Fillable Online REQUEST for PROPOSALS for Contract HVR 2020-2026

Understanding the ny tentative payment

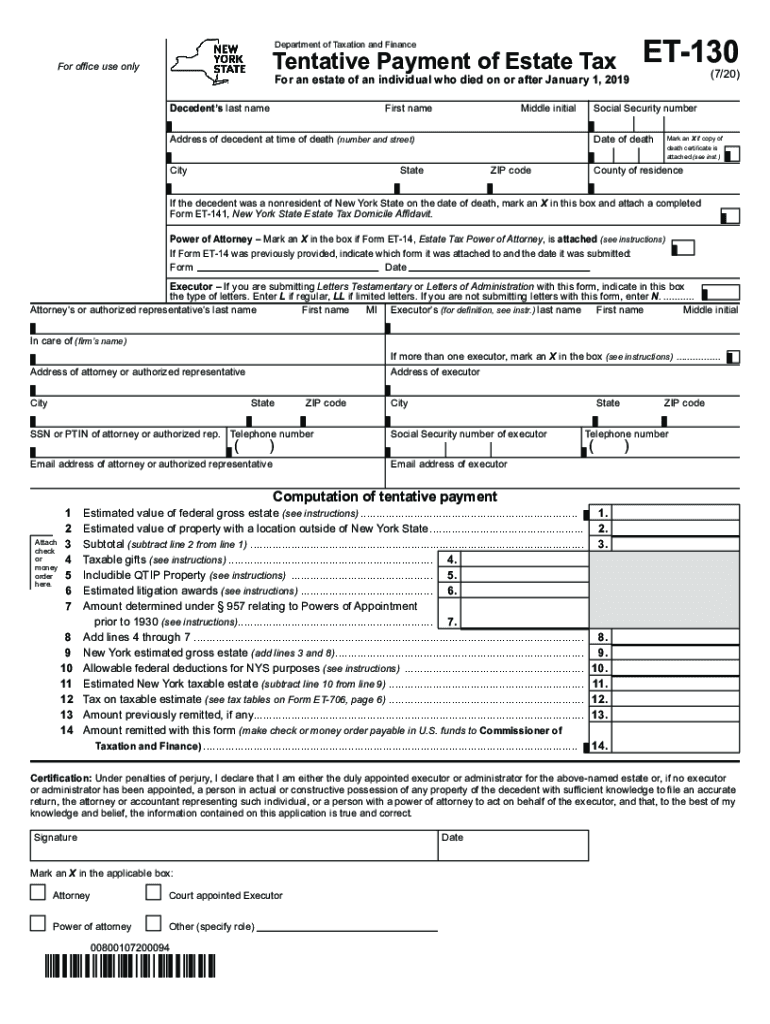

The ny tentative payment is a crucial component for taxpayers in New York, particularly for those who need to estimate their tax liabilities. This form serves as a preliminary payment towards the total tax due, helping to avoid penalties and interest for underpayment. It is essential for individuals and businesses alike to understand the requirements and implications of making a tentative payment to ensure compliance with state tax laws.

Steps to complete the ny tentative payment

Completing the ny tentative payment involves several key steps:

- Gather necessary financial information, including income and deductions.

- Calculate your estimated tax liability based on your projected income for the year.

- Determine the amount of tentative payment required, which is typically a percentage of your estimated tax liability.

- Fill out the ny tentative payment form accurately, ensuring all information is correct.

- Submit the form electronically or via mail, along with the payment, by the specified deadline.

Required documents for the ny tentative payment

To complete the ny tentative payment, you will need several documents:

- Previous year’s tax return for reference.

- Current year income statements, such as W-2s or 1099s.

- Records of deductions and credits you plan to claim.

- Any relevant documentation that supports your estimated income and deductions.

Filing deadlines for the ny tentative payment

It is important to be aware of the filing deadlines for the ny tentative payment to avoid penalties. Generally, the tentative payment is due on the same date as the federal tax return. For most taxpayers, this is April fifteenth. However, if the due date falls on a weekend or holiday, the deadline is extended to the next business day. Staying informed about these dates ensures timely compliance with tax obligations.

Legal use of the ny tentative payment

The ny tentative payment is legally recognized as a valid method for fulfilling part of your tax obligations. When submitted correctly, it helps taxpayers avoid underpayment penalties and demonstrates good faith in meeting tax responsibilities. Compliance with state regulations regarding tentative payments is essential for maintaining a good standing with the New York State Department of Taxation and Finance.

Penalties for non-compliance with the ny tentative payment

Failing to make the ny tentative payment or underpaying can lead to significant penalties. Taxpayers may incur interest on the unpaid balance, as well as additional fines for late payments. Understanding the implications of non-compliance is vital for individuals and businesses to avoid unnecessary financial burdens.

Quick guide on how to complete fillable online request for proposals for contract hvr

Complete Fillable Online REQUEST FOR PROPOSALS FOR Contract HVR effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, enabling you to obtain the necessary form and securely store it online. airSlate SignNow offers all the tools you require to create, edit, and eSign your documents quickly and without delays. Manage Fillable Online REQUEST FOR PROPOSALS FOR Contract HVR on any platform with the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and eSign Fillable Online REQUEST FOR PROPOSALS FOR Contract HVR without hassle

- Find Fillable Online REQUEST FOR PROPOSALS FOR Contract HVR and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information using tools specifically designed for this purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Fillable Online REQUEST FOR PROPOSALS FOR Contract HVR and ensure effective communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable online request for proposals for contract hvr

Create this form in 5 minutes!

How to create an eSignature for the fillable online request for proposals for contract hvr

The way to generate an e-signature for your PDF document in the online mode

The way to generate an e-signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature right from your mobile device

The way to create an electronic signature for a PDF document on iOS devices

The best way to generate an electronic signature for a PDF on Android devices

People also ask

-

What is a NY tentative payment and how does it work with airSlate SignNow?

A NY tentative payment is a temporary payment option that businesses may need to use during financial transactions. With airSlate SignNow, you can easily create, send, and eSign documents that involve tentative payments, allowing for a streamlined process that keeps your business compliant and organized.

-

How does airSlate SignNow handle pricing for NY tentative payments?

airSlate SignNow offers flexible pricing plans that can accommodate businesses needing to manage NY tentative payments. You can choose a plan that suits your transaction volume and budget, ensuring you receive a cost-effective solution for all your signing needs.

-

What features does airSlate SignNow provide for NY tentative payment management?

airSlate SignNow includes features like customizable templates, automated reminders, and secure document storage, all tailored to handle NY tentative payments efficiently. These tools empower users to manage their documentation with ease while ensuring compliance and security.

-

Can I integrate airSlate SignNow with other financial tools for NY tentative payments?

Yes, airSlate SignNow offers integrations with several popular financial software solutions, making it easier to manage your NY tentative payments. This connectivity allows for a smoother workflow, automating processes that require electronic signatures and documentation.

-

What are the benefits of using airSlate SignNow for NY tentative payments?

Using airSlate SignNow for NY tentative payments provides numerous benefits including time savings, improved accuracy, and enhanced security. These advantages help businesses streamline their processes while ensuring that all transactions are compliant and fully documented.

-

Is airSlate SignNow compliant with NY state regulations regarding tentative payments?

Yes, airSlate SignNow is designed to comply with NY state regulations concerning tentative payments. By adopting our solution, businesses can confidently handle electronic signatures and document management in accordance with state laws.

-

What support does airSlate SignNow offer for users dealing with NY tentative payments?

airSlate SignNow provides comprehensive customer support to assist users with their NY tentative payment needs. Our support team is available to help you navigate any challenges, ensuring that you can efficiently manage your documentation and transactions.

Get more for Fillable Online REQUEST FOR PROPOSALS FOR Contract HVR

Find out other Fillable Online REQUEST FOR PROPOSALS FOR Contract HVR

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself