Forms and Instructions ATO 2019-2026

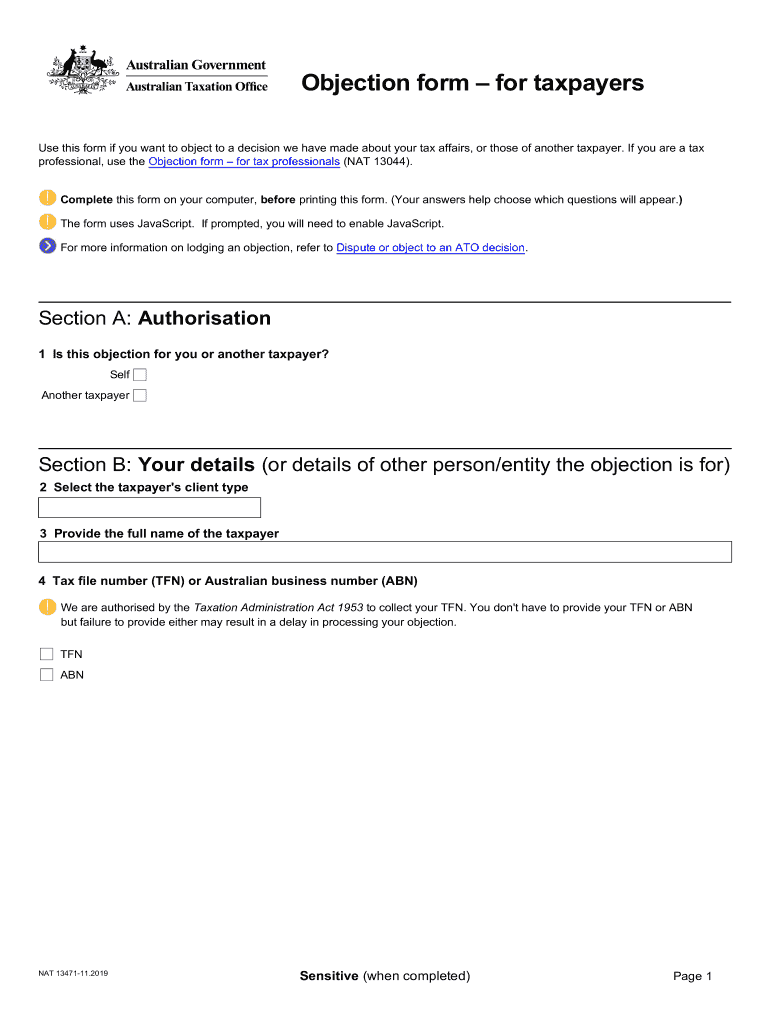

What is the ATO Objection Form?

The ATO objection form is a crucial document for taxpayers who wish to contest decisions made by the Australian Taxation Office (ATO). This form allows individuals and businesses to formally lodge objections against various tax assessments, including income tax, GST, and other tax-related decisions. By completing this form, taxpayers can present their case for reconsideration, ensuring their concerns are officially recorded and reviewed by the ATO.

Steps to Complete the ATO Objection Form

Filling out the ATO objection form involves several important steps to ensure accuracy and compliance. Here are the key steps:

- Gather necessary documentation: Collect all relevant tax documents and evidence that support your objection.

- Fill out the form: Provide accurate personal and tax details, clearly stating the reasons for your objection.

- Attach supporting documents: Include any additional documentation that substantiates your claims.

- Review your submission: Double-check all information for accuracy to avoid delays.

- Submit the form: Send the completed form and attachments to the ATO via the appropriate method.

Legal Use of the ATO Objection Form

The legal validity of the ATO objection form hinges on adherence to specific requirements. When completed correctly, the form serves as a legally binding document that can influence the outcome of a tax dispute. It is essential to ensure that all information is accurate and that the form is submitted within the designated time frames to maintain its legal standing.

Form Submission Methods

Taxpayers have multiple options for submitting the ATO objection form. These methods include:

- Online submission through the ATO's official website, which is often the fastest method.

- Mailing a physical copy of the form to the ATO's designated address.

- In-person submission at an ATO office, if preferred.

Required Documents

To successfully complete the ATO objection form, certain documents are typically required. These may include:

- Tax assessment notices related to the objection.

- Financial records that support your claims.

- Any correspondence with the ATO regarding the issue.

Filing Deadlines / Important Dates

Timeliness is critical when filing an objection. The ATO typically requires that objections be lodged within a specific period following the issuance of a tax assessment. It is important to be aware of these deadlines to ensure that your objection is considered valid and timely.

Quick guide on how to complete forms and instructions ato

Effectively complete Forms And Instructions ATO on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-conscious substitute for conventional printed and signed paperwork, allowing you to access the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly without interruptions. Handle Forms And Instructions ATO on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Forms And Instructions ATO effortlessly

- Find Forms And Instructions ATO and click on Get Form to begin.

- Utilize the instruments we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow.

- Create your signature using the Sign tool, which takes only moments and holds the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your modifications.

- Choose your preferred delivery method for the form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow satisfies all your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign Forms And Instructions ATO and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct forms and instructions ato

Create this form in 5 minutes!

How to create an eSignature for the forms and instructions ato

The way to create an eSignature for your PDF file online

The way to create an eSignature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

How to create an eSignature right from your mobile device

The best way to generate an electronic signature for a PDF file on iOS

How to create an eSignature for a PDF on Android devices

People also ask

-

What is the ato objection form and how does it work?

The ato objection form is a document used by individuals or businesses to contest decisions made by the Australian Taxation Office (ATO). By using airSlate SignNow, you can easily complete, sign, and submit your ato objection form electronically, ensuring a streamlined process that saves you time and reduces errors.

-

Is there a cost associated with using airSlate SignNow for the ato objection form?

Yes, there may be fees associated with using airSlate SignNow, depending on your usage requirements. We offer various pricing plans that cater to different business needs, allowing you to manage your ato objection form and other documents efficiently and cost-effectively.

-

What features does airSlate SignNow offer for managing the ato objection form?

airSlate SignNow provides various features to facilitate the management of your ato objection form, including electronic signatures, template creation, and automated workflows. These features ensure that your documents are always compliant and easily accessible, streamlining your objection process.

-

How can I integrate airSlate SignNow with other tools for the ato objection form?

airSlate SignNow seamlessly integrates with numerous third-party applications, enabling you to manage your ato objection form within your existing workflows. Whether it's connecting with CRMs, storage services, or productivity tools, our platform can enhance your document management experience.

-

What are the benefits of using airSlate SignNow for the ato objection form?

Using airSlate SignNow for your ato objection form offers several benefits, including quicker turnaround times, enhanced security, and improved tracking of document statuses. The ability to eSign documents means you can submit your objection without the hassle of printing and scanning.

-

Can I track the status of my ato objection form with airSlate SignNow?

Absolutely! airSlate SignNow includes tracking features, allowing you to monitor the status of your ato objection form in real-time. You'll receive notifications when the document is viewed, signed, or completed, providing transparency in your objection process.

-

Is airSlate SignNow compliant with legal requirements for the ato objection form?

Yes, airSlate SignNow is designed to meet legal standards for electronic signatures. Our platform complies with relevant regulations, ensuring that your ato objection form is legally binding and secure, thus giving you peace of mind when submitting your documents.

Get more for Forms And Instructions ATO

Find out other Forms And Instructions ATO

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free