Form 211 on any device using the airSlate SignNow applications for Android or iOS and simplify any document-related procedure today.

How to Edit and Electronically Sign Irs Form 211 with Ease

- Find Irs Form 211 and click Get Form to begin.

- Utilize the tools provided to fill out your document.

- Select important sections of your documents or conceal confidential information with features that airSlate SignNow supplies specifically for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method of sending your form: via email, text message (SMS), invitation link, or download it to your computer.

No more worrying about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you select. Modify and electronically sign Irs Form 211 to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 211 2007

Create this form in 5 minutes!

How to create an eSignature for the irs form 211 2007

The best way to generate an electronic signature for your PDF in the online mode

The best way to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature from your smart phone

The way to make an electronic signature for a PDF on iOS devices

The way to make an electronic signature for a PDF file on Android OS

People also ask

-

What is IRS Form 211 and how is it used?

IRS Form 211 is used to apply for an award of an informant's reward. This form is crucial for individuals who provide information regarding federal tax violations. With airSlate SignNow, you can easily prepare and eSign IRS Form 211, streamlining the submission process effectively.

-

Can I use airSlate SignNow to send IRS Form 211 securely?

Yes, airSlate SignNow provides a secure platform for sending IRS Form 211. Our enhanced security features ensure that your sensitive information is protected during the transmission process, giving you peace of mind as you handle important tax documents.

-

Is airSlate SignNow compliant with IRS regulations for IRS Form 211?

Absolutely! airSlate SignNow is designed to be fully compliant with IRS regulations, including those related to IRS Form 211. Our solution adheres to the necessary legal standards, ensuring that your electronic submissions are valid and accepted by the IRS.

-

What features does airSlate SignNow offer for completing IRS Form 211?

airSlate SignNow offers a variety of features tailored for completing IRS Form 211, including easy document editing, electronic signatures, and secure storage. These tools simplify the completion and management of important tax documents, enhancing your workflow.

-

How can I integrate airSlate SignNow with other applications when working with IRS Form 211?

Integrating airSlate SignNow with other applications is easy, allowing you to manage IRS Form 211 alongside your existing business tools. Whether it's CRM systems or cloud storage services, our platform supports seamless integrations, enhancing your overall productivity.

-

What are the pricing options for using airSlate SignNow for IRS Form 211?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including options for solo users and larger teams. With a cost-effective solution, you can efficiently manage IRS Form 211 submissions without breaking the bank.

-

Does airSlate SignNow provide templates for IRS Form 211?

Yes, airSlate SignNow provides customizable templates for IRS Form 211, making it easier to fill out the form accurately and efficiently. These templates save you time and ensure you don’t miss any critical information required by the IRS.

Get more for Irs Form 211

Find out other Irs Form 211

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template