Form D5 'Notification of Dissolution or Surrender' Ohio 2020

What is the Form D5 'Notification Of Dissolution Or Surrender' Ohio

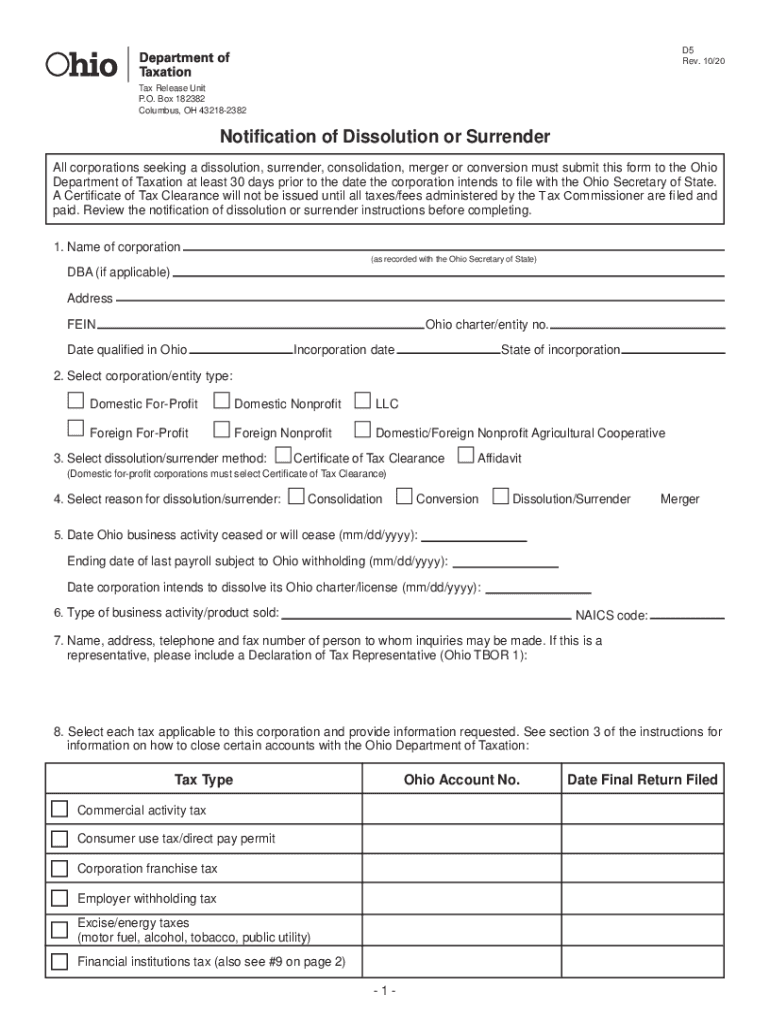

The Form D5, also known as the Notification of Dissolution or Surrender, is an official document used in Ohio for businesses that wish to formally dissolve or surrender their business entity status. This form is essential for limited liability companies (LLCs), corporations, and partnerships that are ceasing operations. Filing this form notifies the Ohio Secretary of State of the entity's decision to dissolve, ensuring compliance with state regulations. It is a crucial step in the legal process of winding down a business, as it helps prevent future liabilities and obligations associated with the entity.

How to use the Form D5 'Notification Of Dissolution Or Surrender' Ohio

Utilizing the Form D5 involves several key steps. First, ensure that all members or shareholders of the business agree on the decision to dissolve. Next, gather the necessary information, such as the business name, identification number, and the reason for dissolution. Complete the form accurately, providing all required details. Once filled out, the form must be submitted to the Ohio Secretary of State, either online or via mail. It is advisable to keep a copy of the submitted form for your records, as it serves as proof of the dissolution process.

Steps to complete the Form D5 'Notification Of Dissolution Or Surrender' Ohio

Completing the Form D5 requires careful attention to detail. Follow these steps for a successful submission:

- Gather essential information, including the business name and identification number.

- Ensure all necessary approvals from members or shareholders are documented.

- Fill out the form, providing accurate information in all required fields.

- Review the completed form for any errors or omissions.

- Submit the form to the Ohio Secretary of State, either electronically or by mail.

- Retain a copy of the submitted form for your records.

Legal use of the Form D5 'Notification Of Dissolution Or Surrender' Ohio

The legal use of the Form D5 is critical for ensuring that the dissolution of a business is recognized by the state of Ohio. This form must be filed in compliance with Ohio Revised Code requirements, which govern the dissolution process. By submitting the D5 form, businesses formally notify the state of their intent to dissolve, which helps to clear any outstanding obligations and liabilities. Failure to file this form may result in continued tax obligations or legal repercussions for the business entity.

Required Documents

When filing the Form D5, certain documents may be required to support the dissolution process. These typically include:

- Approval documentation from members or shareholders indicating consent to dissolve.

- Any outstanding tax clearance certificates, if applicable.

- Previous filings related to the business entity, such as annual reports or tax returns.

Ensuring that all necessary documentation is in order can facilitate a smoother dissolution process.

Form Submission Methods (Online / Mail / In-Person)

The Form D5 can be submitted through various methods, providing flexibility for businesses. The options include:

- Online Submission: Businesses can complete and file the form electronically through the Ohio Secretary of State's website, which is often the quickest method.

- Mail Submission: The completed form can be printed and mailed to the appropriate office of the Ohio Secretary of State.

- In-Person Submission: For those who prefer face-to-face interaction, the form can be submitted in person at designated state offices.

Choosing the right submission method can depend on the urgency and preference of the business.

Quick guide on how to complete form d5 ampquotnotification of dissolution or surrenderampquot ohio

Prepare Form D5 'Notification Of Dissolution Or Surrender' Ohio effortlessly on any device

Online document management has become favored among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can access the necessary form and safely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage Form D5 'Notification Of Dissolution Or Surrender' Ohio on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Form D5 'Notification Of Dissolution Or Surrender' Ohio effortlessly

- Locate Form D5 'Notification Of Dissolution Or Surrender' Ohio and click Get Form to begin.

- Use the tools at your disposal to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information carefully and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require new document copies. airSlate SignNow meets your needs in document management in just a few clicks from any device of your preference. Edit and eSign Form D5 'Notification Of Dissolution Or Surrender' Ohio and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form d5 ampquotnotification of dissolution or surrenderampquot ohio

Create this form in 5 minutes!

How to create an eSignature for the form d5 ampquotnotification of dissolution or surrenderampquot ohio

The best way to generate an eSignature for your PDF online

The best way to generate an eSignature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The best way to create an eSignature straight from your smartphone

How to create an electronic signature for a PDF on iOS

The best way to create an eSignature for a PDF document on Android

People also ask

-

What is airSlate SignNow and how does it relate to 'oh surrender'?

airSlate SignNow is a comprehensive eSignature solution that streamlines the process of sending and signing documents online. The phrase 'oh surrender' captures the essence of our platform’s ability to simplify document management, making it effortless for businesses to get documents signed efficiently.

-

How much does airSlate SignNow cost and is it worth the investment?

The pricing for airSlate SignNow is competitive and designed to cater to businesses of all sizes. Considering the benefits of increased efficiency and reduced paper usage, clients often find that 'oh surrender' to the advantages of our affordable plans is a smart business decision.

-

What features make airSlate SignNow a top choice for businesses?

airSlate SignNow offers a range of features including customizable templates, automated workflows, and secure document storage. With this suite of tools, businesses can experience what 'oh surrender' means in terms of ease, promoting seamless operations and quicker document turnaround times.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow offers integration capabilities with numerous applications such as Google Drive, Salesforce, and others. By optimizing your workflow through these integrations, you will soon realize 'oh surrender' to the enhanced productivity that our platform provides.

-

What are the benefits of using airSlate SignNow over traditional methods?

Utilizing airSlate SignNow eliminates the hassles of paper-based processes, saving time and costs associated with printing and mailing. By adopting an innovative eSigning solution, businesses can truly embrace 'oh surrender' to a more streamlined way of managing documents.

-

Is airSlate SignNow secure for sensitive documents?

Absolutely, airSlate SignNow prioritizes security and compliance with industry standards, ensuring that your sensitive documents are protected. The confidence in knowing your documents are safe allows businesses to say 'oh surrender' to worries about data bsignNowes.

-

How easy is it to use airSlate SignNow for new users?

airSlate SignNow is designed with user-friendliness in mind, allowing even non-technical users to get started quickly. As new users discover the intuitive interface, they often find themselves saying 'oh surrender' to the learning curve and enjoying the onboarding process.

Get more for Form D5 'Notification Of Dissolution Or Surrender' Ohio

Find out other Form D5 'Notification Of Dissolution Or Surrender' Ohio

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile