Certificate of Estate Tax Payment and Real Property 2019

What is the Certificate of Estate Tax Payment and Real Property

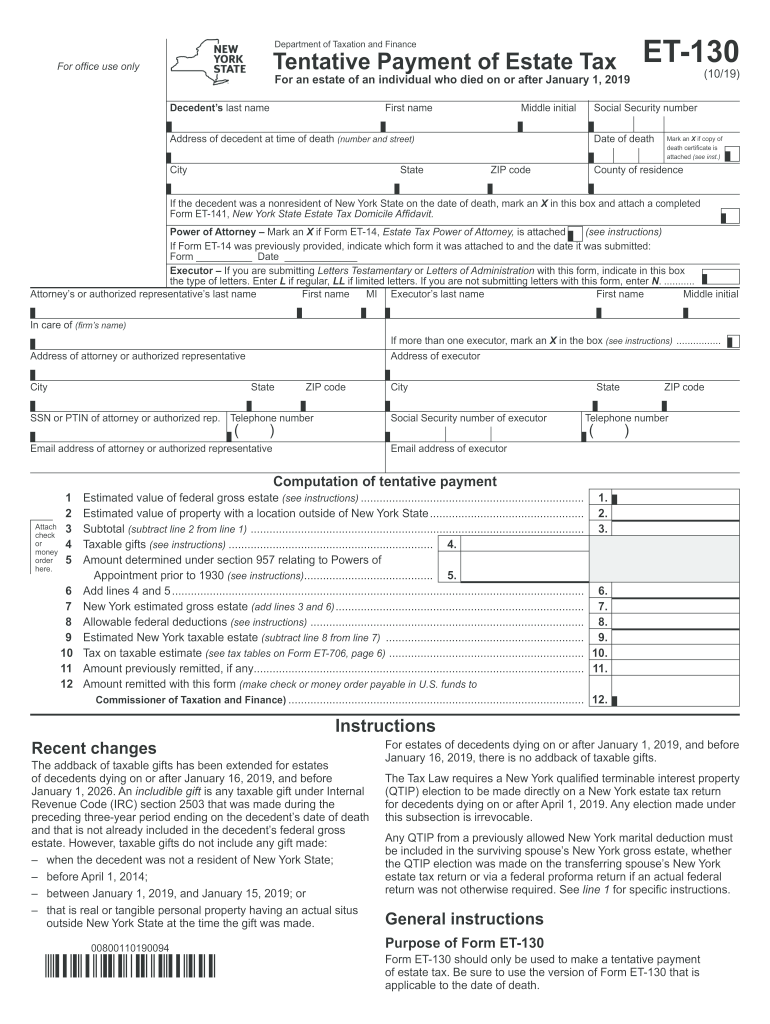

The Certificate of Estate Tax Payment and Real Property is a crucial document in the estate settlement process. It serves as proof that any estate taxes owed have been paid before the transfer of real property ownership. This certificate is particularly important in the context of estate administration, ensuring that all tax obligations are fulfilled to avoid any legal complications. It is often required when transferring property titles, particularly in the state of New York, to confirm that the estate has settled its tax liabilities.

Steps to Complete the Certificate of Estate Tax Payment and Real Property

Completing the Certificate of Estate Tax Payment and Real Property involves several key steps:

- Gather necessary information about the estate, including the decedent's details and property information.

- Calculate the total estate tax owed based on the estate's value and applicable tax rates.

- Fill out the certificate form accurately, ensuring all required fields are completed.

- Submit the completed certificate along with any required documentation to the appropriate tax authority.

- Keep a copy of the submitted certificate for your records, as it may be needed for future reference.

Legal Use of the Certificate of Estate Tax Payment and Real Property

The legal use of the Certificate of Estate Tax Payment and Real Property is primarily to validate that estate taxes have been paid before property ownership can be transferred. This document is essential in preventing disputes over property ownership and ensuring compliance with state laws. It acts as a safeguard for both the estate and the beneficiaries, confirming that all tax obligations have been met, thereby facilitating a smoother transfer process.

Who Issues the Form

The Certificate of Estate Tax Payment and Real Property is typically issued by the state tax authority or the department of revenue in the jurisdiction where the estate is being settled. In New York, this form is managed by the New York State Department of Taxation and Finance. It is important to contact the appropriate agency to obtain the correct version of the form and to ensure compliance with any specific state requirements.

Required Documents

To complete the Certificate of Estate Tax Payment and Real Property, several documents may be required:

- The decedent's death certificate.

- Documentation of the estate's assets and liabilities.

- Proof of any prior estate tax payments.

- Property deeds or titles for the real property being transferred.

Filing Deadlines / Important Dates

Filing deadlines for the Certificate of Estate Tax Payment and Real Property can vary based on state regulations. In New York, the estate tax return must generally be filed within nine months of the decedent's death. It is crucial to adhere to these deadlines to avoid penalties and ensure a smooth transfer of property. Additionally, any estate taxes owed should be settled by this deadline to obtain the necessary certificate.

Quick guide on how to complete certificate of estate tax payment and real property

Complete Certificate Of Estate Tax Payment And Real Property effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the tools you require to create, edit, and eSign your documents quickly and without issues. Manage Certificate Of Estate Tax Payment And Real Property on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and eSign Certificate Of Estate Tax Payment And Real Property with ease

- Access Certificate Of Estate Tax Payment And Real Property and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive information using features that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as an old-fashioned ink signature.

- Review the details and click the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Certificate Of Estate Tax Payment And Real Property and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct certificate of estate tax payment and real property

Create this form in 5 minutes!

How to create an eSignature for the certificate of estate tax payment and real property

How to create an electronic signature for a PDF in the online mode

How to create an electronic signature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The way to create an eSignature right from your smart phone

How to create an eSignature for a PDF on iOS devices

The way to create an eSignature for a PDF on Android OS

People also ask

-

What is the ny form et 130 fill in form?

The ny form et 130 fill in form is a specific type of document required for certain transactions in New York. It provides a structured way to collect necessary information efficiently. By using airSlate SignNow, businesses can easily fill in and eSign the ny form et 130 fill in form to streamline their processes.

-

How can I fill out the ny form et 130 fill in form using airSlate SignNow?

Filling out the ny form et 130 fill in form with airSlate SignNow is simple. You can upload the form to our platform, fill in the required fields, and use our tools for electronic signatures. This saves time and eliminates the need for printing and scanning.

-

What are the pricing options for using airSlate SignNow for the ny form et 130 fill in form?

airSlate SignNow offers a variety of pricing plans to suit different business needs when filling out the ny form et 130 fill in form. Our plans are cost-effective, and we provide a free trial so businesses can explore our features first. Detailed pricing information is available on our website.

-

Is it safe to use airSlate SignNow for the ny form et 130 fill in form?

Yes, airSlate SignNow prioritizes security for all documents, including the ny form et 130 fill in form. Our platform complies with industry standards and employs advanced encryption to protect your data. You can confidently send and eSign your documents knowing they are secure.

-

What features does airSlate SignNow offer for managing the ny form et 130 fill in form?

With airSlate SignNow, you benefit from features such as document templates, customizable fields, and easy tracking of the ny form et 130 fill in form. Our platform also allows you to collaborate with others in real-time, making it easier to complete necessary documentation efficiently.

-

Can I integrate airSlate SignNow with other tools for the ny form et 130 fill in form?

Absolutely! airSlate SignNow offers integrations with various productivity tools and software. This means you can seamlessly connect your existing systems to manage the ny form et 130 fill in form and streamline your workflow without any hassle.

-

What are the benefits of using airSlate SignNow for the ny form et 130 fill in form?

Using airSlate SignNow for the ny form et 130 fill in form brings numerous benefits, including time savings and enhanced productivity. The ease of eSigning and document management allows businesses to focus on more important tasks rather than getting bogged down in paperwork. Additionally, it improves accuracy and reduces errors in document completion.

Get more for Certificate Of Estate Tax Payment And Real Property

- Employee rights agreement form

- Note pledge form

- Loan security form

- Bylaws of martinque ventures corporation form

- Plan of reorganization between zamba corporation zca camworks inc and shareholders form

- Purchase agreement inc form

- Plan of merger between id recap inc and interdent inc form

- Voting shares form

Find out other Certificate Of Estate Tax Payment And Real Property

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document