Communications Services Tax Florida Department of Revenue 2015

What is the Communications Services Tax Florida Department Of Revenue

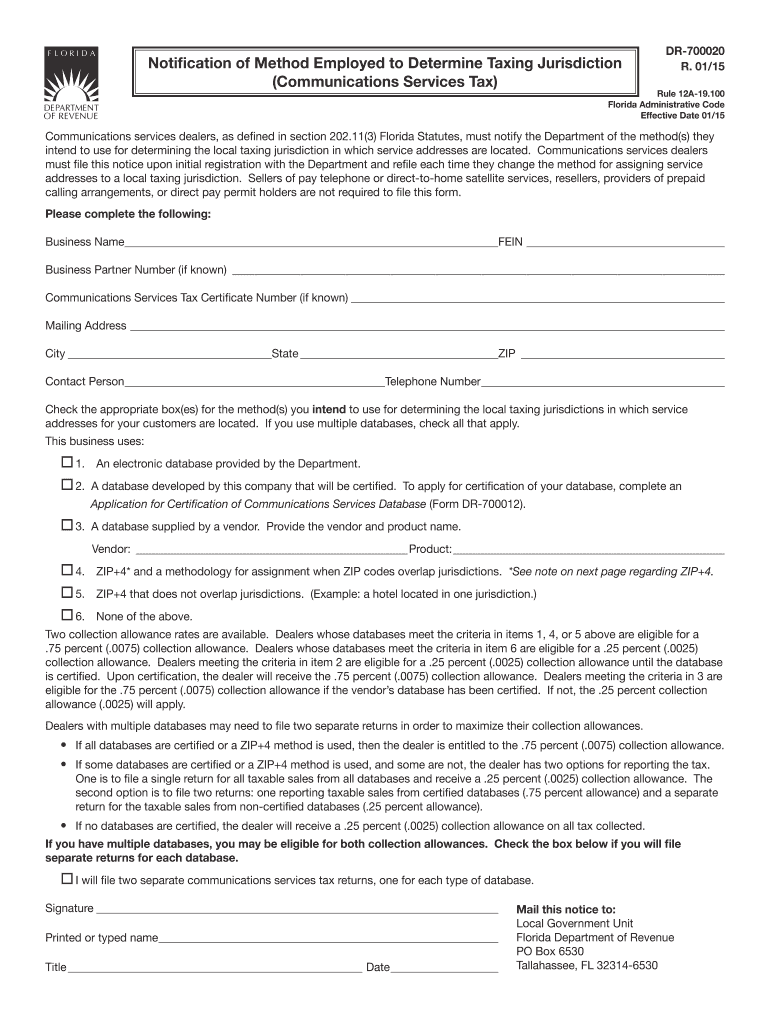

The Communications Services Tax (CST) is a tax levied by the state of Florida on various communication services. This includes services such as telecommunications, video services, and certain related services. The Florida Department of Revenue administers this tax, ensuring compliance and proper collection from service providers. The CST is applicable to both residential and commercial customers and is designed to fund various state and local government services.

Steps to complete the Communications Services Tax Florida Department Of Revenue

Completing the Communications Services Tax form involves several key steps. First, gather all necessary information, including your business details, service types, and revenue figures. Next, accurately fill out the required sections of the form, ensuring that all calculations are correct. After completing the form, review it for accuracy and compliance with Florida's tax regulations. Finally, submit the form either online, by mail, or in person, depending on your preference and the guidelines provided by the Florida Department of Revenue.

Legal use of the Communications Services Tax Florida Department Of Revenue

To ensure the legal use of the Communications Services Tax form, it is essential to comply with all applicable laws and regulations. This includes understanding the specific tax rates and exemptions that may apply to your services. Additionally, the form must be signed and dated appropriately, as electronic signatures are recognized under U.S. law, provided they meet the necessary legal standards. Maintaining accurate records of all transactions and tax payments is also crucial for compliance and potential audits.

Filing Deadlines / Important Dates

Filing deadlines for the Communications Services Tax vary based on the reporting period. Typically, the tax is reported and paid monthly or quarterly, depending on the amount of tax collected. It is important to stay informed about specific due dates to avoid penalties. The Florida Department of Revenue provides a calendar of important dates, including the start of each reporting period and the corresponding deadlines for submission.

Required Documents

When completing the Communications Services Tax form, several documents may be required to ensure accurate reporting. These include detailed records of all communication services provided, invoices issued, and any relevant contracts. Additionally, businesses should have documentation of prior tax payments and any exemptions claimed. Keeping these documents organized will facilitate the completion of the form and support compliance with state regulations.

Penalties for Non-Compliance

Failure to comply with the Communications Services Tax requirements can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is essential for businesses to understand their obligations and ensure timely filing and payment to avoid these consequences. The Florida Department of Revenue outlines specific penalties associated with late submissions and inaccuracies in reporting.

Quick guide on how to complete communications services tax florida department of revenue

Prepare Communications Services Tax Florida Department Of Revenue effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Handle Communications Services Tax Florida Department Of Revenue on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Communications Services Tax Florida Department Of Revenue with ease

- Find Communications Services Tax Florida Department Of Revenue and click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of your documents or censor sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate reprinting document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and electronically sign Communications Services Tax Florida Department Of Revenue and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct communications services tax florida department of revenue

Create this form in 5 minutes!

How to create an eSignature for the communications services tax florida department of revenue

How to generate an eSignature for a PDF file online

How to generate an eSignature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The way to make an eSignature right from your mobile device

The best way to create an eSignature for a PDF file on iOS

The way to make an eSignature for a PDF on Android devices

People also ask

-

What is the Communications Services Tax Florida Department Of Revenue?

The Communications Services Tax Florida Department Of Revenue is a state tax applicable to various communication services. This includes telecommunications and certain digital services. Understanding this tax is essential for businesses operating in Florida to ensure compliance and accurate reporting.

-

How can airSlate SignNow help with Communications Services Tax compliance?

airSlate SignNow aids businesses in managing documentation related to the Communications Services Tax Florida Department Of Revenue. By streamlining document preparation and eSigning, businesses can maintain accurate records and fulfill tax obligations efficiently. This helps avoid penalties associated with non-compliance.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans suitable for a range of business sizes. Each plan includes features that help manage documents effectively, including those related to the Communications Services Tax Florida Department Of Revenue. You can choose a plan that fits your needs, ensuring a cost-effective solution.

-

What features does airSlate SignNow provide for tax documentation?

airSlate SignNow provides features such as customizable templates, automatic reminders, and secure eSigning, which are ideal for handling tax documentation. These tools help manage communications around the Communications Services Tax Florida Department Of Revenue. Enhanced features ensure your documents are processed quickly and securely.

-

Is airSlate SignNow easy to integrate with other tools?

Yes, airSlate SignNow integrates seamlessly with various tools and platforms, enhancing your workflow. Whether you're using CRMs or financial software, you can easily connect them to manage documents, including those related to the Communications Services Tax Florida Department Of Revenue. This integration simplifies your processes and boosts productivity.

-

What are the benefits of using airSlate SignNow for document signing?

Using airSlate SignNow for document signing offers numerous benefits, including faster turnaround times and reduced paper waste. It allows businesses to handle documents concerning the Communications Services Tax Florida Department Of Revenue efficiently and securely. Additionally, eSigning enhances the overall customer experience.

-

Can airSlate SignNow help with audit trails for tax compliance?

Absolutely! airSlate SignNow provides comprehensive audit trails for every document signed, which is crucial for tax compliance. This feature permits businesses dealing with the Communications Services Tax Florida Department Of Revenue to track and verify document history. Audit trails ensure transparency and accountability in your tax-related processes.

Get more for Communications Services Tax Florida Department Of Revenue

- Contractor agreement form template

- Cosmetologist agreement 497337099 form

- Telemarketing agreement self employed independent contractor form

- Electrologist agreement self employed independent contractor form

- Officer contractor 497337102 form

- Financial services agreement form

- Insurance agreement 497337104 form

- Medical transcriptionist agreement self employed independent contractor form

Find out other Communications Services Tax Florida Department Of Revenue

- How Do I eSignature Arkansas Medical Records Release

- How Do I eSignature Iowa Medical Records Release

- Electronic signature Texas Internship Contract Safe

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple