Objection and Request for Departmental Review NC 242 2020-2026

Understanding the Objection and Request for Departmental Review NC 242

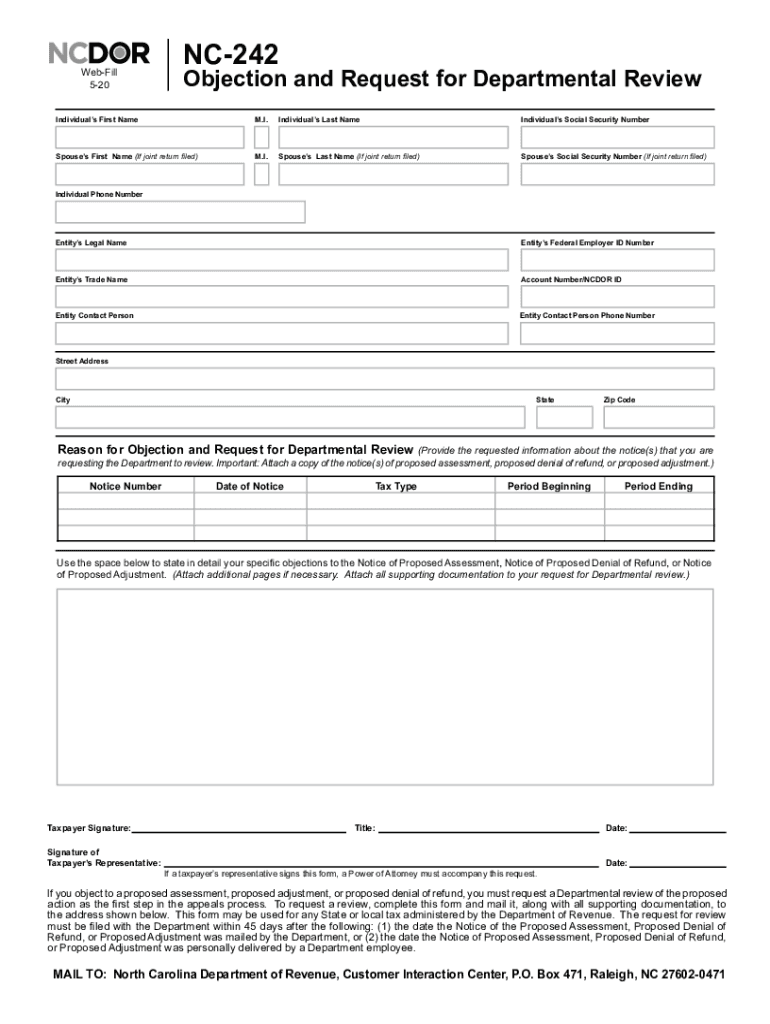

The Objection and Request for Departmental Review NC 242 is a form used by taxpayers in North Carolina to formally contest a decision made by the North Carolina Department of Revenue. This form allows individuals or businesses to request a review of tax assessments or decisions that they believe are incorrect. It is essential for taxpayers who wish to challenge the findings of the Department of Revenue regarding their tax liabilities.

The form serves as a critical tool for ensuring that taxpayers have a voice in the review process. By submitting the NC 242, taxpayers can present their objections and provide supporting documentation to justify their claims. This process is an important aspect of maintaining transparency and fairness within the state's tax system.

Steps to Complete the Objection and Request for Departmental Review NC 242

Completing the NC 242 form requires careful attention to detail. Here are the steps to ensure proper submission:

- Gather necessary information: Collect all relevant documents, including the original tax assessment notice and any supporting evidence that substantiates your objection.

- Fill out the form: Accurately complete all sections of the NC 242 form. Ensure that your contact information and the details of the tax assessment are correctly entered.

- Provide a clear explanation: In the designated section, clearly articulate the reasons for your objection. Include any relevant facts or circumstances that support your case.

- Attach supporting documents: Include copies of any documents that support your objection, such as financial records or correspondence with the Department of Revenue.

- Review your submission: Before sending, double-check the form for accuracy and completeness to avoid delays in processing.

- Submit the form: Follow the submission guidelines provided on the form, whether by mail or electronically, to ensure it reaches the appropriate department.

Legal Use of the Objection and Request for Departmental Review NC 242

The NC 242 form is legally recognized as a formal request for review, and its proper use is governed by North Carolina tax laws. When filed correctly, it provides taxpayers with the right to contest decisions made by the Department of Revenue. This legal standing ensures that taxpayers can seek redress and have their concerns addressed in a structured manner.

It is important to adhere to the guidelines outlined by the Department of Revenue when using this form. Failure to comply with legal requirements may result in the rejection of the objection or a delay in the review process. Understanding the legal implications of the NC 242 is crucial for taxpayers seeking to protect their rights.

Who Issues the Objection and Request for Departmental Review NC 242

The Objection and Request for Departmental Review NC 242 is issued by the North Carolina Department of Revenue. This agency is responsible for administering the state's tax laws and ensuring compliance among taxpayers. The Department of Revenue provides the necessary forms and guidelines for taxpayers wishing to contest tax assessments or decisions.

By utilizing the NC 242 form, taxpayers engage directly with the Department of Revenue, allowing for a formal review process. The agency's role is to assess the objections raised and make determinations based on the information provided.

Filing Deadlines and Important Dates for NC 242

Timeliness is critical when submitting the NC 242 form. Taxpayers must be aware of the specific deadlines associated with filing objections. Generally, the form must be submitted within a certain period following the issuance of the tax assessment notice.

Failure to file within the designated timeframe may result in the loss of the right to contest the assessment. It is advisable for taxpayers to familiarize themselves with these deadlines to ensure their objections are considered valid.

Required Documents for NC 242 Submission

When submitting the Objection and Request for Departmental Review NC 242, it is essential to include all required documents to support your case. This typically includes:

- A copy of the tax assessment notice being contested.

- Any relevant financial documents or records that support your objection.

- Correspondence with the Department of Revenue, if applicable.

- Any additional documentation that may clarify your position or provide context to your objection.

Providing comprehensive documentation enhances the likelihood of a favorable review and demonstrates diligence in addressing the issues at hand.

Quick guide on how to complete objection and request for departmental review nc 242

Complete Objection And Request For Departmental Review NC 242 seamlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documentation, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents rapidly without delays. Manage Objection And Request For Departmental Review NC 242 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven procedure today.

How to modify and electronically sign Objection And Request For Departmental Review NC 242 effortlessly

- Locate Objection And Request For Departmental Review NC 242 and click on Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of the documents or obscure private information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information carefully and click on the Done button to save your changes.

- Choose how you wish to send your form, by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new copies of documents. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Modify and eSign Objection And Request For Departmental Review NC 242 and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct objection and request for departmental review nc 242

Create this form in 5 minutes!

How to create an eSignature for the objection and request for departmental review nc 242

The best way to make an electronic signature for your PDF document online

The best way to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

How to generate an eSignature from your smart phone

How to generate an electronic signature for a PDF document on iOS

How to generate an eSignature for a PDF file on Android OS

People also ask

-

What is nc 242 in relation to airSlate SignNow?

The nc 242 is a specific feature in airSlate SignNow that allows users to automate the signing process. This feature streamlines workflows, ensuring that documents are signed quickly and efficiently, improving turnaround times for businesses.

-

How does airSlate SignNow with nc 242 improve document management?

Using nc 242 within airSlate SignNow enhances document management by providing clear workflow tracking and status updates. This ensures that all team members are informed about document progress, reducing confusion and ensuring accountability.

-

What pricing options are available for airSlate SignNow's nc 242 functionality?

airSlate SignNow offers competitive pricing plans that include access to the nc 242 feature. These plans are designed to fit different business sizes and needs, making it a cost-effective solution for both small and large organizations.

-

Can I integrate nc 242 with other software applications?

Yes, nc 242 supports integrations with a variety of third-party applications, including CRM software and project management tools. This flexibility allows businesses to enhance their operational efficiency by seamlessly connecting airSlate SignNow with existing systems.

-

What are the benefits of using nc 242 in airSlate SignNow for small businesses?

For small businesses, utilizing the nc 242 feature in airSlate SignNow offers signNow benefits such as cost savings and streamlined operations. By automating the signing process, small businesses can save time and resources, allowing them to focus on core activities.

-

Is there a mobile app available for nc 242 within airSlate SignNow?

Absolutely! The nc 242 feature is accessible through the airSlate SignNow mobile app, allowing users to send and sign documents on-the-go. This ensures that your workflow remains uninterrupted, enhancing accessibility and convenience.

-

What security measures does airSlate SignNow implement for nc 242?

airSlate SignNow prioritizes security for its nc 242 functionality by employing advanced encryption methods and compliance with industry regulations. This guarantees that your documents remain secure during the signing process, providing peace of mind to users.

Get more for Objection And Request For Departmental Review NC 242

Find out other Objection And Request For Departmental Review NC 242

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment