Single Transaction Certificate 2020

What is the Single Transaction Certificate

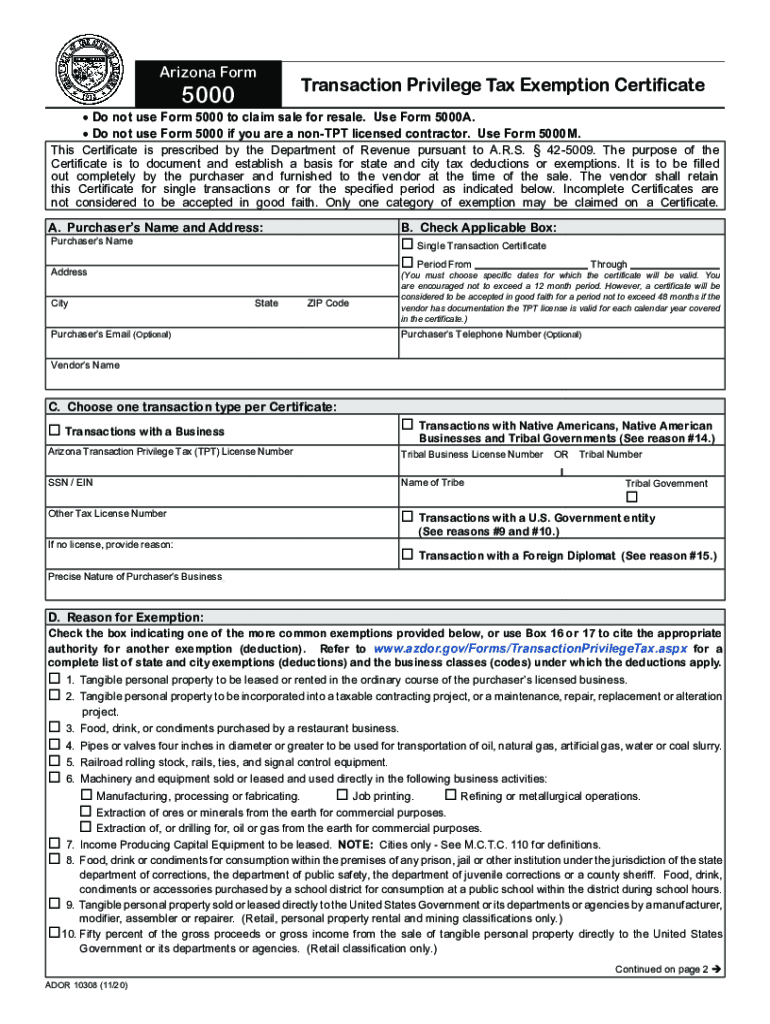

The Single Transaction Certificate (STC) is an essential document used in Arizona for tax exemption purposes. This certificate allows businesses and individuals to make tax-exempt purchases for specific transactions. It is particularly relevant for those who qualify under certain conditions, such as purchasing goods for resale or for use in manufacturing. Understanding the STC is crucial for compliance with state tax laws and for ensuring that tax obligations are met appropriately.

How to use the Single Transaction Certificate

Using the Single Transaction Certificate involves presenting it to the seller at the time of purchase. The seller must accept the certificate to exempt the transaction from sales tax. It is important to fill out the STC accurately, including details such as the buyer's name, address, and the reason for the tax exemption. This ensures that the seller has a valid record of the transaction for their tax reporting purposes.

Steps to complete the Single Transaction Certificate

Completing the Single Transaction Certificate requires careful attention to detail. Follow these steps:

- Download the STC form from the Arizona Department of Revenue website.

- Fill in your name, address, and the seller's information.

- Specify the type of goods or services being purchased.

- Provide a reason for the tax exemption, ensuring it aligns with state guidelines.

- Sign and date the certificate before presenting it to the seller.

Legal use of the Single Transaction Certificate

The legal use of the Single Transaction Certificate is governed by Arizona's tax laws. It is crucial to ensure that the certificate is used only for eligible purchases. Misuse of the STC can lead to penalties, including back taxes and fines. Therefore, understanding the legal implications and requirements surrounding the STC is vital for both buyers and sellers.

Eligibility Criteria

To qualify for using the Single Transaction Certificate, individuals or businesses must meet specific eligibility criteria. Typically, the buyer must be purchasing items for resale or for use in manufacturing. Additionally, the buyer must provide adequate documentation to support their claim for tax exemption. Familiarizing oneself with these criteria helps prevent errors and ensures compliance with Arizona tax regulations.

Form Submission Methods (Online / Mail / In-Person)

The Single Transaction Certificate does not require formal submission to a government agency; however, it must be presented to the seller at the time of purchase. Sellers may keep the certificate on file for their records. It is advisable to maintain a copy of the STC for personal records in case of future audits or inquiries from tax authorities.

Penalties for Non-Compliance

Failure to comply with the regulations surrounding the Single Transaction Certificate can result in significant penalties. If a buyer improperly uses the STC, they may be liable for unpaid sales tax, interest, and potential fines. Sellers who accept an invalid certificate may also face repercussions, including audits and financial penalties. Understanding these risks emphasizes the importance of using the STC correctly and maintaining accurate records.

Quick guide on how to complete single transaction certificate

Complete Single Transaction Certificate effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, since you can access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly without any delays. Manage Single Transaction Certificate on any device utilizing airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest method to modify and electronically sign Single Transaction Certificate without difficulty

- Locate Single Transaction Certificate and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to share your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Single Transaction Certificate and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct single transaction certificate

Create this form in 5 minutes!

How to create an eSignature for the single transaction certificate

The best way to make an electronic signature for your PDF document in the online mode

The best way to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The best way to generate an eSignature from your mobile device

How to generate an electronic signature for a PDF document on iOS devices

The best way to generate an eSignature for a PDF file on Android devices

People also ask

-

What is the 2019 az form and why do I need it?

The 2019 az form is a crucial tax document required by Arizona businesses for income reporting. Using airSlate SignNow allows you to eSign and send the 2019 az form efficiently, ensuring compliance with state regulations while saving time.

-

How does airSlate SignNow simplify the 2019 az form process?

airSlate SignNow streamlines the 2019 az form process by providing an easy-to-use platform where you can prepare, sign, and send documents securely. This minimizes errors and accelerates the completion of your tax documentation.

-

What features does airSlate SignNow offer for managing the 2019 az form?

With airSlate SignNow, you can utilize features such as templates, real-time collaboration, and secure storage tailored for the 2019 az form. These features enhance efficiency and make it easier to manage your documentation needs.

-

Is airSlate SignNow cost-effective for businesses filing the 2019 az form?

Yes, airSlate SignNow offers competitive pricing plans, making it a cost-effective solution for businesses needing to file the 2019 az form. The savings in time and resources can signNowly outweigh traditional methods of handling this documentation.

-

Can I integrate airSlate SignNow with other tools for the 2019 az form?

Absolutely! airSlate SignNow seamlessly integrates with a variety of third-party applications, making it easier to manage your documents, including the 2019 az form, in conjunction with other essential business tools.

-

What are the benefits of using airSlate SignNow for the 2019 az form?

The benefits of using airSlate SignNow for the 2019 az form include faster processing times, reduced paperwork, and enhanced security. These advantages not only streamline your workflow but also help ensure compliance with tax regulations.

-

Is it easy to get started with airSlate SignNow for the 2019 az form?

Yes, getting started with airSlate SignNow for the 2019 az form is straightforward. You can sign up easily, and our user-friendly interface allows you to create, fill out, and sign your documents within minutes.

Get more for Single Transaction Certificate

- Waiver release liability agreement 497427210 form

- Release participation form

- Waiver and release from liability for adult for rally participation form

- Waiver release participation form

- Liability paragliding form

- Waiver and release from liability for adult for sorority function form

- Waiver and release from liability for minor child for sorority function form

- Waiver and release from liability for adult for fraternity event form

Find out other Single Transaction Certificate

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now