Form CA FTB 3885 Fill Online, Printable, Fillable 2021

Understanding the FTB 3885 Form

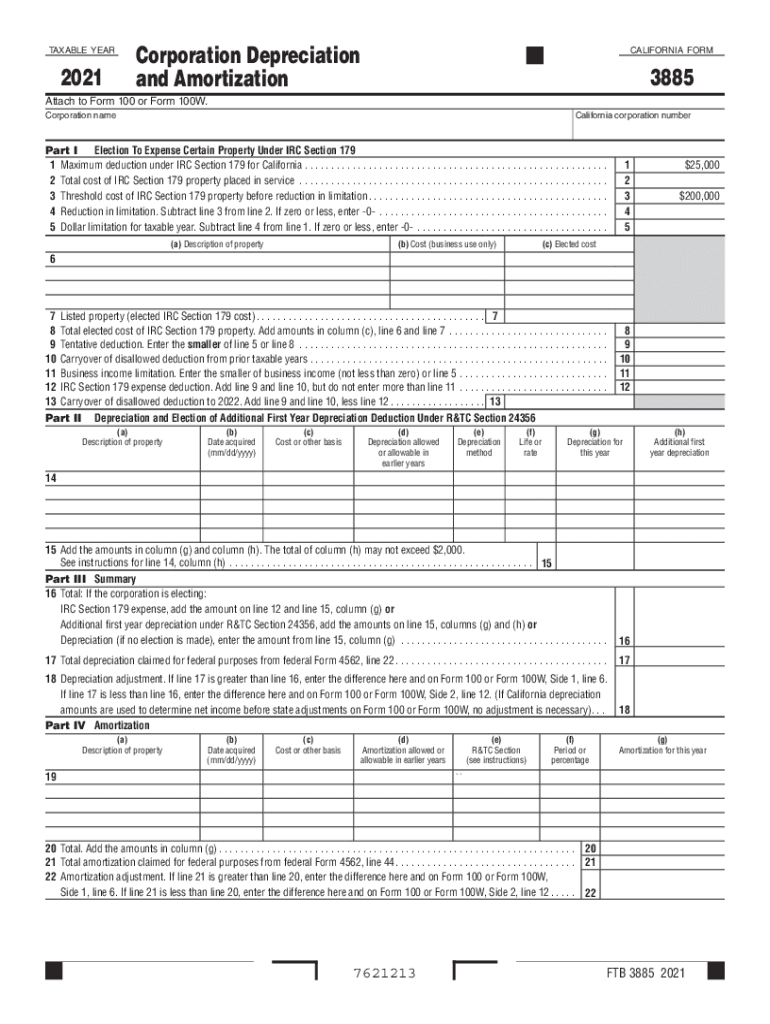

The FTB 3885 form, also known as the California Depreciation and Amortization form, is essential for taxpayers who need to report depreciation on their assets. This form allows individuals and businesses to calculate and claim depreciation deductions for property used in California. Understanding the nuances of this form is crucial for ensuring compliance with state tax regulations.

Steps to Complete the FTB 3885 Form

Completing the FTB 3885 form requires careful attention to detail. Here are the key steps to follow:

- Gather necessary documentation, including purchase receipts and prior year depreciation schedules.

- Determine the type of property being depreciated, such as real estate or equipment.

- Calculate the depreciation using the appropriate method, like straight-line or declining balance.

- Enter the calculated amounts on the form, ensuring accuracy in each section.

- Review the completed form for any errors or omissions before submission.

Legal Use of the FTB 3885 Form

The FTB 3885 form is legally recognized for reporting depreciation in California. To ensure that your form is legally valid, it must be completed accurately and submitted by the designated deadlines. Compliance with state tax laws is essential, as incorrect reporting can lead to penalties or audits.

Filing Deadlines for the FTB 3885 Form

Timely submission of the FTB 3885 form is critical to avoid penalties. The filing deadline typically aligns with the state income tax return due date. For most individuals, this is April 15. However, businesses may have different deadlines based on their fiscal year. It is important to stay informed about any changes to these dates each tax year.

Required Documents for the FTB 3885 Form

When preparing to file the FTB 3885 form, gather the following documents:

- Purchase invoices for the assets being depreciated.

- Prior year tax returns that include depreciation schedules.

- Any relevant tax guidance or publications from the California Franchise Tax Board.

Examples of Using the FTB 3885 Form

The FTB 3885 form can be applied in various scenarios, such as:

- A business claiming depreciation on machinery used in manufacturing.

- An individual reporting depreciation on rental property.

- Partnerships or LLCs claiming deductions for shared assets.

Quick guide on how to complete 2020 form ca ftb 3885 fill online printable fillable

Prepare Form CA FTB 3885 Fill Online, Printable, Fillable effortlessly on any device

Digital document management has grown increasingly popular among companies and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly without any holdups. Manage Form CA FTB 3885 Fill Online, Printable, Fillable on any device using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to adjust and eSign Form CA FTB 3885 Fill Online, Printable, Fillable with ease

- Find Form CA FTB 3885 Fill Online, Printable, Fillable and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or conceal sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, time-consuming form searching, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Form CA FTB 3885 Fill Online, Printable, Fillable and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form ca ftb 3885 fill online printable fillable

Create this form in 5 minutes!

How to create an eSignature for the 2020 form ca ftb 3885 fill online printable fillable

How to generate an e-signature for a PDF online

How to generate an e-signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to make an e-signature right from your smartphone

The best way to create an e-signature for a PDF on iOS

How to make an e-signature for a PDF on Android

People also ask

-

What is the FTB 3885 form and how does it relate to airSlate SignNow?

The FTB 3885 form is a tax form used in California for the annual certification of the business allocation of credits. airSlate SignNow allows users to easily send and eSign FTB 3885 documents, ensuring a streamlined process for online tax submissions.

-

How much does airSlate SignNow cost for managing FTB 3885 documents?

airSlate SignNow offers affordable pricing plans that cater to businesses of all sizes looking to manage FTB 3885 forms efficiently. You can choose from various subscriptions based on your needs, making it a cost-effective solution for eSigning.

-

What features does airSlate SignNow offer for FTB 3885 processing?

airSlate SignNow includes features like document templates, automated reminders, and seamless eSigning to enhance the processing of FTB 3885 forms. These features ensure that your documents are handled quickly and securely.

-

Can I integrate airSlate SignNow with other software for FTB 3885 management?

Yes, airSlate SignNow seamlessly integrates with various platforms like Google Drive, Dropbox, and other document management systems, allowing you to manage your FTB 3885 forms within your existing workflows.

-

What are the benefits of using airSlate SignNow for FTB 3885 eSigning?

Using airSlate SignNow for FTB 3885 eSigning simplifies the signing process, reduces paper waste, and enhances compliance. This ensures that your documents are not only signed quickly but also securely stored for future reference.

-

Is airSlate SignNow secure for handling FTB 3885 forms?

Absolutely! airSlate SignNow employs industry-standard security practices, including data encryption and secure cloud storage, to protect your FTB 3885 forms and any sensitive information contained within them.

-

How does airSlate SignNow improve the workflow for submitting the FTB 3885 form?

airSlate SignNow improves the workflow for submitting the FTB 3885 form by providing an intuitive user interface that guides you through the eSigning process. This leads to faster turnaround times and less administrative burden on your team.

Get more for Form CA FTB 3885 Fill Online, Printable, Fillable

- Living trust for individual who is single divorced or widow or widower with children massachusetts form

- Living trust for husband and wife with one child massachusetts form

- Living trust for husband and wife with minor and or adult children massachusetts form

- Ma trust form

- Living trust property record massachusetts form

- Financial account transfer to living trust massachusetts form

- Assignment to living trust massachusetts form

- Notice of assignment to living trust massachusetts form

Find out other Form CA FTB 3885 Fill Online, Printable, Fillable

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later