Irs Form 211 2014

What is the IRS Form 211

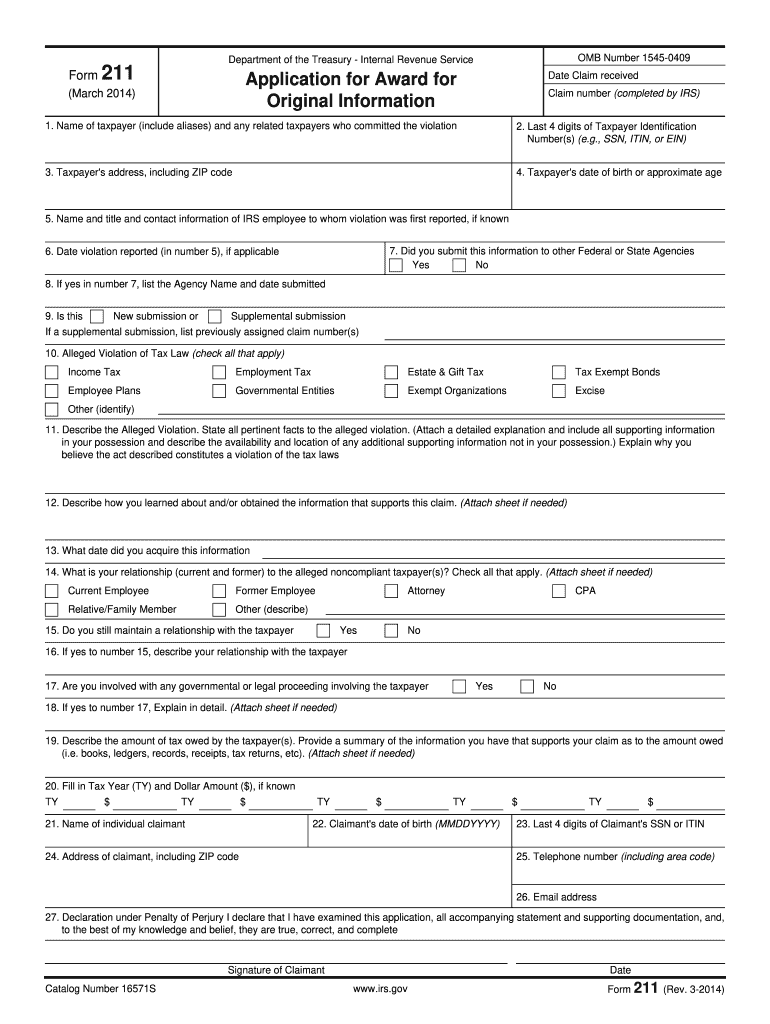

The IRS Form 211, also known as the Application for Undue Hardship, is a document used by taxpayers to request a reduction or elimination of tax liabilities due to financial hardship. This form is particularly relevant for individuals facing significant financial challenges that hinder their ability to pay taxes owed. By submitting Form 211, taxpayers can present their case to the IRS for consideration of relief options.

How to use the IRS Form 211

Using the IRS Form 211 involves several key steps. First, gather all necessary financial documentation that supports your claim of undue hardship. This may include income statements, expense reports, and any relevant tax documents. Next, complete the form accurately, ensuring that all sections are filled out with the required information. After completing the form, submit it to the appropriate IRS office, either by mail or electronically, depending on your situation. It is crucial to keep copies of all submitted documents for your records.

Steps to complete the IRS Form 211

Completing IRS Form 211 requires careful attention to detail. Follow these steps:

- Step 1: Download the form from the IRS website or obtain a physical copy.

- Step 2: Fill out your personal information, including your name, address, and Social Security number.

- Step 3: Provide a detailed explanation of your financial situation, including income, expenses, and any special circumstances.

- Step 4: Attach any supporting documents that validate your claims of hardship.

- Step 5: Review the completed form for accuracy before submission.

- Step 6: Submit the form to the designated IRS office.

Legal use of the IRS Form 211

The legal use of IRS Form 211 is governed by specific IRS guidelines. It is essential to ensure that the information provided is truthful and accurate, as false statements can lead to penalties or legal repercussions. The form serves as a formal request for consideration of financial hardship, and the IRS evaluates each submission based on the information provided and the supporting documentation attached.

Filing Deadlines / Important Dates

When submitting IRS Form 211, it is important to be aware of any relevant deadlines. While there is no specific deadline for submitting this form, timely submission is crucial, especially if you are facing imminent enforcement actions from the IRS. Keeping track of your tax obligations and any communications from the IRS can help you stay informed about important dates that may affect your situation.

Eligibility Criteria

To be eligible to use IRS Form 211, taxpayers must demonstrate that they are experiencing undue hardship that affects their ability to pay taxes. This may include factors such as unemployment, medical expenses, or other financial burdens. The IRS assesses eligibility on a case-by-case basis, considering the unique circumstances of each taxpayer.

Quick guide on how to complete irs form 211 2014

Accomplish Irs Form 211 seamlessly on any device

Digital document management has gained traction with businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, alter, and eSign your documents swiftly without delays. Manage Irs Form 211 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to alter and eSign Irs Form 211 effortlessly

- Locate Irs Form 211 and click Get Form to initiate.

- Utilize the tools we provide to fill out your document.

- Mark important sections of your documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that function.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal authority as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you would like to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require new document copies to be printed. airSlate SignNow accommodates all your document management needs in just a few clicks from your chosen device. Edit and eSign Irs Form 211 to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 211 2014

Create this form in 5 minutes!

How to create an eSignature for the irs form 211 2014

How to create an electronic signature for the Irs Form 211 2014 in the online mode

How to create an eSignature for your Irs Form 211 2014 in Google Chrome

How to create an eSignature for putting it on the Irs Form 211 2014 in Gmail

How to create an electronic signature for the Irs Form 211 2014 straight from your smartphone

How to create an eSignature for the Irs Form 211 2014 on iOS devices

How to make an eSignature for the Irs Form 211 2014 on Android

People also ask

-

What is IRS Form 211 and how does it relate to airSlate SignNow?

IRS Form 211 is used to claim a reward for information provided to the IRS about tax fraud. With airSlate SignNow, you can easily eSign and send IRS Form 211, ensuring your submission is secure and efficient. Our platform simplifies the process of handling important documents like IRS Form 211.

-

How does airSlate SignNow help in filling out IRS Form 211?

airSlate SignNow offers intuitive document editing tools that make filling out IRS Form 211 straightforward. Users can easily input their information and electronically sign the form, streamlining the submission process while ensuring compliance with IRS standards.

-

Is there a cost associated with using airSlate SignNow for IRS Form 211?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solutions ensure that you can efficiently manage IRS Form 211 submissions without breaking the bank, providing excellent value for your investment.

-

Can I integrate airSlate SignNow with other tools for submitting IRS Form 211?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to streamline your workflow when submitting IRS Form 211. These integrations help you manage your documents more effectively and enhance your overall productivity.

-

What features does airSlate SignNow offer for electronic signing of IRS Form 211?

airSlate SignNow provides robust features for electronic signing, including customizable signing workflows and secure storage options for IRS Form 211. Users can confidently manage their documents, knowing they meet all legal requirements for electronic signatures.

-

How secure is airSlate SignNow when handling IRS Form 211?

Security is a top priority at airSlate SignNow. We use advanced encryption methods to protect your IRS Form 211 and other sensitive documents, ensuring that your information remains confidential and secure throughout the signing process.

-

What benefits does airSlate SignNow provide for businesses submitting IRS Form 211?

Using airSlate SignNow to submit IRS Form 211 offers numerous benefits, including enhanced efficiency, reduced turnaround times, and improved organization of your documents. These advantages allow businesses to focus on their core operations while ensuring compliance with IRS requirements.

Get more for Irs Form 211

Find out other Irs Form 211

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now