Form 14950 Rev 8 Premium Tax Credit Verification

What is the Form 14950 Rev 8 Premium Tax Credit Verification

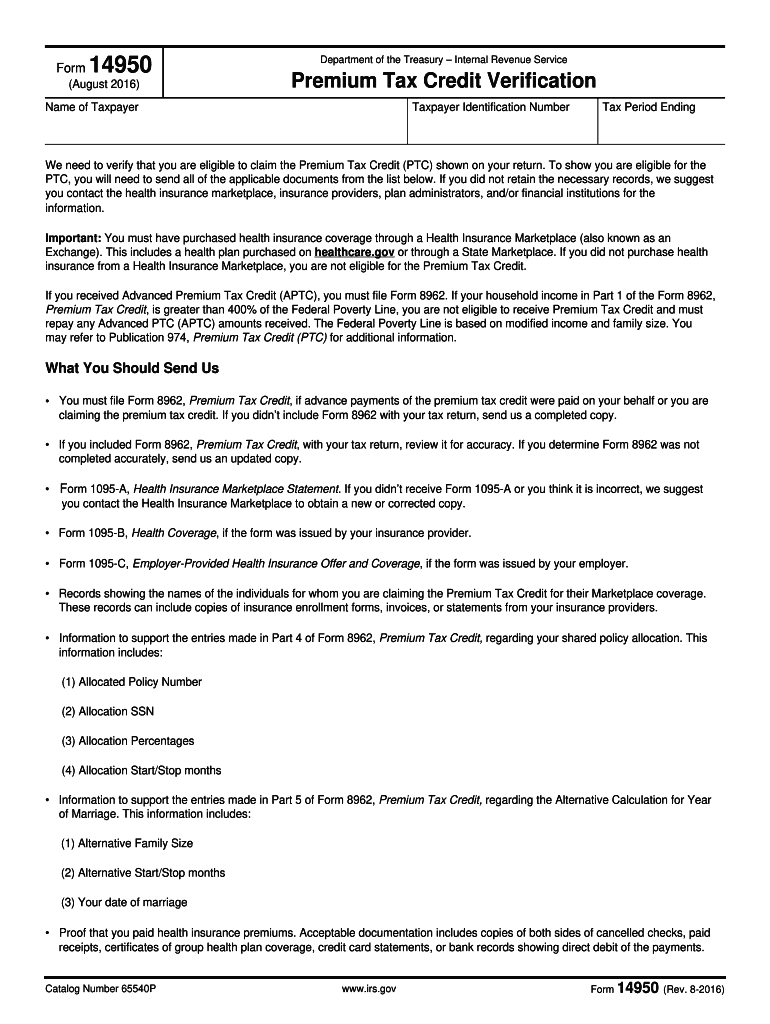

The Form 14950 Rev 8, also known as the Premium Tax Credit Verification, is a crucial document used by taxpayers to verify their eligibility for premium tax credits under the Affordable Care Act. This form is specifically designed to collect information about the taxpayer's household income and family size, which are essential factors in determining the amount of premium tax credit they may qualify for. By accurately completing this form, individuals can ensure they receive the appropriate financial assistance for health insurance coverage.

Steps to Complete the Form 14950 Rev 8 Premium Tax Credit Verification

Completing the Form 14950 Rev 8 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including income statements and details about household members. Next, fill out the form by providing personal information, such as your name, address, and Social Security number. It is important to accurately report your household income and the number of individuals in your household. After completing the form, review it for any errors before submitting it to the appropriate agency. Ensuring that all information is correct will help avoid delays in processing your premium tax credit.

Required Documents for Form 14950 Rev 8

To successfully complete the Form 14950 Rev 8, you will need to provide specific documents that support your claims. These documents typically include:

- Income statements, such as W-2 forms or 1099 forms.

- Proof of household size, which may include birth certificates or social security cards for dependents.

- Any previous tax returns that may be relevant to your current income situation.

Having these documents ready will streamline the process and ensure that your application is processed efficiently.

Eligibility Criteria for the Form 14950 Rev 8 Premium Tax Credit Verification

Eligibility for the premium tax credit is determined by several criteria outlined in the Form 14950 Rev 8. Generally, to qualify, taxpayers must have a household income that falls between one hundred and four hundred percent of the federal poverty level. Additionally, applicants must not be eligible for other qualifying health coverage, such as Medicare or Medicaid. Understanding these eligibility requirements is essential for ensuring that you complete the form correctly and receive the benefits for which you qualify.

Filing Deadlines for Form 14950 Rev 8

Timely submission of the Form 14950 Rev 8 is critical to ensure you receive your premium tax credits without delay. Generally, the form must be filed during the annual tax filing season, which typically runs from January to April. However, specific deadlines may vary based on individual circumstances, such as changes in income or household size throughout the year. It is advisable to stay informed about any updates from the IRS regarding filing deadlines to avoid penalties or loss of benefits.

Digital vs. Paper Version of Form 14950 Rev 8

The Form 14950 Rev 8 can be completed and submitted either digitally or via paper. The digital version offers convenience and faster processing times, as electronic submissions are typically prioritized by the IRS. On the other hand, some taxpayers may prefer the paper version for its tangible nature. Regardless of the method chosen, it is important to ensure that all information is accurately filled out and that the form is submitted to the correct address to avoid any processing delays.

Quick guide on how to complete form 14950 rev 8 2016 premium tax credit verification

Complete Form 14950 Rev 8 Premium Tax Credit Verification effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed papers, as you can acquire the necessary form and securely store it online. airSlate SignNow provides you with all the features you need to create, modify, and eSign your documents promptly without delays. Manage Form 14950 Rev 8 Premium Tax Credit Verification across any platform with airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The easiest way to modify and eSign Form 14950 Rev 8 Premium Tax Credit Verification seamlessly

- Obtain Form 14950 Rev 8 Premium Tax Credit Verification and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form: via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Form 14950 Rev 8 Premium Tax Credit Verification and ensure excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 14950 rev 8 2016 premium tax credit verification

The best way to create an electronic signature for a PDF file in the online mode

The best way to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

How to generate an eSignature from your smartphone

The way to create an eSignature for a PDF file on iOS devices

How to generate an eSignature for a PDF file on Android

People also ask

-

What is airSlate SignNow pricing for the 14950 plan?

The pricing for the 14950 plan of airSlate SignNow is designed to be cost-effective, enabling businesses to manage their document signing effortlessly. This plan offers various pricing tiers depending on the number of users and features required. With the 14950 plan, you receive essential tools to streamline your document workflow without overspending.

-

What features are included in the airSlate SignNow 14950 subscription?

The 14950 subscription includes a comprehensive set of features such as document templates, advanced signing options, and automated workflows. These functionalities empower businesses to enhance efficiency and minimize errors in document management. With airSlate SignNow’s 14950 plan, you'll have everything you need for seamless eSigning and document handling.

-

How does airSlate SignNow benefit businesses under the 14950 plan?

Businesses utilizing the airSlate SignNow 14950 plan benefit from increased productivity, reduced processing time, and improved document accuracy. This plan allows users to electronically sign documents quickly, eliminating the need for physical paperwork. With these advantages, your business can focus more on growth rather than administrative tasks.

-

Can I integrate airSlate SignNow with other software using the 14950 plan?

Yes, the airSlate SignNow 14950 plan supports integrations with various third-party applications such as CRM systems and cloud storage services. This capability enables users to create a cohesive workflow, connecting all essential tools for better document management. Integrating airSlate SignNow helps streamline processes and keep your data organized.

-

Is customer support provided for the 14950 airSlate SignNow plan?

Absolutely! The 14950 airSlate SignNow plan includes dedicated customer support to assist you with any inquiries or issues. Our support team is available to help you navigate through the features and optimize your usage of the platform. This ensures that you can maximize the value from your airSlate SignNow experience.

-

What types of documents can I electronically sign with the 14950 plan?

With the airSlate SignNow 14950 plan, you can electronically sign a wide variety of documents, including contracts, agreements, and forms. The platform supports different file formats, making it versatile for various business needs. You can create, send, and manage these documents easily, promoting a paperless environment.

-

Can the 14950 airSlate SignNow plan help reduce document turnaround time?

Yes, the 14950 airSlate SignNow plan is designed to signNowly reduce document turnaround time through its efficient eSigning process. By eliminating the need for physical signatures, documents can be completed in a fraction of the time. Faster document completion means your business can operate more smoothly and respond to client needs promptly.

Get more for Form 14950 Rev 8 Premium Tax Credit Verification

Find out other Form 14950 Rev 8 Premium Tax Credit Verification

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement