HULL and LIABILITY INSURANCE 2015

What is hull and liability insurance?

Hull and liability insurance is a specialized type of insurance designed to protect businesses that operate watercraft. This insurance covers physical damage to the vessel itself, known as hull coverage, as well as liability for damages or injuries caused to third parties while operating the vessel. It is essential for companies involved in shipping, fishing, or recreational boating, ensuring that they are financially protected against unforeseen incidents.

Key elements of hull and liability insurance

Understanding the key elements of hull and liability insurance is crucial for businesses. The main components include:

- Hull coverage: Protects the physical structure of the vessel against damages from accidents, weather, or vandalism.

- Liability coverage: Offers protection against legal claims arising from injuries or damages to third parties caused by the vessel.

- Protection against theft: Covers loss of the vessel due to theft or piracy.

- Personal effects coverage: Insures personal belongings on board the vessel.

How to obtain hull and liability insurance

Obtaining hull and liability insurance involves several steps. First, assess the specific needs of your business and the type of vessels you operate. Next, research various insurance providers to compare coverage options and premiums. Once you identify a suitable provider, gather necessary documentation, such as vessel specifications and operational details. Finally, submit your application and review the policy terms before finalizing the purchase.

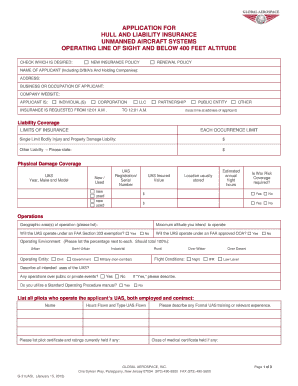

Steps to complete the hull and liability insurance form

Completing the hull and liability insurance form requires attention to detail. Follow these steps for a smooth process:

- Gather required information: Collect details about the vessel, including its make, model, and registration number.

- Provide operational details: Include information about how the vessel will be used, such as commercial or recreational purposes.

- Disclose prior claims: Be transparent about any previous insurance claims related to the vessel.

- Review and submit: Double-check all information for accuracy before submitting the form electronically or via mail.

Legal use of hull and liability insurance

Hull and liability insurance must comply with state and federal regulations to be considered legally valid. This includes adhering to specific coverage requirements and ensuring that the policy meets the standards set by regulatory bodies. Businesses should also be aware of any state-specific rules that may affect their insurance needs, such as minimum liability limits or mandatory coverage types.

Examples of using hull and liability insurance

Hull and liability insurance can be applied in various scenarios. For instance, a fishing charter company may use this insurance to cover damages incurred during a storm, protecting against financial loss. Similarly, a shipping company can rely on liability coverage if an accident occurs, ensuring they are protected against legal claims from injured parties. These examples illustrate the importance of having comprehensive insurance to safeguard business operations.

Quick guide on how to complete hull and liability insurance

Complete HULL AND LIABILITY INSURANCE effortlessly on any device

Online document management has become increasingly favored among businesses and individuals. It offers an excellent environmentally-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and safely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents swiftly without any hold-ups. Manage HULL AND LIABILITY INSURANCE on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to alter and eSign HULL AND LIABILITY INSURANCE with ease

- Find HULL AND LIABILITY INSURANCE and click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight signNow sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which only takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Alter and eSign HULL AND LIABILITY INSURANCE while ensuring excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct hull and liability insurance

Create this form in 5 minutes!

How to create an eSignature for the hull and liability insurance

The way to make an eSignature for a PDF in the online mode

The way to make an eSignature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The best way to make an eSignature straight from your smart phone

The way to make an eSignature for a PDF on iOS devices

The best way to make an eSignature for a PDF document on Android OS

People also ask

-

What is HULL AND LIABILITY INSURANCE?

HULL AND LIABILITY INSURANCE is a specialized type of coverage that protects vessels against physical damage and legal liabilities. This insurance is essential for boat owners and operators, safeguarding them from unforeseen accidents and potential lawsuits. Understanding HULL AND LIABILITY INSURANCE is crucial for anyone involved in maritime activities.

-

How does HULL AND LIABILITY INSURANCE benefit my business?

Having HULL AND LIABILITY INSURANCE ensures that your business is protected from the financial ramifications of accidents or damages involving your vessels. It helps cover repair costs and legal expenses, allowing you to operate your maritime business confidently. This insurance can signNowly reduce risk and protect your assets.

-

What factors affect the pricing of HULL AND LIABILITY INSURANCE?

The pricing of HULL AND LIABILITY INSURANCE is influenced by several factors, including the type of vessel, its age, your location, and usage frequency. Additionally, the coverage limits and deductible options you choose can also impact the premium. It's essential to discuss these factors with an insurance provider to get a tailored quote.

-

Are there different types of HULL AND LIABILITY INSURANCE policies available?

Yes, there are various HULL AND LIABILITY INSURANCE policies available to suit different needs. You can choose from comprehensive coverage, which encompasses a wide range of incidents, or more limited plans focusing on specific risks. Evaluating your business's unique requirements will help you select the best policy.

-

How can I file a claim for HULL AND LIABILITY INSURANCE?

Filing a claim for HULL AND LIABILITY INSURANCE typically involves contacting your insurance provider as soon as the incident occurs. You will need to provide documentation, including photographs and reports, detailing the damage or situation. Your insurer will guide you through the claim process, ensuring you receive the assistance you need.

-

Can HULL AND LIABILITY INSURANCE be customized?

Absolutely! Many insurance providers offer customizable HULL AND LIABILITY INSURANCE policies to cater to specific business needs. You can adjust coverage limits, add endorsements, and select specific exclusions to tailor a plan that best fits your operational requirements.

-

What should I look for in a HULL AND LIABILITY INSURANCE provider?

When choosing a HULL AND LIABILITY INSURANCE provider, consider their reputation, coverage options, and customer service. Look for providers with experience in the maritime industry and positive reviews from other businesses. It's also vital to compare quotes to ensure you get the best coverage at a competitive price.

Get more for HULL AND LIABILITY INSURANCE

- Petition to terminate legal matrimonial regime and enter into separation of property agreement louisiana form

- Louisiana matrimonial form

- Separation property regime 497309447 form

- Habeas corpus 497309448 form

- Habeas 497309449 form

- Judgment regarding child custody louisiana form

- Louisiana annual corporation form

- Louisiana bylaws form

Find out other HULL AND LIABILITY INSURANCE

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online