Form 1122 Instructions 2009

What is the Form 1122 Instructions

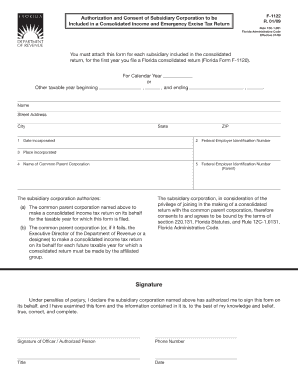

The Form 1122 Instructions provide guidance for the completion of Form 1122, which is used by businesses to request the transfer of a tax attribute from one entity to another. This form is particularly relevant for corporations and partnerships that need to ensure compliance with Internal Revenue Service (IRS) regulations when transferring tax attributes. Understanding the instructions is crucial for accurate submission and to avoid potential penalties.

Steps to Complete the Form 1122 Instructions

Completing the Form 1122 requires careful attention to detail. Here are the essential steps:

- Gather necessary information: Collect all relevant details about the transferring and receiving entities, including their tax identification numbers.

- Fill out the form: Provide accurate information in each section of the form, ensuring that all fields are completed as required.

- Review for accuracy: Double-check all entries to confirm that the information is correct and complete, as errors can lead to delays or rejections.

- Sign and date: Ensure that the authorized representatives of both entities sign and date the form where indicated.

- Submit the form: Choose the appropriate submission method, whether online, by mail, or in-person, as outlined in the instructions.

Legal Use of the Form 1122 Instructions

The legal use of the Form 1122 Instructions is grounded in compliance with IRS regulations. This form must be used correctly to ensure that the transfer of tax attributes is recognized by the IRS. Failure to adhere to the guidelines can result in the denial of the transfer request, leading to tax liabilities for the entities involved. It is essential to understand the legal implications of the information provided and to ensure that all actions taken are in accordance with federal tax laws.

Required Documents

To successfully complete and submit the Form 1122, certain documents are typically required. These may include:

- Tax identification numbers: Both entities must provide their Employer Identification Numbers (EIN).

- Financial statements: Recent financial statements may be needed to support the transfer of tax attributes.

- Previous tax returns: Copies of relevant tax returns may be required to verify the attributes being transferred.

Having these documents ready can streamline the process and help ensure compliance with IRS requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1122 are crucial to ensure compliance with IRS regulations. Typically, the form must be submitted by the due date of the tax return for the year in which the transfer of tax attributes is requested. It is advisable to check the specific deadlines for the current tax year, as they may vary. Missing these deadlines can result in penalties or the inability to complete the transfer.

Form Submission Methods

The Form 1122 can be submitted through various methods, depending on the preferences of the entities involved. Common submission methods include:

- Online submission: If available, this is often the quickest method to file.

- Mail: Sending the completed form via postal service is a traditional method.

- In-person delivery: Some entities may choose to deliver the form directly to an IRS office.

Each method has its own processing times and requirements, so it is important to choose the one that best suits the needs of the entities involved.

Quick guide on how to complete form 1122 instructions

Effortlessly Prepare Form 1122 Instructions on Any Device

Web-based document management has become increasingly popular among businesses and individuals alike. It serves as a perfect eco-friendly alternative to conventional printed and signed documents, enabling you to obtain the necessary form and securely keep it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly and seamlessly. Manage Form 1122 Instructions on any device with airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to Modify and Electronically Sign Form 1122 Instructions with Ease

- Find Form 1122 Instructions and click on Get Form to initiate the process.

- Use the tools we offer to complete your form.

- Emphasize key sections of the documents or redact sensitive information using the tools provided specifically for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your changes.

- Choose your preferred method to send your form: via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form-finding, and mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form 1122 Instructions to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1122 instructions

Create this form in 5 minutes!

How to create an eSignature for the form 1122 instructions

The best way to make an eSignature for a PDF file in the online mode

The best way to make an eSignature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your smartphone

How to make an eSignature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF on Android

People also ask

-

What are the form 1122 instructions for using airSlate SignNow?

The form 1122 instructions for using airSlate SignNow include details on how to prepare and submit the necessary documents electronically. Our platform simplifies the signing process, ensuring your forms are compliant and secure while integrated with your existing workflows.

-

How much does airSlate SignNow cost for managing form 1122 submissions?

AirSlate SignNow offers flexible pricing plans tailored for businesses needing to handle form 1122 submissions. Each plan comes equipped with various features to meet your needs, providing a cost-effective solution to manage your document workflows efficiently.

-

What features does airSlate SignNow offer to assist with form 1122 instructions?

AirSlate SignNow provides features such as templates for form 1122 instructions, real-time tracking, and custom workflows. These capabilities ensure that you can efficiently prepare, sign, and manage your documents all in one place.

-

Are there integrations available for submitting form 1122 with airSlate SignNow?

Yes, airSlate SignNow supports various integrations with popular applications to provide a seamless experience when dealing with form 1122 submissions. You can integrate with tools like Google Drive, Salesforce, and more, maximizing your productivity.

-

Is there customer support available for form 1122 instructions with airSlate SignNow?

Absolutely! AirSlate SignNow offers robust customer support to assist users with form 1122 instructions. Our team is available to help you navigate any challenges, ensuring you can make the most of our eSigning solutions.

-

Can I customize the form 1122 instructions in airSlate SignNow?

Yes, you can customize the form 1122 instructions in airSlate SignNow to meet your specific needs. The platform allows you to modify templates and workflows to suit your business requirements, making it easy to tailor your processes.

-

What are the benefits of using airSlate SignNow for form 1122 instructions?

Utilizing airSlate SignNow for form 1122 instructions brings numerous benefits, such as increased efficiency, reduced paper usage, and improved compliance. Our user-friendly interface ensures that your document management process is not only effective but also environmentally friendly.

Get more for Form 1122 Instructions

- Maryland annual file form

- Notices resolutions simple stock ledger and certificate maryland form

- Minutes for organizational meeting maryland maryland form

- Sample transmittal letter 497310448 form

- Js 44 civil cover sheet federal district court maryland form

- Maryland disclosure form

- Lead based paint disclosure for rental transaction maryland form

- Notice of lease for recording maryland form

Find out other Form 1122 Instructions

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online