G 31UASL 20200304 ApplicationGlobal Aerospace Aviation 2020-2026

Understanding hull and liability insurance

Hull and liability insurance is a specialized form of coverage designed for businesses that operate vessels or other marine vehicles. This insurance protects against physical damage to the hull of the insured vessel as well as liability claims arising from accidents or incidents involving that vessel. It is essential for businesses in the maritime industry to understand the nuances of this insurance to mitigate risks effectively.

Key components of hull and liability insurance

This type of insurance typically includes several key components:

- Hull coverage: Protects against damage to the vessel itself, covering repair costs or total loss.

- Liability coverage: Provides protection against claims for bodily injury or property damage caused by the vessel.

- Protection and indemnity (P&I): Covers legal liabilities associated with operating the vessel, including crew injuries and environmental damage.

- Loss of income: Compensates for lost revenue during the repair period following a covered loss.

Eligibility criteria for hull and liability insurance

To qualify for hull and liability insurance, businesses must meet specific eligibility criteria. These may include:

- Ownership of the vessel, with documentation proving title.

- Compliance with safety regulations and maintenance standards.

- History of claims and loss control measures in place.

Steps to obtain hull and liability insurance

Acquiring hull and liability insurance involves several steps:

- Assess your needs: Determine the level of coverage required based on vessel type, usage, and risk factors.

- Gather necessary documentation: Compile information about the vessel, including specifications, safety records, and ownership proof.

- Shop for quotes: Contact multiple insurance providers to compare coverage options and premiums.

- Review policy terms: Carefully examine the terms and conditions of each policy before making a decision.

- Finalize the policy: Complete the application process and make the initial premium payment to activate coverage.

Common misconceptions about hull and liability insurance

There are several misconceptions surrounding hull and liability insurance that businesses should be aware of:

- All marine insurance is the same: Different policies cater to various needs; understanding the specifics is crucial.

- Liability coverage is optional: For many businesses, liability coverage is essential to protect against significant financial loss.

- Claims are easy to file: The claims process can be complex and requires thorough documentation and evidence.

Importance of regular policy reviews

Regularly reviewing hull and liability insurance policies is vital to ensure adequate coverage. Changes in business operations, vessel modifications, or shifts in risk exposure can affect insurance needs. Conducting annual reviews helps identify gaps in coverage and allows businesses to adjust their policies accordingly.

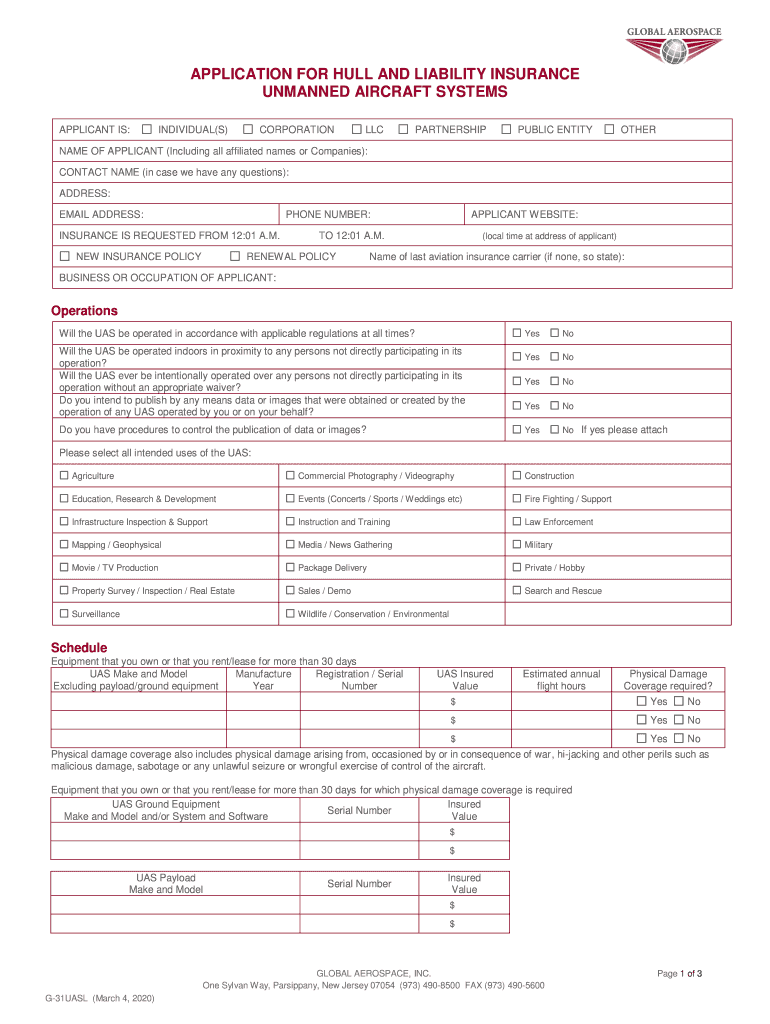

Quick guide on how to complete g 31uasl 20200304 applicationglobal aerospace aviation

Complete G 31UASL 20200304 ApplicationGlobal Aerospace Aviation effortlessly on any device

Online document administration has become more prevalent among organizations and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents quickly without any delays. Manage G 31UASL 20200304 ApplicationGlobal Aerospace Aviation on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign G 31UASL 20200304 ApplicationGlobal Aerospace Aviation with ease

- Find G 31UASL 20200304 ApplicationGlobal Aerospace Aviation and then click Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your updates.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tiring form searching, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign G 31UASL 20200304 ApplicationGlobal Aerospace Aviation and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct g 31uasl 20200304 applicationglobal aerospace aviation

Create this form in 5 minutes!

How to create an eSignature for the g 31uasl 20200304 applicationglobal aerospace aviation

How to create an electronic signature for a PDF document in the online mode

How to create an electronic signature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The way to create an eSignature from your mobile device

How to create an eSignature for a PDF document on iOS devices

The way to create an eSignature for a PDF file on Android devices

People also ask

-

What is hull and liability insurance?

Hull and liability insurance is a type of coverage that protects your vessel from physical damage and provides liability protection for accidents that may occur while operating the vessel. This insurance is essential for boat owners and operators to safeguard against financial losses related to damage or injury, ensuring peace of mind during maritime activities.

-

Why do I need hull and liability insurance?

Having hull and liability insurance is crucial for boat owners as it mitigates the financial risks associated with accidents, damages, and potential legal claims. This type of insurance helps cover repair costs for your vessel and provides liability coverage, which is essential in case of accidents that involve third parties, protecting you and your assets.

-

How much does hull and liability insurance cost?

The cost of hull and liability insurance varies based on factors such as the type and size of the vessel, its value, and your geographic location. Typically, premiums can range from a few hundred to several thousand dollars annually, depending on the specific coverage levels and deductibles you choose.

-

What features should I look for in hull and liability insurance?

When choosing hull and liability insurance, look for features like comprehensive coverage for physical damage, protection against theft, liability limits, and inclusion of personal effects. Additionally, check if the policy provides coverage for environmental damage and offers customizable options to suit your specific needs.

-

Can I combine hull and liability insurance with other types of insurance?

Yes, you can often combine hull and liability insurance with other policies, such as personal property or general liability insurance, to create a comprehensive risk management plan. Bundling these policies may also lead to discounts and lower overall premiums, providing better financial protection.

-

How can hull and liability insurance benefit my business?

Hull and liability insurance can signNowly benefit your business by minimizing potential financial losses from accidents, damages, and lawsuits. It not only protects your investment but also enhances your business's credibility by demonstrating that you have covered potential liabilities, which is vital for client confidence and partnership opportunities.

-

What should I do if I need to file a claim under my hull and liability insurance?

If you need to file a claim under your hull and liability insurance, start by documenting the incident thoroughly, including photos of damages and any relevant witness statements. Contact your insurance provider as soon as possible to report the incident and follow their procedures for submitting a claim, ensuring all necessary information is provided to expedite the process.

Get more for G 31UASL 20200304 ApplicationGlobal Aerospace Aviation

- Option to purchase addendum to residential lease lease or rent to own missouri form

- Missouri prenuptial premarital agreement with financial statements missouri form

- Missouri without form

- Amendment to prenuptial or premarital agreement missouri form

- Financial statements only in connection with prenuptial premarital agreement missouri form

- Revocation of premarital or prenuptial agreement missouri form

- Mo dissolution marriage form

- No fault agreed uncontested divorce package for dissolution of marriage for persons with no children with or without property 497312999 form

Find out other G 31UASL 20200304 ApplicationGlobal Aerospace Aviation

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later