R Form 2014

What is the R Form

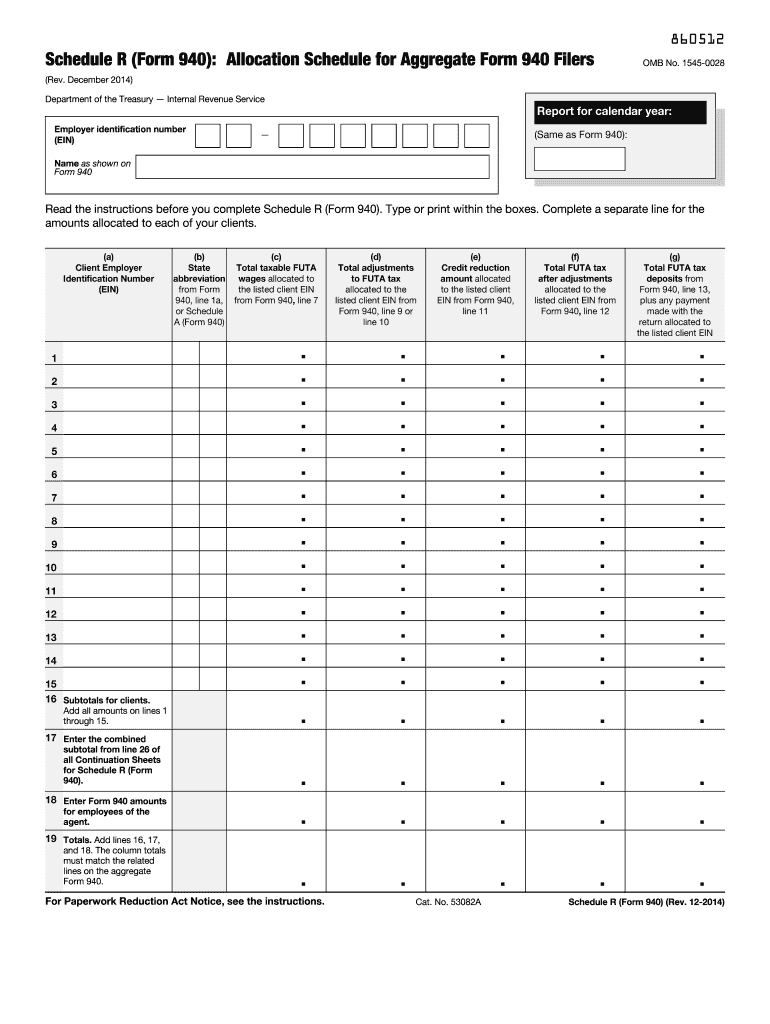

The R Form is a specific document used in various administrative and tax-related processes in the United States. It is designed to collect essential information from individuals or businesses for compliance with federal regulations. This form may be required for reporting income, claiming deductions, or fulfilling other obligations set forth by the IRS. Understanding the purpose and requirements of the R Form is crucial for ensuring accurate and timely submissions.

How to use the R Form

Using the R Form involves several steps to ensure that all required information is accurately captured. First, gather all necessary documentation that supports the information you need to provide. Next, carefully fill out each section of the form, ensuring that you adhere to any specific instructions related to your situation. Once completed, review the form for accuracy before submission to avoid delays or penalties.

Steps to complete the R Form

Completing the R Form can be straightforward if you follow these steps:

- Gather supporting documents, such as previous tax returns and identification.

- Download the R Form from the official IRS website or obtain a physical copy.

- Fill out the form, ensuring all fields are completed accurately.

- Double-check your entries for any errors or omissions.

- Sign and date the form where required.

- Submit the form according to the specified submission methods.

Legal use of the R Form

The R Form is legally binding when filled out and submitted correctly. It must comply with IRS regulations and guidelines to be considered valid. This means that all information provided must be truthful and accurate, as any discrepancies can lead to penalties or legal issues. Understanding the legal implications of the R Form is essential for both individuals and businesses to ensure compliance with tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the R Form can vary depending on the specific requirements set by the IRS. Typically, forms must be submitted by April 15 for individual taxpayers, but extensions may apply in certain circumstances. It is important to stay informed about any changes in deadlines and to mark your calendar accordingly to avoid late submissions, which can result in penalties.

Required Documents

To complete the R Form accurately, you may need to provide several supporting documents. These can include:

- Identification documents, such as a driver's license or Social Security card.

- Previous tax returns for reference.

- Income statements, such as W-2s or 1099s.

- Any relevant financial documents that support your claims.

Form Submission Methods (Online / Mail / In-Person)

The R Form can typically be submitted through various methods, depending on your preference and the specific guidelines provided by the IRS. Common submission methods include:

- Online submission through the IRS e-filing system.

- Mailing a physical copy of the form to the designated IRS address.

- In-person submission at local IRS offices, if applicable.

Quick guide on how to complete r form 2014

Complete R Form effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, as you can obtain the correct form and securely archive it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage R Form on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The simplest method to edit and eSign R Form with ease

- Locate R Form and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign R Form and ensure outstanding communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct r form 2014

Create this form in 5 minutes!

How to create an eSignature for the r form 2014

How to generate an electronic signature for the R Form 2014 online

How to make an eSignature for your R Form 2014 in Chrome

How to make an eSignature for putting it on the R Form 2014 in Gmail

How to make an electronic signature for the R Form 2014 from your smart phone

How to make an eSignature for the R Form 2014 on iOS devices

How to make an electronic signature for the R Form 2014 on Android OS

People also ask

-

What is R Form in airSlate SignNow?

R Form in airSlate SignNow refers to a specific type of document format that allows users to create and manage forms efficiently. With R Form, businesses can streamline their document workflows, ensuring that all necessary information is collected and processed seamlessly. This feature enhances the overall eSigning experience, making it easier for users to manage their documents.

-

How can I use R Form to improve my business processes?

By utilizing R Form in airSlate SignNow, businesses can automate their document workflows, reducing the time spent on paperwork. This feature allows users to create custom forms that can be filled out and signed electronically, which speeds up approvals and enhances collaboration. Ultimately, R Form helps businesses increase efficiency and productivity.

-

Is there a cost associated with using R Form in airSlate SignNow?

airSlate SignNow offers various pricing plans that include access to R Form features. Depending on the plan you choose, you can take advantage of unlimited templates and eSignatures, making it a cost-effective solution for businesses of all sizes. For detailed pricing information, visit our pricing page.

-

What features does R Form offer in airSlate SignNow?

R Form in airSlate SignNow comes with a variety of features, including customizable templates, automated workflows, and real-time tracking of document status. Additionally, users can integrate R Form with other applications to streamline their processes further. These features collectively enhance the user experience and improve document management.

-

Can I integrate R Form with other software applications?

Yes, R Form in airSlate SignNow supports integrations with numerous third-party applications. This allows businesses to connect their existing tools and systems, further enhancing workflow efficiency. Whether it’s CRM software, project management tools, or cloud storage services, R Form can seamlessly integrate to meet your needs.

-

What are the benefits of using R Form for electronic signatures?

Using R Form for electronic signatures in airSlate SignNow offers several benefits, including increased security, reduced turnaround time, and improved accuracy. With R Form, users can sign documents electronically from anywhere, ensuring that approvals are quick and efficient. This leads to faster business operations and a better customer experience.

-

How does R Form ensure document security in airSlate SignNow?

R Form in airSlate SignNow prioritizes document security by employing advanced encryption and authentication protocols. Each signed document is securely stored and can be accessed only by authorized users, ensuring that sensitive information remains protected. This level of security gives businesses peace of mind when managing their critical documents.

Get more for R Form

- Cv 5000 the superior court of california county of santa clara scscourt form

- Nj application form

- Usda form rd 442 7

- Chapter 11 monthly operating report for individuals and justice form

- Kennel permit application form

- M 941 massachusetts 2000 form

- Dep wq d 001 form

- Wales centre support supporting the eo form

Find out other R Form

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document