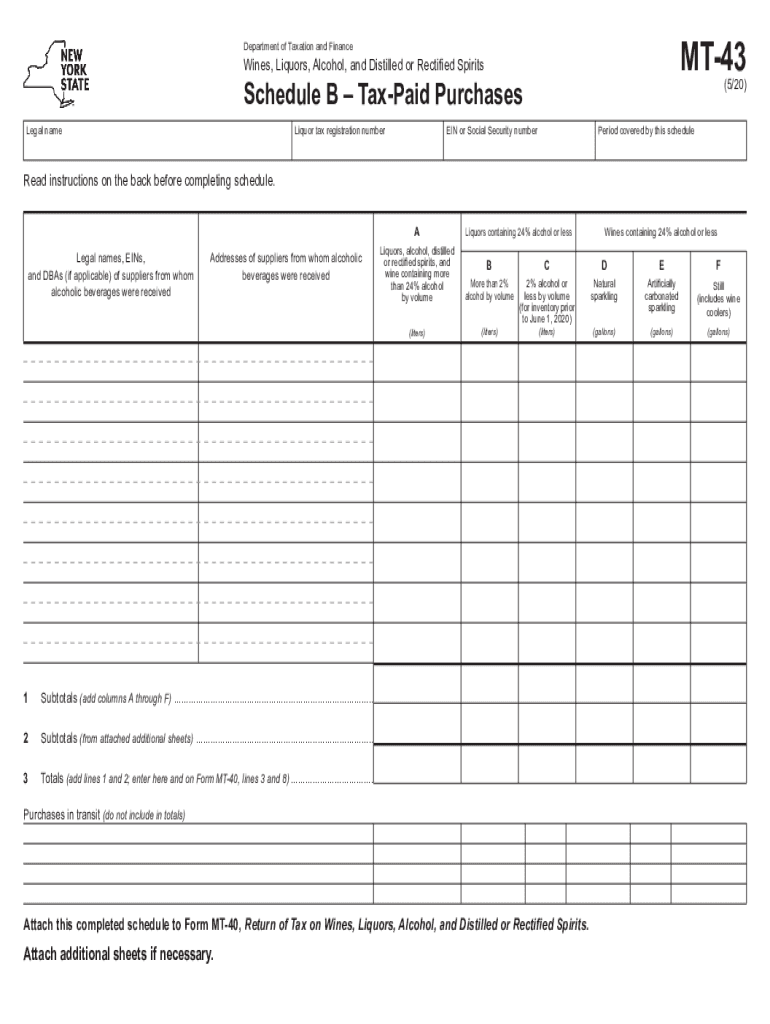

PDF Form MT 43 Department of Taxation and Finance 2020-2026

What is the PDF Form MT 43?

The NYS Form MT 43 is a tax form used by the New York State Department of Taxation and Finance. Specifically, it is known as the Schedule B form, which is utilized for reporting certain tax information related to various types of income. This form is essential for taxpayers who need to disclose specific financial details to ensure compliance with state tax regulations. Understanding the purpose of the MT 43 is crucial for accurate tax reporting and avoiding potential penalties.

Steps to Complete the PDF Form MT 43

Completing the NYS Form MT 43 involves several important steps to ensure accuracy and compliance. Here’s a straightforward guide:

- Gather necessary financial documents, including income statements and previous tax returns.

- Download the PDF Form MT 43 from the New York State Department of Taxation and Finance website.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Report your income details as required in the relevant sections of the form.

- Review the completed form for accuracy, ensuring all figures are correct.

- Sign and date the form before submission.

How to Obtain the PDF Form MT 43

The NYS Form MT 43 can be obtained easily through the New York State Department of Taxation and Finance website. It is available as a downloadable PDF file, allowing taxpayers to print and complete the form at their convenience. Additionally, physical copies may be available at local tax offices or through tax preparation services. Ensuring you have the most current version of the form is essential for compliance.

Legal Use of the PDF Form MT 43

The NYS Form MT 43 is legally binding when completed accurately and submitted in accordance with state tax laws. To ensure its legal validity, it must be signed by the taxpayer or an authorized representative. The form must also adhere to the specific guidelines set forth by the New York State Department of Taxation and Finance, including filing deadlines and submission methods. Compliance with these regulations helps prevent penalties and ensures that the information reported is accepted by the state.

Form Submission Methods

Submitting the NYS Form MT 43 can be done through several methods, providing flexibility for taxpayers. The available submission options include:

- Online: Some taxpayers may have the option to submit the form electronically through the New York State Department of Taxation and Finance's online portal.

- Mail: The completed form can be mailed to the appropriate tax office as indicated in the form instructions.

- In-Person: Taxpayers can also submit the form in person at designated tax offices if preferred.

Key Elements of the PDF Form MT 43

Understanding the key elements of the NYS Form MT 43 is vital for accurate completion. Important components include:

- Taxpayer Information: This section requires personal details such as name, address, and taxpayer identification number.

- Income Reporting: Taxpayers must detail various types of income, including wages, dividends, and other earnings.

- Signature Section: A signature is required to validate the form, confirming that the information provided is accurate and complete.

Quick guide on how to complete pdf form mt 43 department of taxation and finance

Complete PDF Form MT 43 Department Of Taxation And Finance effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the necessary template and securely save it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents swiftly without delays. Manage PDF Form MT 43 Department Of Taxation And Finance on any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The most efficient way to modify and eSign PDF Form MT 43 Department Of Taxation And Finance with ease

- Find PDF Form MT 43 Department Of Taxation And Finance and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choice. Edit and eSign PDF Form MT 43 Department Of Taxation And Finance and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pdf form mt 43 department of taxation and finance

Create this form in 5 minutes!

How to create an eSignature for the pdf form mt 43 department of taxation and finance

The way to generate an eSignature for a PDF in the online mode

The way to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The best way to generate an eSignature right from your smart phone

The way to create an eSignature for a PDF on iOS devices

The best way to generate an eSignature for a PDF on Android OS

People also ask

-

What is the nys form mt 43?

The nys form mt 43 is a tax form used in New York State for specific financial reporting requirements. It's essential for businesses to accurately fill this form to ensure compliance with state tax regulations. airSlate SignNow simplifies the process of signing and submitting the nys form mt 43 electronically.

-

How does airSlate SignNow help with the nys form mt 43?

airSlate SignNow provides a platform for businesses to easily fill out and electronically sign the nys form mt 43. This not only streamlines the completion process but also ensures that your documents are securely stored and easily accessible for future reference.

-

Is airSlate SignNow cost-effective for processing the nys form mt 43?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. By using this platform for the nys form mt 43, you can save time and reduce costs associated with traditional paper-based processes, ultimately improving your efficiency.

-

What features does airSlate SignNow offer for the nys form mt 43?

With airSlate SignNow, users can benefit from features such as customizable templates, real-time tracking, and easy sharing options for the nys form mt 43. These features enhance collaboration and ensure that all parties involved can efficiently manage their documentation.

-

Can I integrate airSlate SignNow with other tools for handling the nys form mt 43?

Absolutely! airSlate SignNow supports integration with various applications, making it easy to streamline workflows related to the nys form mt 43. This allows users to connect with CRMs, cloud storage, and other essential tools to manage their documents effectively.

-

What are the benefits of using airSlate SignNow for the nys form mt 43?

Using airSlate SignNow for the nys form mt 43 offers several benefits, including increased security, speed, and ease of access. Electronic signatures eliminate the hassle of printing and mailing forms, while secure cloud storage ensures your documents are safe and easy to retrieve.

-

Is it easy to get started with airSlate SignNow for the nys form mt 43?

Yes, getting started with airSlate SignNow is quick and straightforward. Users can sign up for an account, explore the platform, and begin processing the nys form mt 43 within minutes, thanks to user-friendly onboarding and support resources.

Get more for PDF Form MT 43 Department Of Taxation And Finance

Find out other PDF Form MT 43 Department Of Taxation And Finance

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement