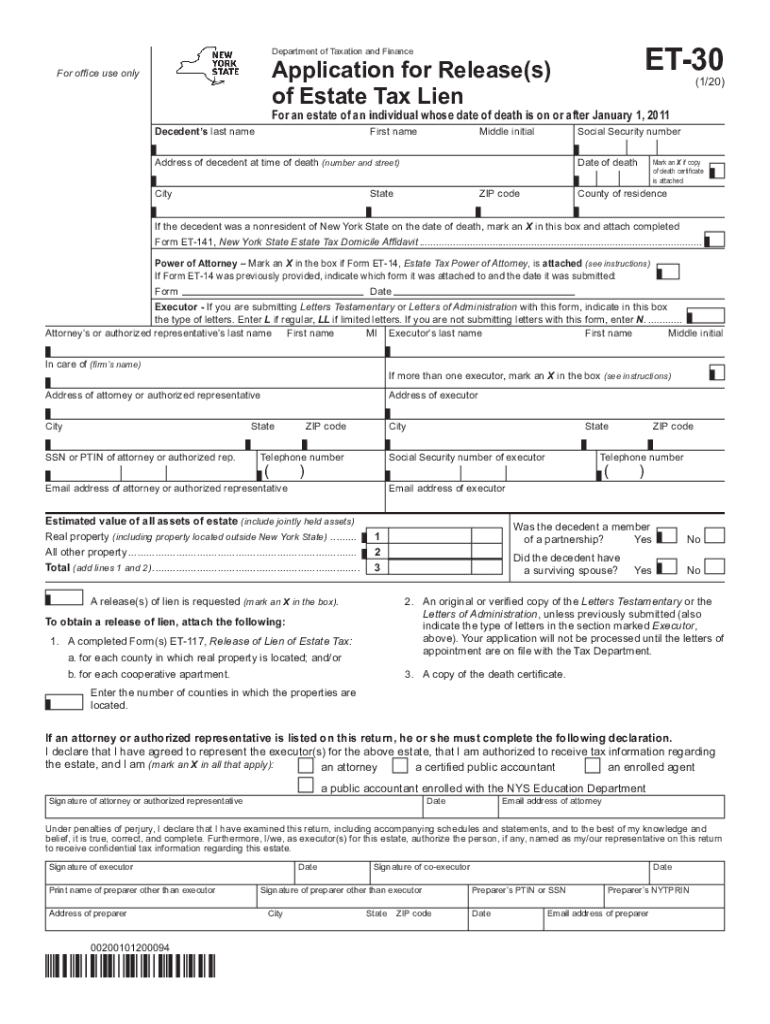

Form ET 30120Application for Releases of Estate Tax Lienet30 2020-2026

Understanding the NYS Inheritance Tax Waiver Form

The NYS inheritance tax waiver form is an essential document used in the estate settlement process. This form serves to release the estate from any inheritance tax liabilities that may be due. It is particularly relevant for heirs and beneficiaries who need to ensure that the estate can be distributed without tax encumbrances. Understanding the purpose and implications of this form is crucial for anyone involved in estate planning or management.

Steps to Complete the NYS Inheritance Tax Waiver Form

Completing the NYS inheritance tax waiver form involves several key steps:

- Gather necessary information about the deceased, including their full name, date of death, and estate details.

- Provide information about the beneficiaries, including their names and relationships to the deceased.

- Fill out the form accurately, ensuring that all required fields are completed.

- Review the form for any errors or omissions before submission.

- Sign the form, as required, to validate the information provided.

Required Documents for the NYS Inheritance Tax Waiver Form

To successfully complete the NYS inheritance tax waiver form, certain documents are typically required. These may include:

- The death certificate of the deceased.

- A copy of the will, if available.

- Proof of identity for the beneficiaries.

- Documentation of the estate's assets and liabilities.

Filing Methods for the NYS Inheritance Tax Waiver Form

The NYS inheritance tax waiver form can be submitted through various methods:

- Online submission through the appropriate state tax website.

- Mailing the completed form to the designated tax authority.

- In-person submission at local tax offices, if applicable.

Legal Use of the NYS Inheritance Tax Waiver Form

The NYS inheritance tax waiver form is legally binding once completed and submitted correctly. It is important to ensure compliance with all state regulations regarding inheritance tax to avoid potential penalties. This form helps to clarify the tax status of the estate and protects the interests of beneficiaries by ensuring that all tax obligations are settled before asset distribution.

Common Scenarios for Using the NYS Inheritance Tax Waiver Form

There are several scenarios where the NYS inheritance tax waiver form is necessary:

- When an estate is being settled and needs to clear any tax obligations before distribution.

- For beneficiaries who are inheriting property or assets and need to ensure that there are no outstanding tax issues.

- In cases where the estate is small enough to qualify for a tax exemption, the waiver form helps formalize this status.

Quick guide on how to complete form et 30120application for releases of estate tax lienet30

Complete Form ET 30120Application For Releases Of Estate Tax Lienet30 effortlessly on any device

Online document management has become popular with businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Form ET 30120Application For Releases Of Estate Tax Lienet30 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and electronically sign Form ET 30120Application For Releases Of Estate Tax Lienet30 seamlessly

- Obtain Form ET 30120Application For Releases Of Estate Tax Lienet30 and click on Get Form to begin.

- Utilize the tools we supply to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Form ET 30120Application For Releases Of Estate Tax Lienet30 and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form et 30120application for releases of estate tax lienet30

Create this form in 5 minutes!

How to create an eSignature for the form et 30120application for releases of estate tax lienet30

The way to generate an electronic signature for a PDF document in the online mode

The way to generate an electronic signature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The best way to create an electronic signature right from your mobile device

The best way to make an eSignature for a PDF document on iOS devices

The best way to create an electronic signature for a PDF on Android devices

People also ask

-

What is a NYS inheritance tax waiver form?

The NYS inheritance tax waiver form is a legal document required in New York State to waive any potential inheritance tax liability for beneficiaries. It's essential for estate settlements, ensuring that heirs receive their inherited assets without tax encumbrances. Using airSlate SignNow makes it easy to eSign and manage these forms efficiently.

-

How can I obtain the NYS inheritance tax waiver form?

You can obtain the NYS inheritance tax waiver form directly from the New York State Department of Taxation and Finance website. Alternatively, many estate planning professionals and legal services can provide you with this form. Once you have it, airSlate SignNow offers a seamless way to complete and eSign the document.

-

What are the benefits of using airSlate SignNow for the NYS inheritance tax waiver form?

Using airSlate SignNow for the NYS inheritance tax waiver form streamlines the signing process, allowing you to eSign documents quickly and securely. It enhances compliance and document management, making it easier to track the status of your forms. Additionally, its cost-effective solution reduces the need for physical paperwork.

-

Is there a cost associated with filing the NYS inheritance tax waiver form?

Filing the NYS inheritance tax waiver form itself does not require a fee, but you may incur costs depending on the services you use to prepare and submit the form. By utilizing airSlate SignNow, you can minimize costs associated with printing and mailing, as the platform allows for digital submissions. Its affordable pricing plans further support budget management.

-

Can I integrate airSlate SignNow with other applications for the NYS inheritance tax waiver form?

Yes, airSlate SignNow can be integrated with a variety of applications to facilitate the process of managing the NYS inheritance tax waiver form. Our platform supports integrations with popular tools like Google Drive and Dropbox, enabling seamless access to your documents. This flexibility enhances your workflow and saves time.

-

What features does airSlate SignNow offer for managing the NYS inheritance tax waiver form?

airSlate SignNow provides several features designed to enhance the management of the NYS inheritance tax waiver form, including eSigning, document templates, and automated reminders. These features ensure that you can handle your documents efficiently and stay compliant with all deadlines. It also allows for secure document storage and easy collaboration.

-

How long does it take to process the NYS inheritance tax waiver form using airSlate SignNow?

The processing time for the NYS inheritance tax waiver form using airSlate SignNow can vary, but the eSign process is typically completed within minutes. After eSigning, the turnaround time for formal approval by tax authorities may differ. However, using our platform can signNowly speed up documentation procedures and reduce delays.

Get more for Form ET 30120Application For Releases Of Estate Tax Lienet30

Find out other Form ET 30120Application For Releases Of Estate Tax Lienet30

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template