Comparing Information from Your FAFSA Application with Copies of Yours and Your Parents Federal Tax 2019

What is the Comparing Information From Your FAFSA Application With Copies Of Yours And Your Parents Federal Tax

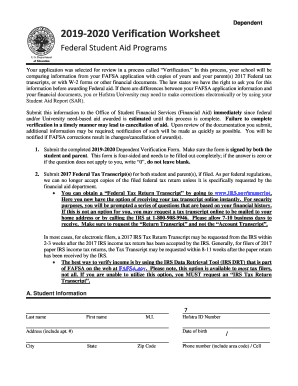

The process of comparing information from your FAFSA application with copies of yours and your parents' federal tax returns is essential for ensuring accuracy in financial aid applications. This comparison helps verify the financial data provided in the FAFSA against the official tax documents. By aligning these records, students can avoid discrepancies that may affect their eligibility for federal student aid. The FAFSA, or Free Application for Federal Student Aid, requires specific financial information, including income and tax details, which must match the figures reported on the IRS tax returns.

Steps to complete the Comparing Information From Your FAFSA Application With Copies Of Yours And Your Parents Federal Tax

To effectively compare the information from your FAFSA application with the federal tax returns, follow these steps:

- Gather your FAFSA application and copies of the relevant federal tax returns for both you and your parents.

- Review the income sections on the FAFSA and the tax returns to ensure the reported figures match.

- Check for any discrepancies in the number of dependents claimed and other financial details.

- Make note of any differences and gather documentation to support the correct figures.

- If necessary, make corrections to your FAFSA application before submitting it.

Legal use of the Comparing Information From Your FAFSA Application With Copies Of Yours And Your Parents Federal Tax

The legal use of comparing information from your FAFSA application with tax documents is grounded in the requirement for accuracy in financial disclosures. Federal regulations mandate that the information provided on the FAFSA must be truthful and verifiable. Any discrepancies can lead to penalties, including loss of financial aid eligibility. It is crucial to maintain compliance with the legal standards set forth by the U.S. Department of Education while ensuring that the information aligns with IRS records.

Required Documents

When comparing information from your FAFSA application with copies of yours and your parents' federal tax returns, the following documents are necessary:

- Your completed FAFSA application.

- Your and your parents' federal tax returns for the relevant tax year.

- W-2 forms or 1099 forms that report income.

- Any additional documentation that supports income claims, such as pay stubs or bank statements.

IRS Guidelines

IRS guidelines play a significant role in the process of comparing FAFSA information with tax returns. The IRS provides specific instructions on how income should be reported, including adjustments for certain deductions and credits. Understanding these guidelines ensures that the information reported on the FAFSA is accurate and compliant with federal regulations. Students should refer to IRS publications and resources for detailed instructions on reporting income and other financial information relevant to the FAFSA.

Form Submission Methods (Online / Mail / In-Person)

When submitting the FAFSA and any necessary corrections, there are several methods available:

- Online submission through the FAFSA website, which is the most efficient method.

- Mailing a paper FAFSA form to the designated processing center.

- In-person submission is generally not available, but students can seek assistance at financial aid offices.

Quick guide on how to complete comparing information from your fafsa application with copies of yours and your parents 2017 federal tax

Effortlessly Prepare Comparing Information From Your FAFSA Application With Copies Of Yours And Your Parents Federal Tax on Any Device

Online document administration has gained traction among businesses and individuals. It provides an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the appropriate form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without complications. Manage Comparing Information From Your FAFSA Application With Copies Of Yours And Your Parents Federal Tax on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to Modify and Electronically Sign Comparing Information From Your FAFSA Application With Copies Of Yours And Your Parents Federal Tax with Ease

- Find Comparing Information From Your FAFSA Application With Copies Of Yours And Your Parents Federal Tax and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to store your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over missing or lost documents, cumbersome form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Comparing Information From Your FAFSA Application With Copies Of Yours And Your Parents Federal Tax to ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct comparing information from your fafsa application with copies of yours and your parents 2017 federal tax

Create this form in 5 minutes!

How to create an eSignature for the comparing information from your fafsa application with copies of yours and your parents 2017 federal tax

The way to create an eSignature for a PDF file in the online mode

The way to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature straight from your smartphone

The best way to generate an eSignature for a PDF file on iOS devices

How to make an electronic signature for a PDF document on Android

People also ask

-

How can airSlate SignNow assist me in Comparing Information From Your FAFSA Application With Copies Of Yours And Your Parents Federal Tax?

airSlate SignNow offers a user-friendly platform that helps you organize and streamline the comparison process. You can easily upload your FAFSA application and your parents' federal tax documents to ensure accuracy. This reduces errors and simplifies the review for your financial aid.

-

What features does airSlate SignNow provide for effective document comparison?

Our platform allows you to easily upload, edit, and annotate documents, making it ideal for Comparing Information From Your FAFSA Application With Copies Of Yours And Your Parents Federal Tax. You can highlight discrepancies, add comments, and share documents securely with necessary parties.

-

Is airSlate SignNow a cost-effective solution for managing FAFSA documents?

Yes, airSlate SignNow is a budget-friendly choice for students and families looking to streamline their financial aid process. With flexible pricing plans, you can choose the one that best fits your needs without compromising on features while efficiently Comparing Information From Your FAFSA Application With Copies Of Yours And Your Parents Federal Tax.

-

Can I integrate airSlate SignNow with other tools to enhance my document comparison process?

Absolutely! airSlate SignNow offers integration with various applications, making it easier to manage documents effectively. This feature allows you to use other essential tools while Comparing Information From Your FAFSA Application With Copies Of Yours And Your Parents Federal Tax, resulting in a seamless workflow.

-

What benefits can I expect from using airSlate SignNow for FAFSA document management?

Using airSlate SignNow simplifies the process of Comparing Information From Your FAFSA Application With Copies Of Yours And Your Parents Federal Tax. You can expect increased accuracy, reduced processing time, and improved efficiency, allowing you to focus on securing financial aid.

-

How secure is my information when using airSlate SignNow for document comparisons?

Security is a top priority for airSlate SignNow. We implement robust encryption and secure sharing options to protect sensitive information while you are Comparing Information From Your FAFSA Application With Copies Of Yours And Your Parents Federal Tax. Your documents are safe, giving you peace of mind.

-

Are there any limitations to the file types I can compare through airSlate SignNow?

airSlate SignNow supports a variety of file formats for document comparison, including PDF, DOCX, and others. This versatility ensures that you can easily upload your FAFSA application and your parents' federal tax documents while Comparing Information From Your FAFSA Application With Copies Of Yours And Your Parents Federal Tax.

Get more for Comparing Information From Your FAFSA Application With Copies Of Yours And Your Parents Federal Tax

- Public entity 497329790 form

- Complaint for amount due for work and labor done on open account basis breach of oral or implied contracts form

- Ohio mobile home park regulations form

- License granting use of land for playing baseball softball or soccer form

- Household goods form

- Building security services agreement form

- Confirm title 497329796 form

- Real estate addendum form

Find out other Comparing Information From Your FAFSA Application With Copies Of Yours And Your Parents Federal Tax

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word