After Financial Statements Form

What is the After Financial Statements

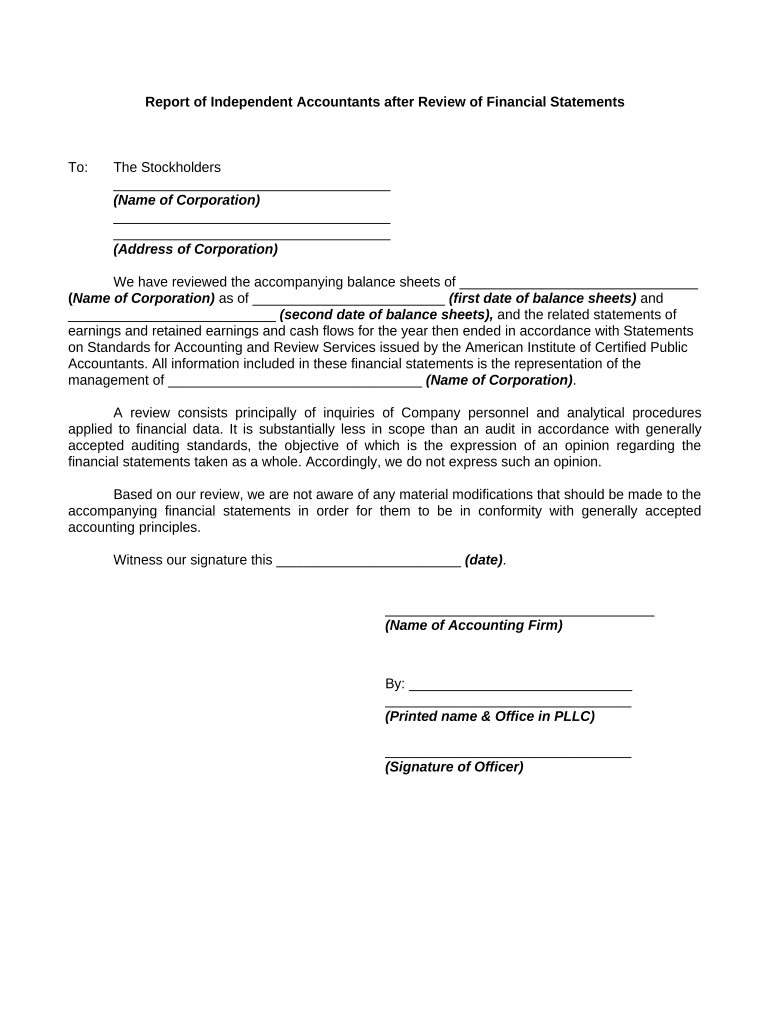

The after financial statements form is a crucial document used by businesses to provide a comprehensive overview of their financial status after a specific reporting period. This form typically includes key financial metrics such as income, expenses, assets, and liabilities. It serves as a tool for stakeholders to assess the financial health of an organization, enabling informed decision-making. Understanding the contents and implications of this form is essential for both internal management and external parties, such as investors or regulatory bodies.

How to use the After Financial Statements

Using the after financial statements form involves several steps to ensure accuracy and compliance. First, gather all relevant financial data from accounting records, including income statements and balance sheets. Next, input this data into the form, ensuring that all figures are correctly represented. It is important to review the completed form for any discrepancies before submission. Finally, the form can be shared with stakeholders or filed with regulatory authorities as required. Utilizing digital tools can streamline this process, making it easier to fill out, sign, and submit the form securely.

Key elements of the After Financial Statements

The after financial statements form typically includes several key elements that provide a clear picture of a company's financial performance. These elements often encompass:

- Income Statement: Details revenues, expenses, and net income over the reporting period.

- Balance Sheet: Summarizes assets, liabilities, and equity at a specific point in time.

- Cash Flow Statement: Illustrates cash inflows and outflows, highlighting liquidity.

- Notes and Disclosures: Provides additional context and explanations for financial figures.

Each of these components plays a vital role in presenting a complete financial picture, aiding in analysis and decision-making.

Steps to complete the After Financial Statements

Completing the after financial statements form involves a systematic approach to ensure all necessary information is accurately captured. Follow these steps:

- Collect all financial data from relevant accounting records.

- Fill in the income statement, detailing revenues and expenses.

- Complete the balance sheet with accurate asset and liability figures.

- Prepare the cash flow statement to show cash movements.

- Include necessary notes and disclosures for clarity.

- Review the form for accuracy and completeness.

- Submit the form to the appropriate stakeholders or regulatory bodies.

By following these steps, businesses can ensure their after financial statements are thorough and compliant.

Legal use of the After Financial Statements

The after financial statements form must comply with various legal requirements to be considered valid. In the United States, adherence to the Generally Accepted Accounting Principles (GAAP) is essential for financial reporting. Additionally, the form should be prepared and signed by authorized personnel to ensure its legitimacy. Electronic signatures, when used, must comply with the ESIGN Act and UETA, ensuring that they are legally binding. Understanding these legal frameworks is crucial for businesses to avoid potential disputes and ensure their financial documents are recognized by regulatory authorities.

Examples of using the After Financial Statements

Businesses utilize the after financial statements form in various scenarios. For instance:

- A corporation may present its after financial statements to shareholders during an annual meeting to discuss performance and future strategies.

- A small business might use the form to apply for a loan, providing lenders with a clear picture of its financial health.

- Non-profit organizations often prepare after financial statements to demonstrate fiscal responsibility to donors and grant agencies.

These examples illustrate the versatility and importance of the after financial statements form across different sectors.

Quick guide on how to complete after financial statements

Complete After Financial Statements seamlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without holdups. Handle After Financial Statements on any device with airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

The easiest way to alter and eSign After Financial Statements effortlessly

- Obtain After Financial Statements and click on Get Form to begin.

- Use the tools we offer to fill in your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes only a few seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select how you want to send your form, whether by email, SMS, or invitation link, or download it onto your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Adjust and eSign After Financial Statements to ensure outstanding communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What actions can I take after financial statements are prepared using airSlate SignNow?

After financial statements are prepared, you can seamlessly send them for eSignature using airSlate SignNow. This ensures that all involved parties can review and approve the documents quickly, streamlining your financial processes signNowly.

-

How can airSlate SignNow enhance the accessibility of documents after financial statements are generated?

airSlate SignNow allows you to access your documents from anywhere, anytime, which becomes crucial after financial statements are generated. This flexibility means you can manage approvals and feedback in real-time, regardless of your location.

-

What features does airSlate SignNow offer for managing documents after financial statements?

After financial statements are created, airSlate SignNow offers a range of features such as template creation, automated reminders, and tracking of document status. These features help businesses ensure that approvals are obtained swiftly and that all necessary parties are notified during the process.

-

Is there a cost-effective pricing plan for small businesses needing services after financial statements?

Yes, airSlate SignNow provides various pricing plans tailored for small businesses that need eSignature solutions after financial statements are prepared. This ensures that even budget-conscious organizations can benefit from powerful document management without breaking the bank.

-

How does airSlate SignNow integrate with other accounting software after financial statements?

airSlate SignNow can easily integrate with popular accounting software, allowing for a seamless workflow after financial statements are generated. This integration automates the document handling process, ensuring that your financial data flows smoothly between platforms.

-

What are the security measures in place for documents signed after financial statements?

airSlate SignNow prioritizes security and offers robust measures for documents signed after financial statements. All documents are encrypted, and we comply with industry standards to protect sensitive financial information throughout the signing process.

-

Can I track the status of documents sent after financial statements with airSlate SignNow?

Yes, you can track the status of documents sent after financial statements using airSlate SignNow’s tracking feature. This allows you to see who has viewed and signed your documents, helping to keep your financial workflows organized and timely.

Get more for After Financial Statements

- Request to restrict disclosure dhs 8028doc med quest form

- Health plan manual provider med questus med quest form

- Microsoft word dhs form 204 rev 0307 instructionsdoc med quest

- Authorizat ion t0 disclose confjdential information med quest

- Exemption checklist department of human services med quest med quest form

- State of hawaii department of human services med quest division acs p med quest form

- Traveling form for inter island travel in hawaii

- 1 centers for medicare amp medicaid services special med quest form

Find out other After Financial Statements

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast