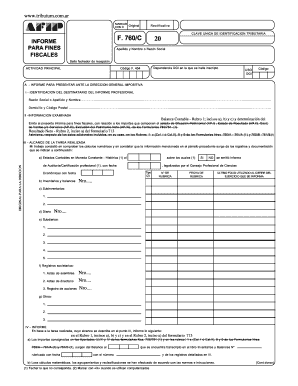

Formulario 760

What is the Formulario 760

The Formulario 760, also known as the 760 fiscales form, is a critical document used for tax purposes in the United States. It serves as a declaration for various fiscal obligations, particularly for individuals and businesses. This form is essential for reporting income, claiming deductions, and ensuring compliance with tax regulations. Understanding its purpose is vital for both taxpayers and tax professionals.

How to use the Formulario 760

Using the Formulario 760 involves several key steps that ensure accurate reporting of financial information. First, gather all necessary financial documents, including income statements and receipts for deductions. Next, carefully fill out the form, ensuring that all information is accurate and complete. Once completed, the form can be submitted electronically or via mail, depending on the specific requirements set forth by the IRS. Utilizing digital tools can streamline this process, making it easier to manage and submit.

Steps to complete the Formulario 760

Completing the Formulario 760 requires a systematic approach. Begin by reviewing the form's instructions thoroughly. Follow these steps:

- Collect necessary documents, such as W-2s, 1099s, and receipts.

- Fill in personal information, including your name, address, and Social Security number.

- Report your income accurately, ensuring all sources are included.

- Claim any eligible deductions and credits to minimize your tax liability.

- Review the completed form for accuracy before submission.

Taking the time to ensure that each section is filled out correctly can prevent delays and potential penalties.

Legal use of the Formulario 760

The Formulario 760 must be completed and submitted in accordance with IRS regulations to be considered legally valid. This includes adhering to deadlines and ensuring that all information provided is truthful and accurate. Failure to comply with these legal requirements can result in penalties, including fines or audits. It is important to understand the legal implications of the information reported on the form and to maintain thorough records in case of future inquiries.

Required Documents

To successfully complete the Formulario 760, certain documents are required. These typically include:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses.

- Previous year’s tax return for reference.

Having these documents on hand will facilitate the completion process and ensure that all income and deductions are accurately reported.

Form Submission Methods

The Formulario 760 can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the IRS e-file system.

- Mailing a paper form to the appropriate IRS address.

- In-person submission at designated IRS offices.

Choosing the right submission method can depend on personal preference and the urgency of processing the form.

Quick guide on how to complete formulario 760

Accomplish Formulario 760 seamlessly on any gadget

Digital document administration has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly without any holdups. Manage Formulario 760 on any gadget with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest method to edit and eSign Formulario 760 effortlessly

- Locate Formulario 760 and click on Get Form to commence.

- Utilize the resources we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Formulario 760 and ensure outstanding communication at every step of your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the formulario 760

The best way to generate an electronic signature for a PDF file in the online mode

The best way to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature right from your smartphone

The way to make an eSignature for a PDF file on iOS devices

How to make an electronic signature for a PDF on Android

People also ask

-

What is an AFIP informe and why is it important?

An AFIP informe is a document generated by the Argentine tax authority that provides valuable information for businesses and individuals regarding their tax obligations. Understanding your AFIP informe is crucial for staying compliant with tax regulations and avoiding potential penalties.

-

How can airSlate SignNow help with AFIP informe management?

airSlate SignNow offers seamless integration for managing AFIP informes efficiently. Through our eSignature solution, you can easily send, sign, and store your AFIP informe documents in a secure and organized manner, ensuring you never miss important deadlines.

-

Is there a cost associated with using airSlate SignNow for AFIP informes?

Yes, airSlate SignNow provides various pricing plans that cater to different business needs. Each plan offers cost-effective solutions for managing AFIP informes, allowing you to choose the best option that fits your budget and requirements.

-

Can I integrate airSlate SignNow with my current systems for AFIP informes?

Absolutely! airSlate SignNow supports easy integration with various business applications, ensuring that you can manage your AFIP informes seamlessly within your existing workflow. This integration helps streamline the document signing process across platforms.

-

What are the security features available for AFIP informes in airSlate SignNow?

Security is a top priority at airSlate SignNow. When handling AFIP informes, our platform employs bank-level encryption, user authentication, and detailed audit trails to protect your sensitive information, ensuring that your documents are safe from unauthorized access.

-

How does eSigning an AFIP informe enhance efficiency?

eSigning an AFIP informe with airSlate SignNow signNowly speeds up the document signing process. Instead of dealing with paper and ink signatures, you can quickly send and receive signed AFIP informes digitally, saving time and reducing the risk of document loss.

-

Are there templates available for AFIP informe documents?

Yes, airSlate SignNow offers customizable templates specifically designed for AFIP informes. These templates help you create, send, and manage your documents more efficiently while ensuring compliance with requisite regulations.

Get more for Formulario 760

- Probating will form

- Quitclaim deed from corporation to llc mississippi form

- Motion for discovery form

- Motion for blood tests in order to help determine paternity court ordered mississippi form

- Notice creditors sample form

- Quitclaim deed from corporation to corporation mississippi form

- Warranty deed from corporation to corporation mississippi form

- Mississippi probate form

Find out other Formulario 760

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors