Massachusetts Form M 1310 Statement of Claimant to 2019-2026

What is the Massachusetts Form M 1310 Statement Of Claimant To

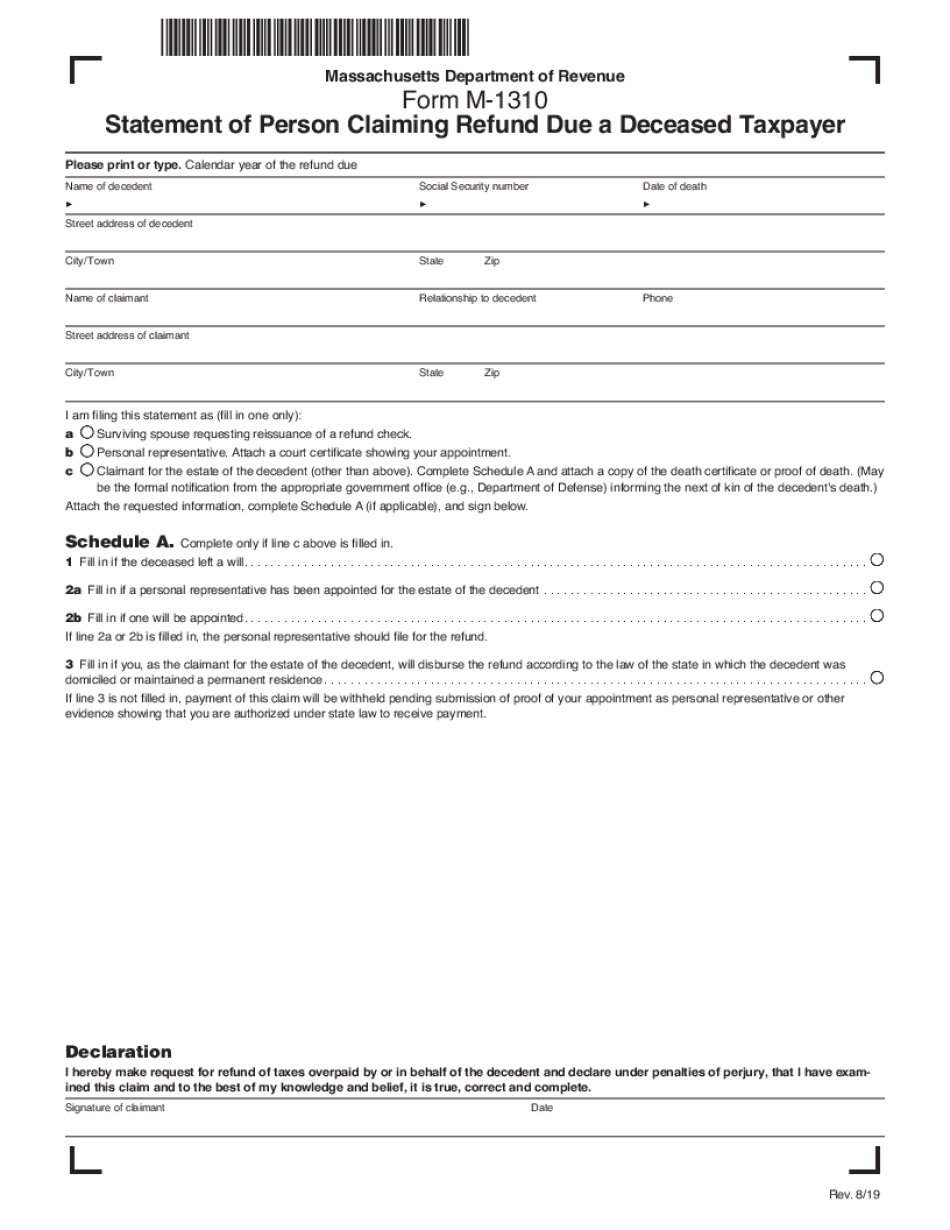

The Massachusetts Form M 1310, known as the Statement of Claimant to Refund Due a Deceased Taxpayer, is a crucial document for individuals seeking to claim a tax refund on behalf of a deceased taxpayer. This form is specifically designed for situations where a taxpayer has passed away, and a refund is owed to their estate. It allows the claimant, typically an executor or administrator, to formally request the refund from the Massachusetts Department of Revenue.

How to use the Massachusetts Form M 1310 Statement Of Claimant To

To effectively use the Massachusetts Form M 1310, the claimant must fill out the form accurately, providing all necessary information about the deceased taxpayer. This includes the taxpayer's name, Social Security number, and details regarding the refund being claimed. The form must be signed by the claimant, affirming their authority to act on behalf of the deceased. Once completed, the form should be submitted to the Massachusetts Department of Revenue along with any required documentation that supports the claim.

Steps to complete the Massachusetts Form M 1310 Statement Of Claimant To

Completing the Massachusetts Form M 1310 involves several key steps:

- Gather necessary information about the deceased taxpayer, including their full name, Social Security number, and details of the tax return that resulted in the refund.

- Fill out the form accurately, ensuring all sections are completed, including the claimant's information and relationship to the deceased.

- Attach any supporting documents, such as a copy of the death certificate and proof of the claimant's authority, like a will or court appointment.

- Review the completed form for accuracy and ensure that all required signatures are present.

- Submit the form to the Massachusetts Department of Revenue via mail or any designated submission method.

Legal use of the Massachusetts Form M 1310 Statement Of Claimant To

The legal use of the Massachusetts Form M 1310 is governed by state tax laws that outline the rights of claimants to seek refunds on behalf of deceased taxpayers. The form must be used in compliance with Massachusetts tax regulations, and it is essential that the claimant has the legal authority to act on behalf of the deceased. Proper use of the form ensures that the estate can recover any funds owed, while also adhering to legal requirements surrounding estate management and tax obligations.

Eligibility Criteria

To be eligible to file the Massachusetts Form M 1310, the claimant must meet specific criteria:

- The claimant must be the executor, administrator, or a legally designated representative of the deceased taxpayer's estate.

- The deceased taxpayer must have been entitled to a tax refund for the tax year in question.

- The claim must be filed within the applicable time limits set by the Massachusetts Department of Revenue.

Form Submission Methods (Online / Mail / In-Person)

The Massachusetts Form M 1310 can be submitted through various methods, depending on the preferences of the claimant and the guidelines provided by the Massachusetts Department of Revenue. The primary submission methods include:

- Mail: The completed form can be mailed to the appropriate address specified by the Department of Revenue.

- In-Person: Claimants may also have the option to submit the form in person at designated Department of Revenue offices.

- Online: While the form itself may not be available for online submission, claimants should check if any online services are offered for tracking or managing claims.

Quick guide on how to complete massachusetts form m 1310 statement of claimant to

Complete Massachusetts Form M 1310 Statement Of Claimant To effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without any holdups. Manage Massachusetts Form M 1310 Statement Of Claimant To on any platform using airSlate SignNow's Android or iOS apps and enhance any document-centric process today.

The simplest way to modify and eSign Massachusetts Form M 1310 Statement Of Claimant To without stress

- Obtain Massachusetts Form M 1310 Statement Of Claimant To and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Choose how you wish to send your form, by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate the printing of new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Massachusetts Form M 1310 Statement Of Claimant To and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct massachusetts form m 1310 statement of claimant to

Create this form in 5 minutes!

How to create an eSignature for the massachusetts form m 1310 statement of claimant to

The way to create an eSignature for a PDF online

The way to create an eSignature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

How to make an electronic signature from your smartphone

The best way to generate an eSignature for a PDF on iOS

How to make an electronic signature for a PDF file on Android

People also ask

-

What is the process for obtaining a refund taxpayer massachusetts?

To obtain a refund taxpayer massachusetts, you must first submit a completed tax return to the Massachusetts Department of Revenue. Ensure all necessary forms and documentation are included to expedite the process. Once processed, refunds are typically issued within 3-6 weeks.

-

How can airSlate SignNow help with refund taxpayer massachusetts applications?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending necessary documents related to your refund taxpayer massachusetts applications. Using our solution can streamline the paperwork process and reduce delays caused by manual signatures or document handling.

-

Are there any fees associated with filing for a refund taxpayer massachusetts?

There may be fees associated with using certain software or tax preparation services, but filing directly with the Massachusetts Department of Revenue typically incurs no fees. Using airSlate SignNow for document management can help save costs by ensuring efficiency during the refund taxpayer massachusetts process.

-

What documents do I need to file for a refund taxpayer massachusetts?

To file for a refund taxpayer massachusetts, you'll need to gather your W-2 forms, 1099 forms, and any other tax documents that report your income and expenses. It's crucial to keep accurate records, as airSlate SignNow can help you manage and securely sign these documents.

-

How long does it take to receive a refund taxpayer massachusetts?

The timeline for receiving a refund taxpayer massachusetts can vary, but generally, you can expect to receive your refund within 3-6 weeks if filed electronically. Utilizing airSlate SignNow can help speed up the process by ensuring timely submissions.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers features like eSignature, document templates, and secure cloud storage to help you manage tax documents related to your refund taxpayer massachusetts. These user-friendly tools streamline the documentation process and ensure compliance with tax regulations.

-

Is airSlate SignNow compatible with other accounting software for refund taxpayer massachusetts?

Yes, airSlate SignNow integrates seamlessly with various accounting software, making it easy to link your refund taxpayer massachusetts documents and workflows. This integration simplifies your documentation and helps you maintain organization throughout the tax filing process.

Get more for Massachusetts Form M 1310 Statement Of Claimant To

Find out other Massachusetts Form M 1310 Statement Of Claimant To

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free

- Can I Electronic signature Vermont Bulk Sale Agreement

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy

- How Can I Electronic signature New Jersey Medical Records Release

- Electronic signature New Mexico Medical Records Release Easy

- How Can I Electronic signature Alabama Advance Healthcare Directive

- How Do I Electronic signature South Carolina Advance Healthcare Directive

- eSignature Kentucky Applicant Appraisal Form Evaluation Later

- Electronic signature Colorado Client and Developer Agreement Later

- Electronic signature Nevada Affiliate Program Agreement Secure

- Can I Electronic signature Pennsylvania Co-Branding Agreement

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now