Centennial Sales Tax 2011

What is the Centennial Sales Tax

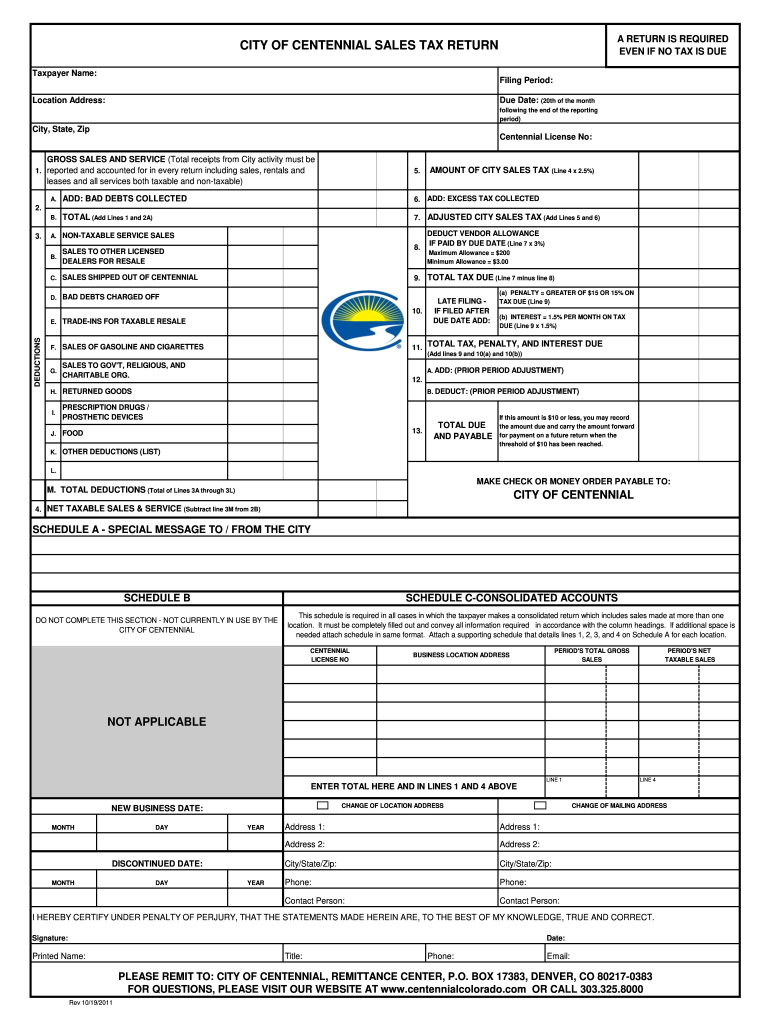

The city of Centennial sales tax is a local tax imposed on the sale of goods and services within the city limits of Centennial, Colorado. This tax is collected by businesses at the point of sale and is an essential source of revenue for the city, helping to fund public services, infrastructure, and community programs. The sales tax rate may vary depending on the type of goods or services sold, and it is important for both consumers and businesses to understand its implications.

How to use the Centennial Sales Tax

Using the city of Centennial sales tax involves understanding how it applies to various transactions. Businesses must collect the appropriate sales tax from customers during sales and remit it to the city. For consumers, it is crucial to be aware that the sales tax is included in the total price of items purchased. When filing taxes, individuals and businesses should accurately report the sales tax collected to ensure compliance with local regulations.

Steps to complete the Centennial Sales Tax

Completing the city of Centennial sales tax involves several key steps:

- Determine the applicable sales tax rate based on the type of goods or services.

- Collect the sales tax from customers at the point of sale.

- Keep accurate records of all sales and the corresponding sales tax collected.

- File the necessary sales tax returns with the city, detailing the total sales and tax collected.

- Remit the collected sales tax to the city by the specified deadline.

Legal use of the Centennial Sales Tax

The legal use of the city of Centennial sales tax is governed by local laws and regulations. Businesses must comply with these laws to ensure that they collect and remit the correct amount of sales tax. Failure to comply can result in penalties, fines, or legal action. It is essential for businesses to stay informed about any changes in tax laws or rates that may affect their operations.

Filing Deadlines / Important Dates

Filing deadlines for the city of Centennial sales tax are crucial for businesses to avoid penalties. Typically, sales tax returns are due on a monthly or quarterly basis, depending on the volume of sales. Businesses should mark their calendars with these important dates to ensure timely filing. Additionally, any changes to the tax rate or filing requirements should be monitored closely to maintain compliance.

Required Documents

To successfully file the city of Centennial sales tax, businesses need to prepare several key documents:

- Sales records detailing all transactions and the corresponding sales tax collected.

- Completed sales tax return forms as required by the city.

- Any supporting documentation that may be necessary to substantiate claims or deductions.

Penalties for Non-Compliance

Non-compliance with the city of Centennial sales tax regulations can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is important for businesses to understand the consequences of failing to collect or remit the appropriate sales tax and to take proactive measures to ensure compliance with all local tax laws.

Quick guide on how to complete centennial sales tax

Finalize Centennial Sales Tax effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to easily locate the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents quickly without any hold-ups. Manage Centennial Sales Tax on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Centennial Sales Tax without hassle

- Find Centennial Sales Tax and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight important sections of your files or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or errors that necessitate reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Centennial Sales Tax to ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct centennial sales tax

Create this form in 5 minutes!

How to create an eSignature for the centennial sales tax

The way to generate an electronic signature for a PDF file in the online mode

The way to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature right from your smartphone

The best way to make an eSignature for a PDF file on iOS devices

The way to create an electronic signature for a PDF on Android

People also ask

-

What is the city of Centennial sales tax rate?

The city of Centennial sales tax rate is currently set at 2.5%. This tax applies to the sale of tangible personal property and certain services within the city. It's essential for business owners to stay updated on any changes to ensure compliance.

-

How can airSlate SignNow help with managing city of Centennial sales tax documents?

airSlate SignNow allows businesses to streamline the process of managing city of Centennial sales tax documents by providing a digital platform for eSigning and organizing these essential files. This can save time and reduce errors, making tax preparation more efficient.

-

Are there integration options with accounting software for city of Centennial sales tax reporting?

Yes, airSlate SignNow supports integrations with various accounting software programs. This allows businesses to easily manage their city of Centennial sales tax reporting and ensure accurate filings without the hassle of manual data entry.

-

What features does airSlate SignNow offer for preparing city of Centennial sales tax documents?

airSlate SignNow offers a user-friendly interface, customizable templates, and secure eSigning features. These tools enable businesses to expedite the preparation of their city of Centennial sales tax documents while maintaining compliance and organization.

-

Can I use airSlate SignNow on mobile devices for city of Centennial sales tax processes?

Absolutely! airSlate SignNow is optimized for mobile devices, allowing users to manage their city of Centennial sales tax documents on the go. This flexibility ensures that you can eSign and send important documents whenever and wherever you need to.

-

What are the benefits of using airSlate SignNow for city of Centennial sales tax compliance?

Using airSlate SignNow simplifies the process of ensuring city of Centennial sales tax compliance. The platform helps businesses maintain organized records, reduce paperwork, and streamline eSigning processes, ultimately minimizing the risk of errors and late submissions.

-

How does pricing for airSlate SignNow work for businesses focused on city of Centennial sales tax?

airSlate SignNow offers flexible pricing plans to cater to businesses of all sizes. These plans are designed to provide cost-effective solutions, particularly beneficial for those dealing with the complexities of city of Centennial sales tax documentation and compliance.

Get more for Centennial Sales Tax

Find out other Centennial Sales Tax

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF