Form DTF 281420Survivor's Affidavitdtf281 2020-2026

What is the New York Survivor's Affidavit (DTF-281)?

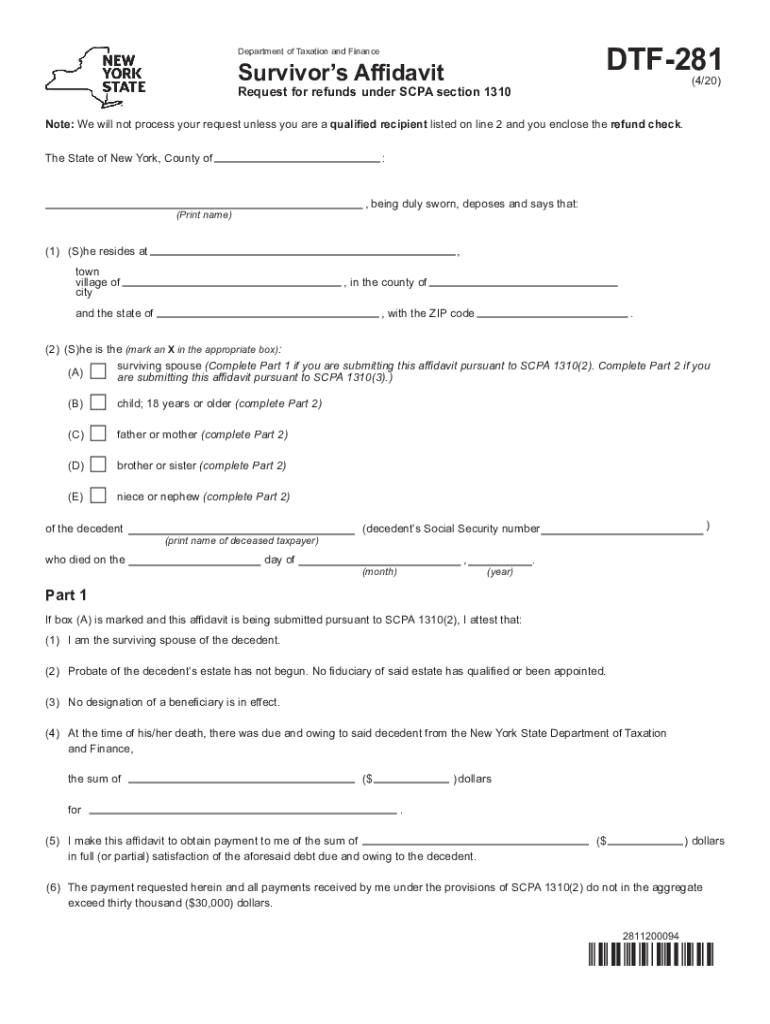

The New York Survivor's Affidavit, also known as the DTF-281 form, is a legal document used to claim a refund for taxes withheld from a deceased individual's income. This form is particularly relevant for beneficiaries who need to establish their right to the deceased's tax refund. The DTF-281 serves as an affidavit, affirming that the signer is entitled to the funds due to their status as a survivor. It is essential for ensuring that the rightful heirs can access any tax refunds that may be due following the death of the taxpayer.

Steps to Complete the New York Survivor's Affidavit (DTF-281)

Completing the DTF-281 form involves several important steps to ensure accuracy and compliance with New York state regulations. Begin by gathering necessary information, including the deceased's full name, Social Security number, and details regarding the tax refund being claimed. Next, fill out the form with required personal information, including your relationship to the deceased and your contact details. It is crucial to provide a clear and truthful account of your claim. After completing the form, sign it in the designated area and ensure that it is dated appropriately. Finally, submit the form as instructed to the appropriate tax authority.

Legal Use of the New York Survivor's Affidavit (DTF-281)

The DTF-281 form is legally binding and must be used in accordance with New York state tax laws. It is designed to protect the rights of survivors in claiming tax refunds owed to a deceased individual. To ensure legal validity, the form must be completed accurately and submitted within the required time frame. The affidavit serves as proof of the survivor's entitlement to the funds, and any inaccuracies or omissions could lead to delays or denials of the claim. Therefore, understanding the legal implications of the DTF-281 is essential for all claimants.

Required Documents for the New York Survivor's Affidavit (DTF-281)

When preparing to submit the DTF-281 form, certain supporting documents are typically required to validate the claim. These may include a copy of the deceased's death certificate, proof of your relationship to the deceased, and any relevant tax documents that demonstrate the amount of tax withheld. It is advisable to include any additional documentation that may support your claim, such as prior tax returns or correspondence from the tax authority. Ensuring that all required documents are included can help facilitate a smoother processing of your affidavit.

Filing Methods for the New York Survivor's Affidavit (DTF-281)

The DTF-281 form can be submitted through various methods, depending on the preferences of the claimant and the requirements of the tax authority. Options typically include filing online through the New York State Department of Taxation and Finance website, mailing a printed copy of the form to the appropriate office, or delivering it in person. Each method has its own guidelines regarding processing times and confirmation of receipt, so it is important to choose the option that best suits your needs and to follow the instructions carefully to ensure successful submission.

Eligibility Criteria for the New York Survivor's Affidavit (DTF-281)

To be eligible to file the DTF-281 form, you must be a legal heir or beneficiary of the deceased individual. This typically includes spouses, children, or other relatives who can demonstrate their relationship to the deceased. Additionally, the deceased must have had tax withholdings that are eligible for refund. Understanding the eligibility requirements is crucial, as only those who meet these criteria can successfully submit the affidavit and claim the associated tax refunds.

Quick guide on how to complete form dtf 281420survivors affidavitdtf281

Effortlessly Prepare Form DTF 281420Survivor's Affidavitdtf281 on Any Device

Web-based document management has become increasingly favored by both organizations and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Form DTF 281420Survivor's Affidavitdtf281 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centered task today.

How to Modify and eSign Form DTF 281420Survivor's Affidavitdtf281 with Ease

- Obtain Form DTF 281420Survivor's Affidavitdtf281 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you want to share your form: via email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form navigation, or errors requiring you to print new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form DTF 281420Survivor's Affidavitdtf281 to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form dtf 281420survivors affidavitdtf281

Create this form in 5 minutes!

How to create an eSignature for the form dtf 281420survivors affidavitdtf281

The way to generate an eSignature for a PDF file online

The way to generate an eSignature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The best way to generate an eSignature right from your mobile device

The way to create an eSignature for a PDF file on iOS

The best way to generate an eSignature for a PDF on Android devices

People also ask

-

What is a survivor form and how does it work with airSlate SignNow?

A survivor form is a document designed to ensure that essential information is collected from participants after an event. With airSlate SignNow, users can easily create, send, and eSign survivor forms, allowing for a streamlined process that enhances efficiency and accuracy in data collection.

-

Can I customize my survivor form using airSlate SignNow?

Yes, airSlate SignNow provides robust customization options for your survivor form. Users can add fields, modify layouts, and incorporate branding elements to tailor the document to their specific needs, ensuring a professional appearance and improved user experience.

-

Are there any costs associated with using the survivor form feature?

airSlate SignNow offers competitive pricing plans that include access to the survivor form feature. Depending on your selected plan, you will benefit from various functionalities and unlimited access to sending and signing documents, including your customizable survivor forms.

-

What benefits do survivor forms provide when using airSlate SignNow?

Survivor forms offered by airSlate SignNow improve document management and facilitate faster data collection. These forms enhance accuracy through eSignatures and reduce manual processing, allowing businesses to focus on core activities rather than paperwork.

-

Does airSlate SignNow integrate with other applications for handling survivor forms?

Absolutely! airSlate SignNow integrates seamlessly with various applications and software platforms, enhancing functionality when managing survivor forms. These integrations allow for automatic data syncing and improved workflows, ensuring your processes remain efficient.

-

Is it secure to use airSlate SignNow for managing survivor forms?

Yes, security is a top priority for airSlate SignNow. All survivor forms are protected with advanced encryption and secure access controls, ensuring that sensitive information is safeguarded throughout the signing process.

-

How can I track the status of my survivor forms with airSlate SignNow?

Users can easily track the status of survivor forms within the airSlate SignNow dashboard. The platform provides real-time notifications and updates throughout the signing process, keeping you informed and facilitating timely follow-ups if needed.

Get more for Form DTF 281420Survivor's Affidavitdtf281

Find out other Form DTF 281420Survivor's Affidavitdtf281

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now