Form ST MAB 4 Rev 315 Instructions for Sales Tax on 2018-2026

Understanding the Massachusetts ST MAB 4 Form

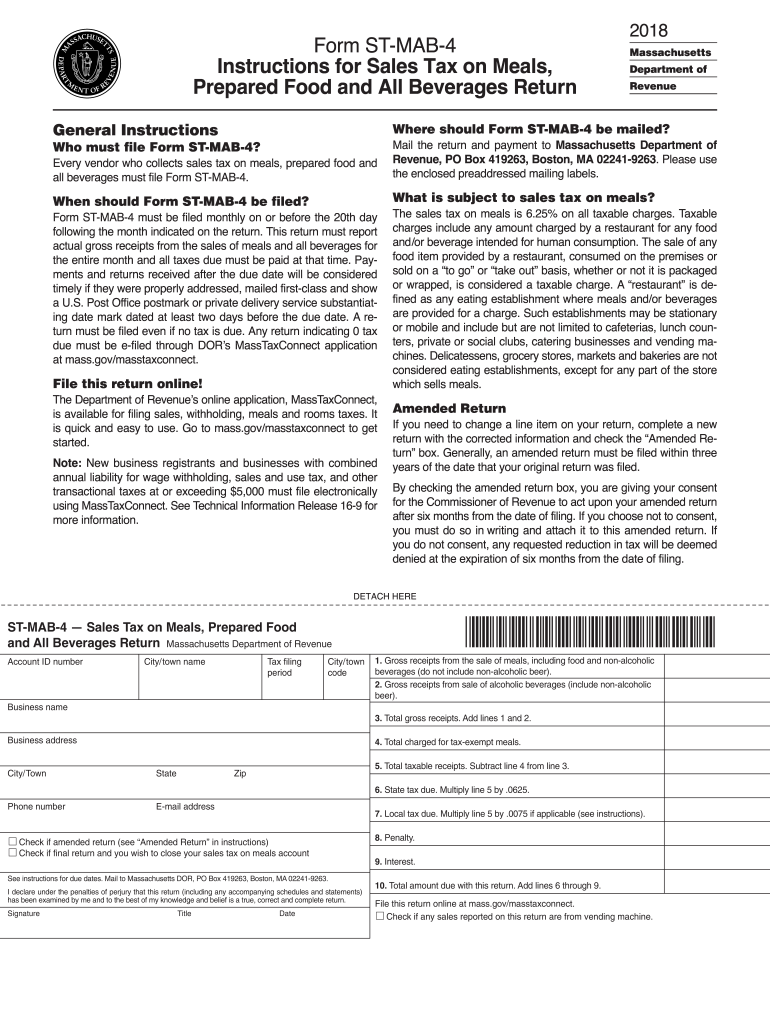

The Massachusetts ST MAB 4 form, also known as the Sales Tax on Services form, is essential for businesses that provide taxable services in the state. This form allows businesses to report and remit sales tax collected on services rendered. Understanding its purpose is crucial for compliance with state tax regulations. The ST MAB 4 form is specifically designed for service providers, ensuring that they fulfill their tax obligations accurately and timely.

Steps to Complete the Massachusetts ST MAB 4 Form

Completing the Massachusetts ST MAB 4 form involves several key steps to ensure accuracy and compliance. Here is a straightforward guide:

- Gather necessary information, including your business details and the total sales tax collected.

- Fill in the required fields on the form, including your business name, address, and tax identification number.

- Calculate the total amount of sales tax due based on the services provided.

- Review the completed form for any errors or omissions.

- Submit the form by the designated deadline to avoid penalties.

Legal Use of the Massachusetts ST MAB 4 Form

The Massachusetts ST MAB 4 form is legally binding when completed and submitted correctly. It serves as a formal declaration of the sales tax collected on services, which is required by the Massachusetts Department of Revenue. Proper use of this form ensures that businesses remain compliant with state tax laws, avoiding potential legal issues or penalties associated with non-compliance.

Filing Deadlines for the Massachusetts ST MAB 4 Form

Timely filing of the Massachusetts ST MAB 4 form is crucial to avoid penalties. The filing deadlines typically align with the state’s tax reporting schedule. Businesses should be aware of the following key dates:

- Quarterly filing deadlines for businesses reporting sales tax on a quarterly basis.

- Annual deadlines for businesses that file on an annual basis.

It is advisable to check the Massachusetts Department of Revenue website for the most current deadlines and any updates to filing requirements.

Obtaining the Massachusetts ST MAB 4 Form

The Massachusetts ST MAB 4 form can be obtained directly from the Massachusetts Department of Revenue website. It is available as a printable document, allowing businesses to fill it out manually or digitally. Additionally, businesses may also find the form through various tax preparation software that supports Massachusetts tax filings.

Examples of Using the Massachusetts ST MAB 4 Form

Understanding practical scenarios can help clarify the use of the Massachusetts ST MAB 4 form. Here are a few examples:

- A consulting firm that provides taxable services must report the sales tax collected from clients using the ST MAB 4 form.

- A contractor offering renovation services needs to remit sales tax on the labor and materials provided, utilizing this form for accurate reporting.

These examples illustrate how different service providers can effectively use the ST MAB 4 form to remain compliant with state tax regulations.

Quick guide on how to complete form st mab 4 rev 315 instructions for sales tax on

Effortlessly prepare Form ST MAB 4 Rev 315 Instructions For Sales Tax On on any device

Digital document management has become widely embraced by both businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to easily locate the necessary forms and securely store them online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Form ST MAB 4 Rev 315 Instructions For Sales Tax On on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and electronically sign Form ST MAB 4 Rev 315 Instructions For Sales Tax On with ease

- Find Form ST MAB 4 Rev 315 Instructions For Sales Tax On and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the information and click the Done button to save your changes.

- Select how you want to send your form, via email, text message (SMS), or a sharing link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Form ST MAB 4 Rev 315 Instructions For Sales Tax On to ensure seamless communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form st mab 4 rev 315 instructions for sales tax on

Create this form in 5 minutes!

How to create an eSignature for the form st mab 4 rev 315 instructions for sales tax on

The way to create an electronic signature for your PDF document online

The way to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

How to make an electronic signature right from your smart phone

The best way to create an electronic signature for a PDF document on iOS

How to make an electronic signature for a PDF on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to massachusetts st mab4?

airSlate SignNow is a versatile eSigning solution that enables businesses to efficiently send and sign documents online. In relation to massachusetts st mab4, our platform simplifies the document workflow for users in this region, making it easy to manage important paperwork.

-

How much does airSlate SignNow cost for users in massachusetts st mab4?

Our pricing for airSlate SignNow is competitive and tailored to meet the needs of businesses in massachusetts st mab4. We offer different subscription tiers to accommodate varying usage levels, ensuring that you only pay for what you need.

-

What features does airSlate SignNow offer for massachusetts st mab4 users?

airSlate SignNow provides a comprehensive suite of features, including customizable templates, real-time tracking, and automated reminders. For users in massachusetts st mab4, these features streamline the signing process and enhance document security.

-

How can airSlate SignNow benefit my business in massachusetts st mab4?

By using airSlate SignNow, businesses in massachusetts st mab4 can enhance their efficiency and reduce turnaround times for document signing. The platform allows for seamless collaboration among teams and clients, making it an effective tool for today's fast-paced work environment.

-

Is airSlate SignNow easy to integrate with other tools for massachusetts st mab4 customers?

Absolutely! airSlate SignNow integrates easily with a variety of third-party applications, including CRM systems and project management tools, providing a comprehensive solution for users in massachusetts st mab4. This ensures your existing workflows remain uninterrupted.

-

Can I use airSlate SignNow for legally binding documents in massachusetts st mab4?

Yes, documents signed via airSlate SignNow are legally binding in massachusetts st mab4, adhering to electronic signature laws. This ensures that your eSigned documents hold the same legal weight as those signed in person, providing peace of mind for businesses and individuals.

-

What support options are available for massachusetts st mab4 users of airSlate SignNow?

airSlate SignNow offers robust customer support for users in massachusetts st mab4, including online resources, tutorials, and dedicated support teams. We are committed to helping you navigate any challenges you might face while utilizing our platform.

Get more for Form ST MAB 4 Rev 315 Instructions For Sales Tax On

Find out other Form ST MAB 4 Rev 315 Instructions For Sales Tax On

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy