Schedule R Form 940 Rev December Allocation Schedule for Aggregate Form 940 Filers Irs 2011

What is the Schedule R Form 940 Rev December Allocation Schedule For Aggregate Form 940 Filers IRS

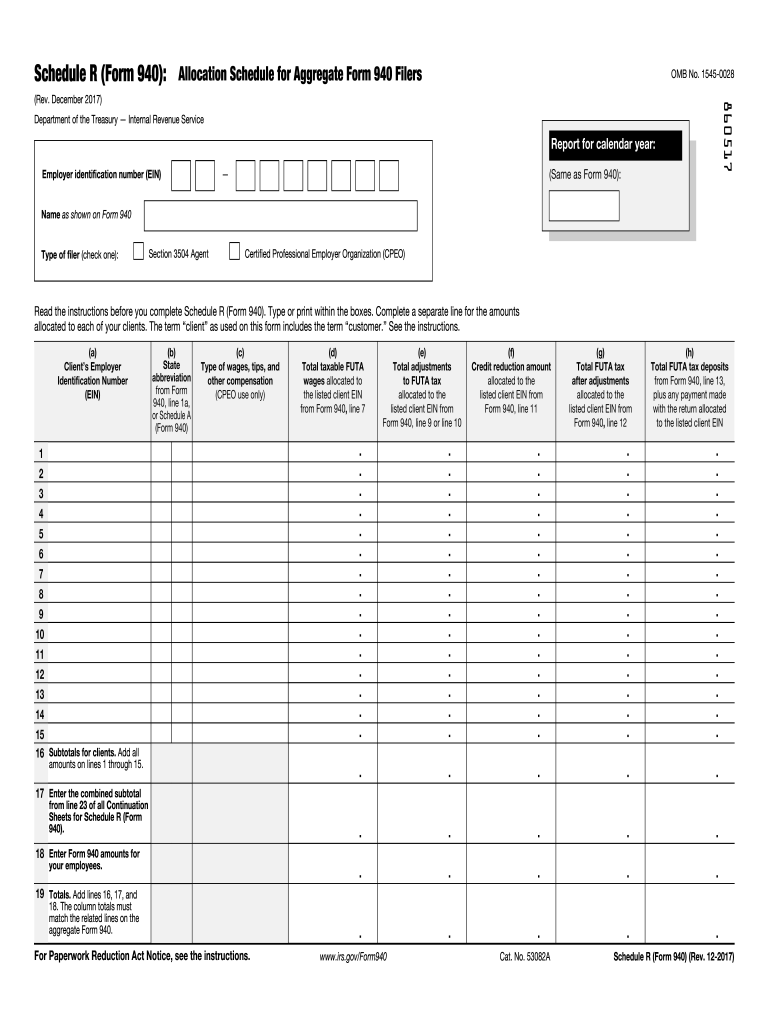

The Schedule R Form 940 Rev December is an essential document for employers who file Form 940, the Employer's Annual Federal Unemployment (FUTA) Tax Return. This allocation schedule is specifically designed for aggregate filers, allowing them to report the allocation of their FUTA tax liability among various entities. The IRS requires this form to ensure accurate tax reporting and compliance with federal regulations. It is crucial for businesses that operate multiple entities or have a complex organizational structure to use this form to allocate their unemployment tax responsibilities correctly.

How to Use the Schedule R Form 940 Rev December Allocation Schedule For Aggregate Form 940 Filers IRS

Using the Schedule R Form 940 involves several steps to ensure accurate completion. First, gather all necessary information about your business entities, including their respective FUTA tax liabilities. Next, complete the form by entering the required details for each entity. This includes the entity's name, Employer Identification Number (EIN), and the amount of FUTA tax allocated to each. After filling out the form, review it carefully to ensure all information is accurate before submitting it along with your Form 940. Utilizing digital tools can simplify this process, making it easier to fill out and sign the form electronically.

Steps to Complete the Schedule R Form 940 Rev December Allocation Schedule For Aggregate Form 940 Filers IRS

Completing the Schedule R Form 940 requires attention to detail. Follow these steps:

- Gather all relevant information for each entity, including names and EINs.

- Calculate the total FUTA tax liability for all entities combined.

- Allocate the total liability among the entities based on their respective payrolls.

- Fill out the Schedule R Form 940, ensuring each section is completed accurately.

- Double-check all entries for accuracy and completeness.

- Submit the completed form along with your Form 940 by the due date.

Legal Use of the Schedule R Form 940 Rev December Allocation Schedule For Aggregate Form 940 Filers IRS

The Schedule R Form 940 is legally valid when completed accurately and submitted in compliance with IRS regulations. It serves as a formal record of how FUTA tax liabilities are allocated among multiple entities. To ensure its legal standing, businesses must adhere to the guidelines set forth by the IRS, including timely submission and accurate reporting. Electronic signatures can also be used to enhance the legal validity of the document, provided they comply with federal eSignature laws.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule R Form 940. These include instructions on how to calculate FUTA tax liabilities, the proper way to allocate these liabilities among multiple entities, and the deadlines for submission. It is important for businesses to familiarize themselves with these guidelines to avoid penalties and ensure compliance. The IRS also updates these guidelines periodically, so staying informed about any changes is essential for accurate reporting.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule R Form 940 are aligned with the due date for Form 940, which is typically January 31 of the following year. If you are making deposits, you may have different deadlines based on your deposit schedule. It is crucial to mark these dates on your calendar to ensure timely submission and avoid penalties. Businesses should also be aware of any extensions that may apply and how they affect filing requirements.

Quick guide on how to complete schedule r form 940 rev december 2017 allocation schedule for aggregate form 940 filers irs

Complete Schedule R Form 940 Rev December Allocation Schedule For Aggregate Form 940 Filers Irs effortlessly on any gadget

Web-based document management has gained traction among companies and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to find the right template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your files quickly without delays. Manage Schedule R Form 940 Rev December Allocation Schedule For Aggregate Form 940 Filers Irs on any device with airSlate SignNow Android or iOS applications and simplify any document-related workflow today.

How to modify and eSign Schedule R Form 940 Rev December Allocation Schedule For Aggregate Form 940 Filers Irs with ease

- Find Schedule R Form 940 Rev December Allocation Schedule For Aggregate Form 940 Filers Irs and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign function, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to deliver your form, via email, text (SMS), an invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require printing additional document copies. airSlate SignNow meets your document management needs in a few clicks from any device of your choice. Modify and eSign Schedule R Form 940 Rev December Allocation Schedule For Aggregate Form 940 Filers Irs and ensure excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule r form 940 rev december 2017 allocation schedule for aggregate form 940 filers irs

Create this form in 5 minutes!

How to create an eSignature for the schedule r form 940 rev december 2017 allocation schedule for aggregate form 940 filers irs

The best way to make an electronic signature for your PDF document online

The best way to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

How to generate an eSignature from your smart phone

How to generate an electronic signature for a PDF document on iOS

How to generate an eSignature for a PDF file on Android OS

People also ask

-

What is the Schedule R Form 940 Rev December Allocation Schedule For Aggregate Form 940 Filers IRS?

The Schedule R Form 940 Rev December Allocation Schedule For Aggregate Form 940 Filers IRS is a tax form used by employers to report and allocate certain employment taxes. This form is specifically designed for businesses that file aggregate Form 940, making it easier to calculate and declare various employee-related taxes. Understanding this form is crucial for ensuring compliance with IRS regulations.

-

How can airSlate SignNow help with the Schedule R Form 940 Rev December Allocation Schedule?

AirSlate SignNow provides a streamlined platform that enables businesses to easily digitize, send, and eSign the Schedule R Form 940 Rev December Allocation Schedule For Aggregate Form 940 Filers IRS. With our user-friendly interface and robust features, organizations can reduce paperwork and expedite the submission process to the IRS. This enhances overall efficiency and accuracy in tax filing.

-

What features does airSlate SignNow offer for handling IRS forms?

AirSlate SignNow offers numerous features tailored for handling IRS forms, including customizable templates, electronic signatures, and document tracking. Specifically for the Schedule R Form 940 Rev December Allocation Schedule For Aggregate Form 940 Filers IRS, our templates allow for quick and accurate data entry. Additionally, real-time collaboration tools enable teams to work together seamlessly on tax documents.

-

Is there a cost associated with using airSlate SignNow for IRS forms?

Yes, there is a cost associated with using airSlate SignNow, but we offer various pricing plans to accommodate different business needs. Our solutions for signing and managing documents, including the Schedule R Form 940 Rev December Allocation Schedule For Aggregate Form 940 Filers IRS, are cost-effective compared to traditional methods. Users can choose from monthly or annual plans to find the best fit for their budget.

-

What are the benefits of using airSlate SignNow for IRS document management?

Using airSlate SignNow for IRS document management offers numerous benefits, including enhanced security, increased efficiency, and reduced turnaround time for forms like the Schedule R Form 940 Rev December Allocation Schedule For Aggregate Form 940 Filers IRS. Our platform uses state-of-the-art encryption to protect sensitive information, while automated workflows simplify the signing process. Ultimately, businesses enjoy improved compliance and record-keeping.

-

Can airSlate SignNow integrate with other business tools?

Yes, airSlate SignNow offers versatile integrations with a wide range of business tools, enhancing the productivity of teams. These integrations make it easy to link the Schedule R Form 940 Rev December Allocation Schedule For Aggregate Form 940 Filers IRS with other software platforms you may already be using. This ensures a smoother workflow and improved data management across various departments.

-

How secure is airSlate SignNow for sensitive documents like IRS forms?

AirSlate SignNow prioritizes the security of sensitive documents, including IRS forms like the Schedule R Form 940 Rev December Allocation Schedule For Aggregate Form 940 Filers IRS. Our platform employs encryption, secure access controls, and compliance with industry regulations to ensure your data is safe. Users can confidently store and manage their tax documents without fear of data bsignNowes.

Get more for Schedule R Form 940 Rev December Allocation Schedule For Aggregate Form 940 Filers Irs

Find out other Schedule R Form 940 Rev December Allocation Schedule For Aggregate Form 940 Filers Irs

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter