Fillable 940 Orm 2017-2026

What is the Fillable 940 Form?

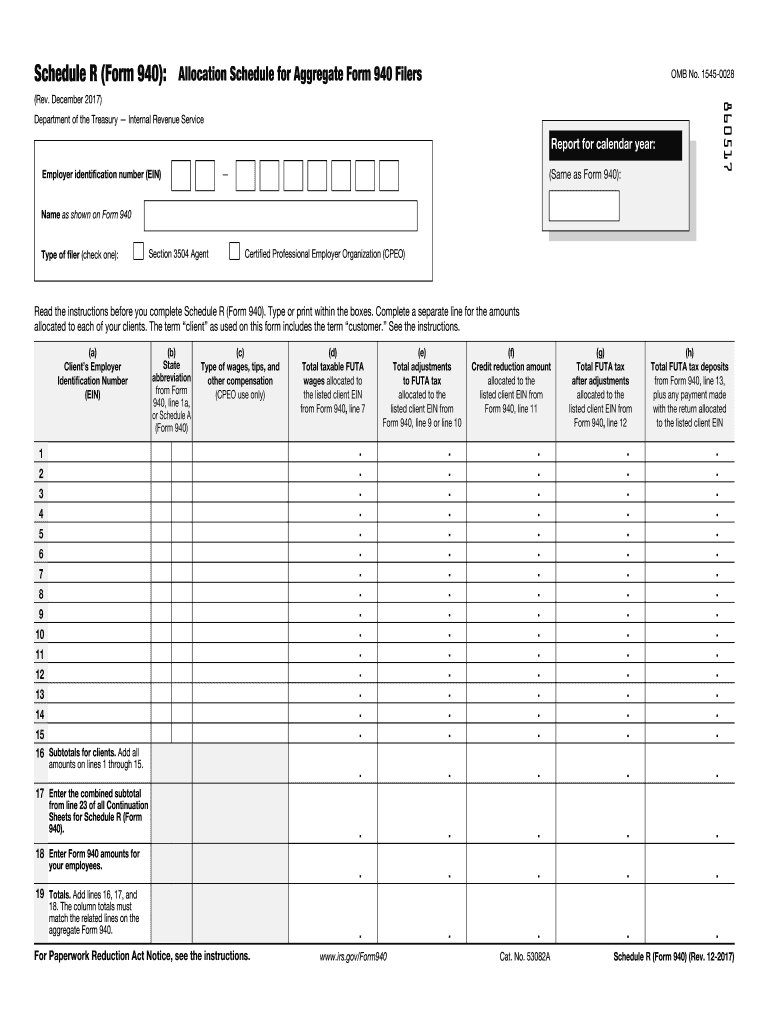

The Fillable 940 Form is a tax document used by employers to report their Federal Unemployment Tax Act (FUTA) liability to the Internal Revenue Service (IRS). This form is essential for businesses to ensure compliance with federal unemployment tax regulations. Employers must file this form annually to report wages paid to employees and calculate the amount of FUTA tax owed. The form captures important information such as total taxable wages, adjustments, and credits that may reduce the overall tax liability.

Steps to Complete the Fillable 940 Form

Completing the Fillable 940 Form involves several key steps:

- Gather necessary information, including total wages paid, any adjustments, and credits.

- Access the Fillable 940 Form through a reliable source, ensuring it is the latest version.

- Fill in the required fields accurately, including your business information and total taxable wages.

- Calculate your FUTA tax liability, taking into account any applicable credits.

- Review the completed form for accuracy before submission.

IRS Guidelines for the Fillable 940 Form

The IRS provides specific guidelines for completing the Fillable 940 Form. Employers must adhere to these guidelines to avoid penalties and ensure compliance. Key points include:

- Filing the form by the due date, which is typically January 31 of the following year.

- Ensuring all information is accurate and complete to prevent delays in processing.

- Retaining copies of the form and related records for at least four years.

Filing Deadlines for the Fillable 940 Form

Understanding the filing deadlines for the Fillable 940 Form is crucial for compliance. Employers must submit the form by January 31 of each year for the previous tax year. If January 31 falls on a weekend or holiday, the deadline may be extended to the next business day. Employers should also be aware of any state-specific deadlines that may apply.

Required Documents for the Fillable 940 Form

When completing the Fillable 940 Form, employers need to gather specific documents to ensure accurate reporting. Required documents include:

- Payroll records detailing wages paid to employees.

- Any previous filings related to FUTA taxes.

- Documentation of any adjustments or credits claimed.

Penalties for Non-Compliance with the Fillable 940 Form

Employers should be aware of the potential penalties for failing to file the Fillable 940 Form on time or for inaccuracies. The IRS may impose fines for late filings, which can increase over time. Additionally, failure to report accurate information can lead to further penalties, including interest on unpaid taxes. It is essential to file the form correctly and on time to avoid these consequences.

Quick guide on how to complete fillable 2019 940 orm

Complete Fillable 940 Orm effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an excellent eco-conscious alternative to conventional printed and signed documents, as you can access the necessary form and safely store it online. airSlate SignNow equips you with all the essential tools to create, amend, and eSign your documents rapidly without delays. Manage Fillable 940 Orm on any device using airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest way to amend and eSign Fillable 940 Orm with ease

- Find Fillable 940 Orm and then select Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize signNow sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your PC.

Eliminate concerns over missing or misplaced documents, tiresome form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Fillable 940 Orm to ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable 2019 940 orm

Create this form in 5 minutes!

How to create an eSignature for the fillable 2019 940 orm

The way to generate an eSignature for a PDF file online

The way to generate an eSignature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

How to generate an eSignature right from your mobile device

The way to create an eSignature for a PDF file on iOS

How to generate an eSignature for a PDF on Android devices

People also ask

-

What is R tax FUTA and why is it important?

R tax FUTA stands for Federal Unemployment Tax Act, which is crucial for funding unemployment benefits in the U.S. Understanding R tax FUTA helps businesses comply with federal regulations and avoid potential penalties. This tax is essential for protecting employees and maintaining business integrity.

-

How can airSlate SignNow assist with R tax FUTA documentation?

airSlate SignNow provides an efficient platform for businesses to send, eSign, and manage essential R tax FUTA documentation. Our solution simplifies the process of collecting signatures and storing documents securely. This ensures that organizations can maintain compliance with R tax FUTA requirements easily.

-

Is there a cost associated with using airSlate SignNow for R tax FUTA documents?

Yes, airSlate SignNow offers various pricing plans that are cost-effective for businesses of all sizes. Each plan provides features tailored to manage R tax FUTA and other documentation needs efficiently. You can choose a plan that best fits your budget and business objectives.

-

What key features does airSlate SignNow offer for managing R tax FUTA?

With airSlate SignNow, you benefit from features like customizable templates, automated workflows, and secure cloud storage for R tax FUTA documents. These functionalities streamline the eSigning process and help you track document status in real-time. Our platform enhances productivity and reduces time spent on paperwork.

-

Can I integrate airSlate SignNow with my existing accounting software for R tax FUTA?

Absolutely! airSlate SignNow allows seamless integration with various accounting and payroll software to simplify the management of R tax FUTA. This integration helps synchronize data, ensuring your R tax FUTA calculations are accurate and up-to-date. You'll have a more cohesive workflow with minimal manual input.

-

How does airSlate SignNow ensure the security of R tax FUTA documents?

Security is a top priority at airSlate SignNow. We utilize advanced encryption methods and secure access controls to protect your R tax FUTA documents from unauthorized access. Our platform is compliant with various data protection regulations, giving you peace of mind regarding your sensitive information.

-

What are the benefits of using airSlate SignNow for R tax FUTA compliance?

Using airSlate SignNow for R tax FUTA compliance streamlines document management, saves time, and minimizes the risk of errors. Our user-friendly platform simplifies the eSigning process, ensuring you meet deadlines associated with R tax FUTA filings. This ultimately helps your business maintain compliance while enhancing overall efficiency.

Get more for Fillable 940 Orm

- County hold harmless agreement form

- County hold harmless agreement 555976896 form

- Pha code name phone fax email physical address type form

- Syep 2021 enrollment survey form

- Completion of the chemical classification packet orange form

- Completion of the chemical classification packet ocfa ocfa form

- Fill adjustment form

- Vtsid 09 swm facility record report amp certification form

Find out other Fillable 940 Orm

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now