Sales Tax Return Form City of Centennial 2019-2026

What is the Sales Tax Return Form City Of Centennial

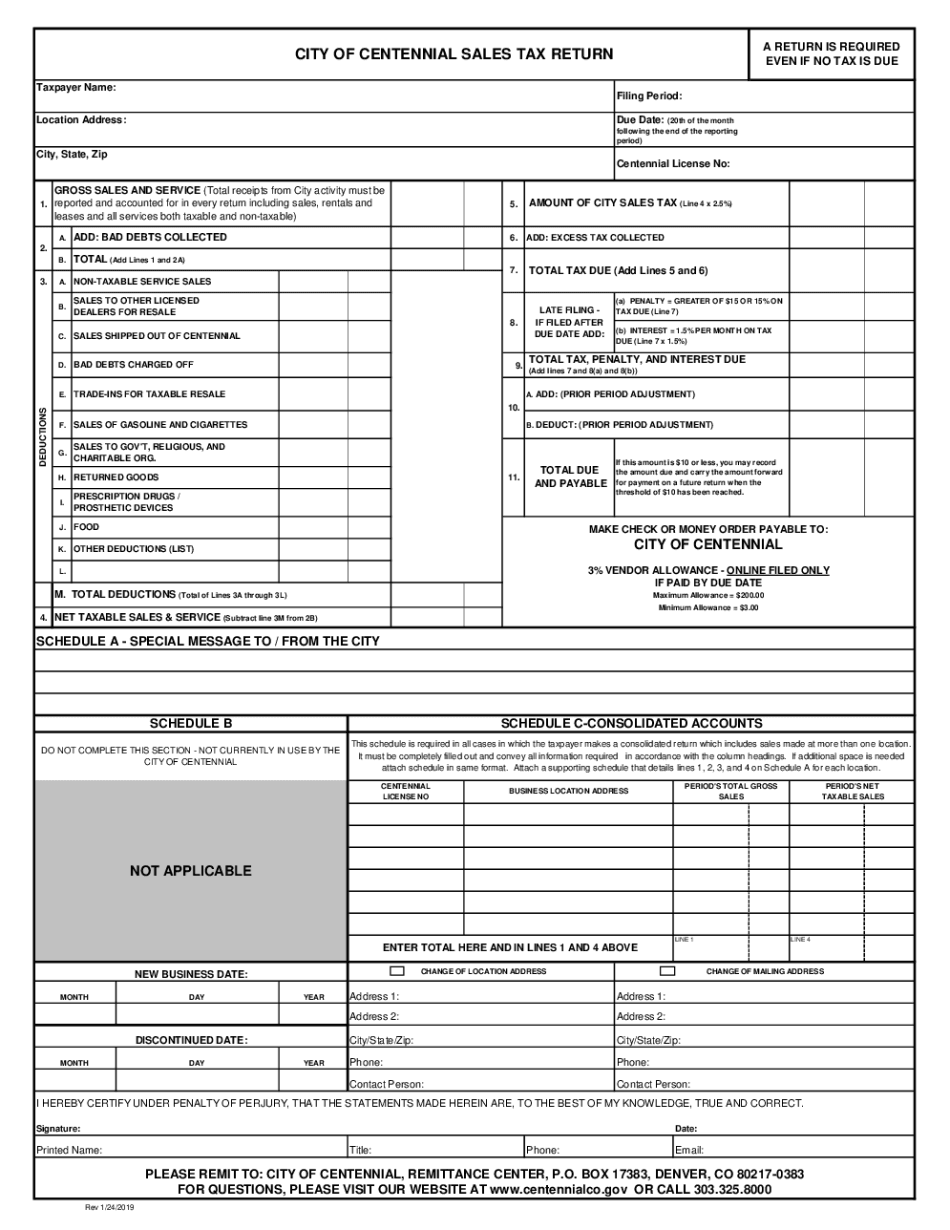

The Sales Tax Return Form for the City of Centennial is a document that businesses must complete to report their sales tax collections to the city. This form is essential for ensuring compliance with local tax regulations and helps the city maintain accurate records of sales tax revenue. Businesses operating within Centennial are required to file this form regularly, typically on a monthly or quarterly basis, depending on their sales volume.

How to use the Sales Tax Return Form City Of Centennial

Using the Sales Tax Return Form involves several steps. First, businesses need to gather all relevant sales data for the reporting period. This includes total sales, taxable sales, and any exemptions. Once the data is collected, the form must be filled out accurately, detailing the amounts collected and any applicable deductions. After completing the form, businesses can submit it electronically through the city’s online portal or by mailing a physical copy to the appropriate city department.

Steps to complete the Sales Tax Return Form City Of Centennial

Completing the Sales Tax Return Form involves a systematic approach:

- Gather sales records for the reporting period, including receipts and invoices.

- Calculate total sales and identify which sales are subject to tax.

- Fill out the form, ensuring all sections are completed accurately.

- Double-check calculations for accuracy, including total tax due.

- Submit the form online or mail it to the designated city office.

Legal use of the Sales Tax Return Form City Of Centennial

The Sales Tax Return Form must be used in accordance with local laws governing sales tax in Centennial. This includes adhering to filing deadlines and accurately reporting sales figures. Failure to comply with these regulations can result in penalties, including fines and interest on unpaid taxes. It is crucial for businesses to understand their legal obligations to avoid any legal issues related to tax compliance.

Key elements of the Sales Tax Return Form City Of Centennial

Key elements of the Sales Tax Return Form include:

- Business Information: Name, address, and tax identification number of the business.

- Sales Data: Total sales, taxable sales, and any exemptions claimed.

- Tax Calculation: Total sales tax collected and the amount due to the city.

- Signature: Required signature of the business owner or authorized representative.

Form Submission Methods (Online / Mail / In-Person)

The Sales Tax Return Form can be submitted through various methods to accommodate different preferences:

- Online: Businesses can file the form electronically via the City of Centennial's online portal.

- Mail: A physical copy of the completed form can be mailed to the city’s finance department.

- In-Person: Businesses may also choose to submit the form in person at the city’s finance office during business hours.

Quick guide on how to complete sales tax return form city of centennial

Effortlessly Prepare Sales Tax Return Form City Of Centennial on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed materials, allowing you to obtain the proper forms and securely store them online. airSlate SignNow equips you with all the tools necessary to swiftly create, modify, and electronically sign your documents without any hold-ups. Manage Sales Tax Return Form City Of Centennial on any system with airSlate SignNow’s Android or iOS applications and simplify your document-related tasks today.

The Easiest Way to Modify and eSign Sales Tax Return Form City Of Centennial Seamlessly

- Find Sales Tax Return Form City Of Centennial and click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure confidential details using the tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a standard ink signature.

- Review the details and click the Done button to finalize your changes.

- Select your preferred method for sharing your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Sales Tax Return Form City Of Centennial to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sales tax return form city of centennial

Create this form in 5 minutes!

How to create an eSignature for the sales tax return form city of centennial

The best way to generate an eSignature for a PDF file online

The best way to generate an eSignature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The best way to create an eSignature right from your mobile device

How to create an eSignature for a PDF file on iOS

The best way to create an eSignature for a PDF on Android devices

People also ask

-

What is the centennial sales tax login process?

The centennial sales tax login process is simple and user-friendly. You just need to visit the designated website, enter your credentials, and you will have access to your sales tax information. This streamlined process ensures that managing your sales tax obligations is hassle-free.

-

How does airSlate SignNow help with the centennial sales tax login?

AirSlate SignNow enhances your experience with the centennial sales tax login by providing a digital solution for document signing. You can securely eSign necessary tax documents, streamlining your workflows and ensuring compliance. This way, managing your sales tax paperwork becomes efficient and effortless.

-

Are there any fees associated with centennial sales tax login?

Accessing the centennial sales tax login is generally free; however, specific fees may apply to services needed alongside the process. For instance, using airSlate SignNow for document processing might involve subscription fees, which are often offset by the time and cost savings realized. Check the pricing structure to find an option that meets your needs.

-

What features does airSlate SignNow offer to support my centennial sales tax login?

AirSlate SignNow offers a range of features that support your centennial sales tax login, including easy document sharing, customizable templates, and audit trails. These features ensure that all your sales tax-related documents are properly managed and securely stored. By utilizing these tools, you enhance accuracy and compliance for your business.

-

Can I integrate airSlate SignNow with other platforms for my centennial sales tax login?

Yes, airSlate SignNow easily integrates with various platforms, enhancing your centennial sales tax login experience. This means you can connect with accounting software or customer relationship management tools to streamline your tax filing and document management process. Integration ensures a cohesive workflow, maximizing efficiency.

-

What are the benefits of using airSlate SignNow for my centennial sales tax login?

Using airSlate SignNow for your centennial sales tax login provides signNow benefits, including increased efficiency and reduced paperwork. Digital signatures help you manage your sales tax documents conveniently and securely. As a result, you can focus more on your core business activities rather than administrative tasks.

-

Is airSlate SignNow user-friendly for centennial sales tax login?

Absolutely! AirSlate SignNow is designed with user experience in mind, making the centennial sales tax login process straightforward and intuitive. Even those who aren’t tech-savvy can navigate and utilize all the features effectively. This ease of use empowers you to handle your sales tax responsibilities without unnecessary stress.

Get more for Sales Tax Return Form City Of Centennial

Find out other Sales Tax Return Form City Of Centennial

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors