Form 1098 Mortgage Interest Statement

What is the Form 1098 Mortgage Interest Statement

The Form 1098, also known as the Mortgage Interest Statement, is a tax document used in the United States. It is issued by mortgage lenders to report the amount of interest paid on a mortgage during the tax year. This form is essential for taxpayers who itemize deductions on their federal tax returns. The information provided on the form can significantly impact a taxpayer's overall tax liability, allowing them to claim deductions for mortgage interest paid on their primary residence or other qualifying properties.

How to use the Form 1098 Mortgage Interest Statement

To use the Form 1098 effectively, taxpayers should first ensure they receive the form from their mortgage lender, typically by the end of January each year. Once received, the form should be reviewed for accuracy, including the total interest paid and any points paid on the mortgage. Taxpayers can then use this information when completing their federal income tax return, specifically on Schedule A, where they can itemize deductions. It is crucial to keep a copy of the Form 1098 for personal records and future reference, as it serves as proof of the interest paid for tax purposes.

Steps to complete the Form 1098 Mortgage Interest Statement

Completing the Form 1098 involves several straightforward steps. First, gather all relevant information regarding your mortgage, including the lender's name, your account number, and the total interest paid during the year. Next, accurately fill out the form with this information, ensuring that all entries match the lender's records. After completing the form, review it for any errors or omissions. Finally, submit the form to the IRS along with your tax return, or keep it for your records if you are not required to file it directly.

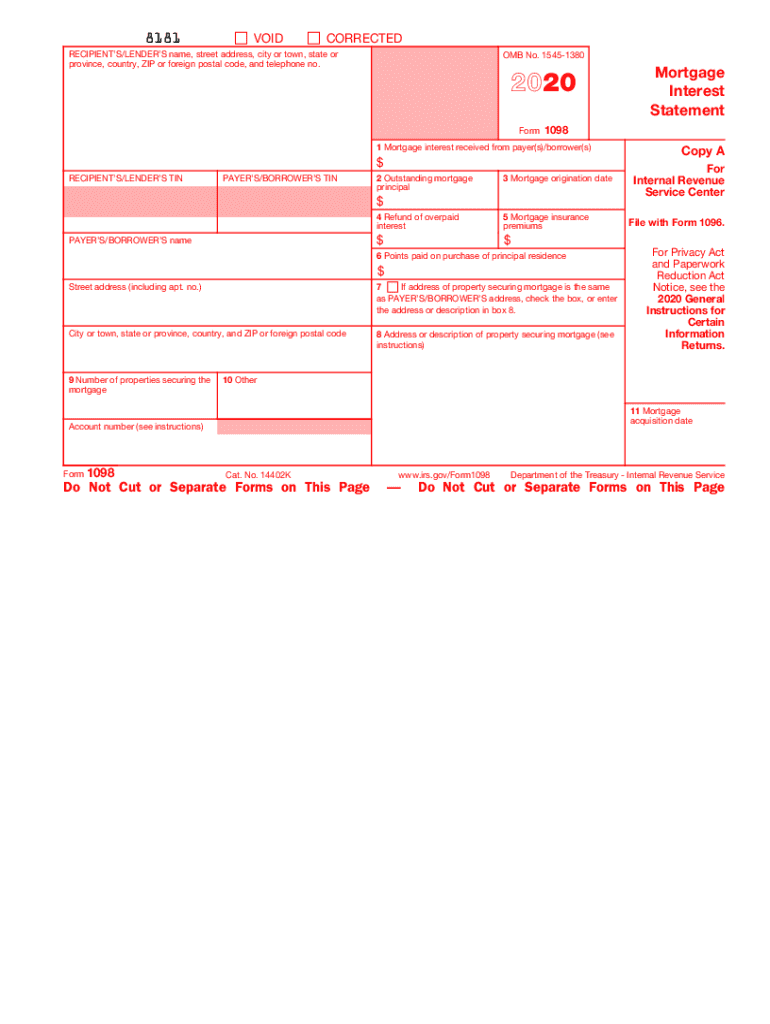

Key elements of the Form 1098 Mortgage Interest Statement

The Form 1098 includes several key elements that are important for taxpayers. These elements typically include:

- Lender's Information: Name, address, and taxpayer identification number of the lender.

- Borrower's Information: Name, address, and taxpayer identification number of the borrower.

- Mortgage Interest Paid: Total amount of interest paid on the mortgage during the tax year.

- Points Paid: Any points paid on the mortgage that may be deductible.

- Property Information: Address of the property secured by the mortgage.

IRS Guidelines

The IRS provides specific guidelines regarding the use and submission of the Form 1098. Taxpayers must ensure that the information reported on the form is accurate and reflects the actual payments made during the tax year. The IRS requires that lenders file the Form 1098 with the agency and provide a copy to the borrower. It is essential for taxpayers to understand these guidelines to avoid potential issues with their tax returns and ensure they maximize their eligible deductions.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1098 are crucial for taxpayers. Lenders must send out the Form 1098 to borrowers by January 31 of the year following the tax year in which the interest was paid. Taxpayers should file their federal income tax returns by April 15, unless they file for an extension. It is important to be aware of these dates to ensure timely filing and avoid penalties or interest on unpaid taxes.

Quick guide on how to complete 2020 form 1098 mortgage interest statement

Accomplish Form 1098 Mortgage Interest Statement seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can access the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents rapidly without holdups. Manage Form 1098 Mortgage Interest Statement on any device with the airSlate SignNow apps for Android or iOS and enhance any document-driven process today.

How to modify and electronically sign Form 1098 Mortgage Interest Statement effortlessly

- Obtain Form 1098 Mortgage Interest Statement and click on Get Form to begin.

- Utilize the features we provide to finalize your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that task.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose your preferred method for submitting your form, whether by email, text message (SMS), invitation link, or download it to your PC.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you select. Modify and electronically sign Form 1098 Mortgage Interest Statement to ensure excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 1098 mortgage interest statement

The best way to create an eSignature for a PDF online

The best way to create an eSignature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

How to generate an electronic signature from your smartphone

The way to generate an eSignature for a PDF on iOS

How to generate an electronic signature for a PDF file on Android

People also ask

-

What is the form 2020 1098 and why do I need it?

The form 2020 1098 is an IRS document used to report certain types of payments, including mortgage interest received by lenders. It's essential for taxpayers to accurately report this information on their tax returns, ensuring compliance and avoiding penalties.

-

How can airSlate SignNow help me with the form 2020 1098?

airSlate SignNow simplifies the process of eSigning and sending the form 2020 1098 securely. With our platform, you can streamline document workflows, making it easier to manage tax-related paperwork and ensuring timely submissions.

-

Is there a cost associated with using airSlate SignNow for the form 2020 1098?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our plans are designed to be cost-effective, providing valuable features for managing documents like the form 2020 1098 without incurring high expenses.

-

Can I integrate airSlate SignNow with other software for managing the form 2020 1098?

Absolutely! airSlate SignNow offers seamless integrations with popular software applications, allowing you to manage the form 2020 1098 alongside your existing tools. This helps enhance productivity and facilitates better document management.

-

What features does airSlate SignNow offer for handling the form 2020 1098?

airSlate SignNow includes features such as electronic signatures, document tracking, templates, and secure storage making it easy to manage the form 2020 1098. These functionalities ensure that your documents are completed accurately and efficiently.

-

Can multiple users collaborate on the form 2020 1098 with airSlate SignNow?

Yes, airSlate SignNow allows collaboration among multiple users on documents, including the form 2020 1098. This feature ensures that teams can work together in real-time, making edits and sending the document for signatures seamlessly.

-

How secure is the information on the form 2020 1098 when using airSlate SignNow?

Your information is secure when using airSlate SignNow to manage the form 2020 1098. Our platform employs advanced encryption and security protocols, ensuring that sensitive data remains protected at all times during the document handling process.

Get more for Form 1098 Mortgage Interest Statement

- Letter from tenant to landlord containing notice of failure to return security deposit and demand for return texas form

- Assessment threatened endangered species form

- Letter from tenant to landlord containing notice of wrongful deductions from security deposit and demand for return texas form

- Letter from tenant to landlord containing request for permission to sublease texas form

- Texas seller financing form

- Tx sublease form

- Tx contract resale form

- Landlord rent paid 497327555 form

Find out other Form 1098 Mortgage Interest Statement

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form