3885 Corporation Depreciation and Amortization 3885, Corporation Depreciation and Amortization 2019

Understanding the 3885 Corporation Depreciation and Amortization

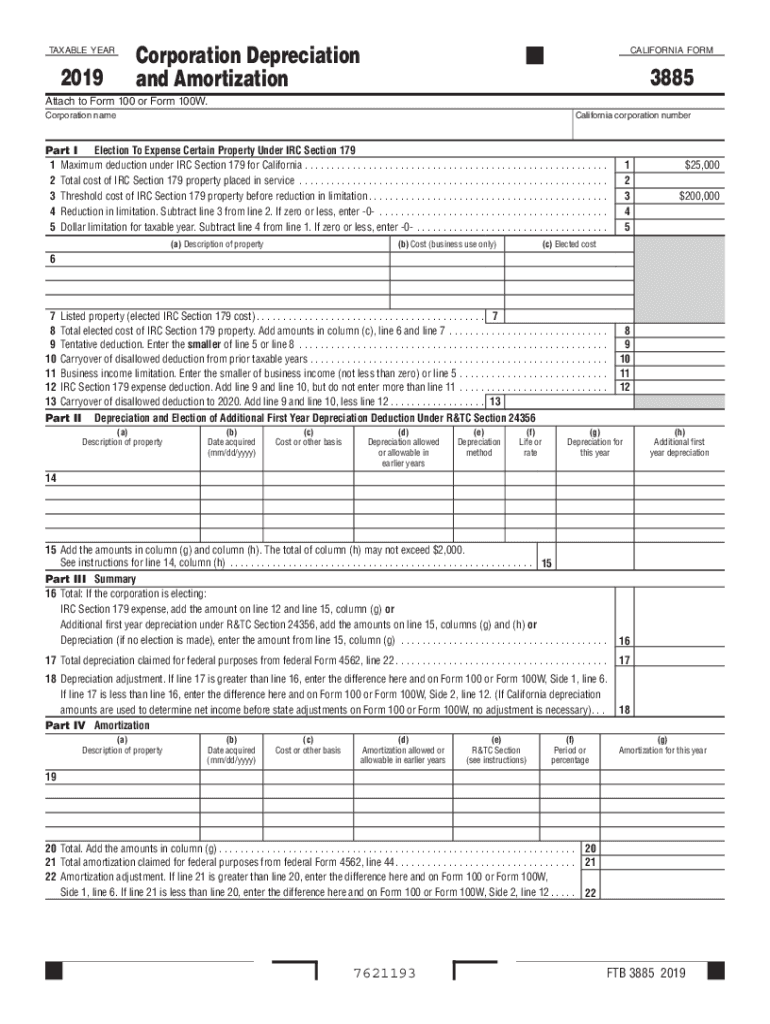

The ftb form 3885 is essential for corporations in California to report depreciation and amortization. This form allows businesses to claim deductions for the wear and tear of their assets over time. Depreciation applies to tangible assets, while amortization pertains to intangible assets. Understanding how to utilize this form effectively can lead to significant tax savings for eligible corporations.

Steps to Complete the 3885 Corporation Depreciation and Amortization

Completing the ftb form 3885 involves several key steps:

- Gather necessary documentation, including asset purchase invoices and prior depreciation schedules.

- Determine the classification of each asset to apply the correct depreciation method.

- Fill out the form accurately, ensuring all calculations reflect the current tax year.

- Review the completed form for any errors or omissions before submission.

Legal Use of the 3885 Corporation Depreciation and Amortization

To ensure the legal validity of the ftb form 3885, it must comply with the relevant tax laws and regulations. This includes adhering to the guidelines set forth by the California Franchise Tax Board. Properly executed, this form can serve as a legally binding document for tax purposes, allowing corporations to substantiate their claims for depreciation and amortization deductions.

Filing Deadlines and Important Dates

Corporations must be aware of the filing deadlines associated with the ftb form 3885. Generally, this form is due on the same date as the corporation's tax return. For most corporations, this is the fifteenth day of the third month following the end of their fiscal year. Missing these deadlines can result in penalties and interest, making timely submission crucial.

Required Documents for Form Submission

When preparing to file the ftb form 3885, corporations should have the following documents ready:

- Asset purchase agreements or invoices.

- Previous years' depreciation schedules.

- Any relevant financial statements that support depreciation claims.

Examples of Using the 3885 Corporation Depreciation and Amortization

Consider a corporation that purchased machinery for $100,000 with a useful life of ten years. By applying the appropriate depreciation method, the corporation can deduct a portion of the asset's cost each year on the ftb form 3885. This systematic deduction reduces taxable income, ultimately lowering the corporation's tax liability.

Quick guide on how to complete 2019 3885 corporation depreciation and amortization 2019 3885 corporation depreciation and amortization

Effortlessly set up 3885 Corporation Depreciation And Amortization 3885, Corporation Depreciation And Amortization on any device

Managing documents online has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents quickly and without delays. Manage 3885 Corporation Depreciation And Amortization 3885, Corporation Depreciation And Amortization on any device using the airSlate SignNow Android or iOS applications and enhance any document-based task today.

How to modify and electronically sign 3885 Corporation Depreciation And Amortization 3885, Corporation Depreciation And Amortization effortlessly

- Find 3885 Corporation Depreciation And Amortization 3885, Corporation Depreciation And Amortization and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal significance as a traditional handwritten signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you wish to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors requiring new printouts. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign 3885 Corporation Depreciation And Amortization 3885, Corporation Depreciation And Amortization and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 3885 corporation depreciation and amortization 2019 3885 corporation depreciation and amortization

Create this form in 5 minutes!

How to create an eSignature for the 2019 3885 corporation depreciation and amortization 2019 3885 corporation depreciation and amortization

The way to create an eSignature for your PDF document in the online mode

The way to create an eSignature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The way to create an eSignature from your mobile device

The best way to generate an electronic signature for a PDF document on iOS devices

The way to create an eSignature for a PDF file on Android devices

People also ask

-

What is the ftb form 3885 2018 No Download Needed?

The ftb form 3885 2018 No Download Needed is a specific tax form used for California tax purposes. It allows individuals to claim various credits and deductions on their tax returns without the need for downloading or printing physical documents. With airSlate SignNow, you can easily fill out and eSign this form online.

-

How can I access the ftb form 3885 2018 No Download Needed?

You can access the ftb form 3885 2018 No Download Needed directly through the airSlate SignNow platform. Our service allows you to fill out and manage the form online, ensuring a hassle-free experience without downloads. Simply log in to SignNow, locate the form, and start completing it.

-

Is there a cost associated with using the ftb form 3885 2018 No Download Needed on airSlate SignNow?

Yes, airSlate SignNow offers a subscription-based model that includes access to the ftb form 3885 2018 No Download Needed. We provide a variety of pricing plans that cater to different business sizes and needs. Enjoy a cost-effective solution for your eSigning and document management needs.

-

What features does airSlate SignNow offer for managing the ftb form 3885 2018 No Download Needed?

airSlate SignNow offers several features for managing the ftb form 3885 2018 No Download Needed, including an intuitive interface, online form filling, and secure eSignature capabilities. Additionally, you can track document status and collaborate with others, making the process efficient and straightforward.

-

Can I integrate airSlate SignNow with other applications for using the ftb form 3885 2018 No Download Needed?

Absolutely! airSlate SignNow supports integrations with various applications like Google Drive, Dropbox, and CRM systems. This means you can easily work with the ftb form 3885 2018 No Download Needed while leveraging other tools in your workflow for enhanced productivity.

-

What are the benefits of using airSlate SignNow for the ftb form 3885 2018 No Download Needed?

Using airSlate SignNow for the ftb form 3885 2018 No Download Needed offers numerous benefits, including time savings, improved accuracy, and enhanced security. You can complete and eSign your documents quickly and efficiently, ensuring compliance with all necessary regulations without the hassle of download.

-

Is it easy to eSign the ftb form 3885 2018 No Download Needed?

Yes, eSigning the ftb form 3885 2018 No Download Needed on airSlate SignNow is very easy. Our user-friendly platform allows you to add your signature digitally in just a few clicks, helping you streamline your document processes. Plus, you can do it all online without any downloads.

Get more for 3885 Corporation Depreciation And Amortization 3885, Corporation Depreciation And Amortization

- Restoration services authorization denial utah form

- Interrogatories to defendant for motor vehicle accident utah form

- Llc notices resolutions and other operations forms package utah

- Utah disclosure 497427525 form

- Notice of dishonored check criminal keywords bad check bounced check utah form

- Mutual wills containing last will and testaments for man and woman living together not married with no children utah form

- Mutual wills package of last wills and testaments for man and woman living together not married with adult children utah form

- Mutual wills or last will and testaments for man and woman living together not married with minor children utah form

Find out other 3885 Corporation Depreciation And Amortization 3885, Corporation Depreciation And Amortization

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe