Httpsapi14 Ilovepdf Comv1download 2021

Understanding the AZ 5000 Fillable Form

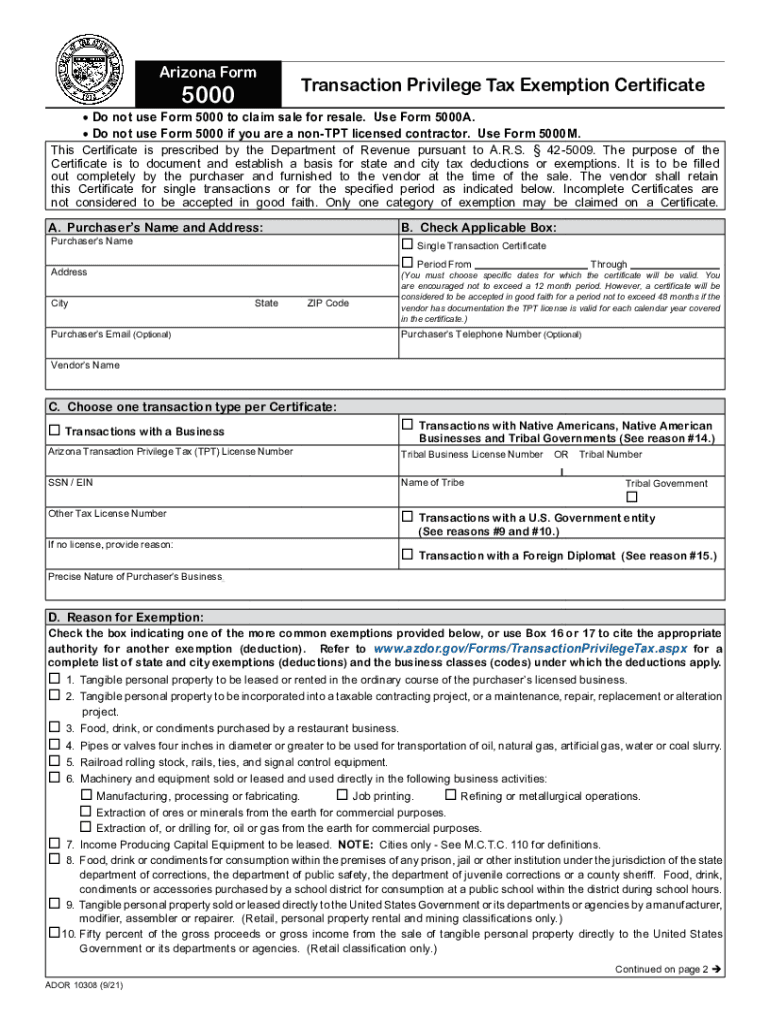

The AZ 5000 fillable form, also known as the Arizona tax exemption certificate, is essential for individuals and businesses seeking to claim tax exemptions in Arizona. This form allows eligible taxpayers to avoid sales tax on specific purchases by providing proof of their exemption status. Understanding the requirements and proper usage of this form is crucial for compliance with state tax regulations.

Steps to Complete the AZ 5000 Fillable Form

Filling out the AZ 5000 form requires careful attention to detail. Here are the steps to ensure accurate completion:

- Gather necessary information, including your name, address, and tax identification number.

- Identify the specific exemption category that applies to your situation, such as non-profit status or government purchases.

- Clearly indicate the purpose of the exemption in the designated section of the form.

- Review all entries for accuracy before submitting the form.

Legal Use of the AZ 5000 Fillable Form

To ensure the legal validity of the AZ 5000 form, it must be filled out completely and accurately. The form should be signed by an authorized representative if submitted by an organization. Compliance with Arizona state tax laws is essential; failure to adhere to these regulations can result in penalties or denial of the exemption claim.

Form Submission Methods

The AZ 5000 fillable form can be submitted through various methods. Taxpayers have the option to submit the completed form online, via mail, or in person at designated state offices. Each submission method may have different processing times, so it is advisable to choose the method that best suits your needs.

IRS Guidelines for Tax Exemptions

While the AZ 5000 form is specific to Arizona, it is important to be aware of the IRS guidelines regarding tax exemptions. The IRS outlines eligibility criteria and documentation requirements for various exemption types, which can help ensure that your claim is valid at both state and federal levels.

Filing Deadlines and Important Dates

Being aware of filing deadlines is crucial for maintaining compliance with tax regulations. The AZ 5000 form must be submitted by specific dates to ensure that your exemption is recognized for the applicable tax period. Keeping track of these deadlines can prevent unnecessary complications and ensure timely processing of your exemption claim.

Quick guide on how to complete httpsapi14ilovepdfcomv1download

Complete Httpsapi14 ilovepdf comv1download effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, as you can access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly and without delays. Manage Httpsapi14 ilovepdf comv1download on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered operation today.

The easiest way to modify and eSign Httpsapi14 ilovepdf comv1download with ease

- Obtain Httpsapi14 ilovepdf comv1download and then click Get Form to initiate.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal significance as a conventional handwritten signature.

- Verify the details and then click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Modify and eSign Httpsapi14 ilovepdf comv1download and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct httpsapi14ilovepdfcomv1download

Create this form in 5 minutes!

How to create an eSignature for the httpsapi14ilovepdfcomv1download

The best way to generate an e-signature for your PDF file in the online mode

The best way to generate an e-signature for your PDF file in Chrome

How to make an e-signature for putting it on PDFs in Gmail

The best way to create an electronic signature right from your smartphone

How to create an electronic signature for a PDF file on iOS devices

The best way to create an electronic signature for a PDF on Android

People also ask

-

What is the AZ 5000 fillable form?

The AZ 5000 fillable form is a customizable document template that allows users to easily input data. With airSlate SignNow, you can create and manage these forms effortlessly, ensuring a streamlined document flow for your business processes.

-

How do I create an AZ 5000 fillable form using airSlate SignNow?

Creating an AZ 5000 fillable form is simple with airSlate SignNow. You just need to select the template, add your fields, and customize it according to your needs. Once designed, you can easily share the form with your clients or team members.

-

What are the key features of the AZ 5000 fillable template?

The AZ 5000 fillable template offers features like customizable fields, eSignature capabilities, and secure storage. These features ensure a smooth and efficient document workflow while keeping your information safe and accessible.

-

Is the AZ 5000 fillable form suitable for all types of businesses?

Yes, the AZ 5000 fillable form is versatile and can be tailored for various industries and business needs. Whether you're in healthcare, finance, or education, this form can help you manage your documents effectively.

-

What is the pricing model for airSlate SignNow's AZ 5000 fillable forms?

airSlate SignNow offers competitive pricing for using AZ 5000 fillable forms based on your subscription plan. You can choose from different tiers, ensuring you find a solution that fits your budget while maximizing functionality.

-

Can I integrate the AZ 5000 fillable form with other business tools?

Absolutely! The AZ 5000 fillable form can be integrated with various business tools, such as CRM systems, email platforms, and more. This compatibility allows for a seamless workflow, enhancing overall productivity.

-

What are the benefits of using an AZ 5000 fillable form?

Using an AZ 5000 fillable form enhances efficiency by reducing paperwork and streamlining the signing process. It also improves accuracy by minimizing manual data entry error, ultimately saving time and resources.

Get more for Httpsapi14 ilovepdf comv1download

Find out other Httpsapi14 ilovepdf comv1download

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation