BUSINESS INCOME & RECEIPTS TAX 2019-2026

What is the Business Income & Receipts Tax?

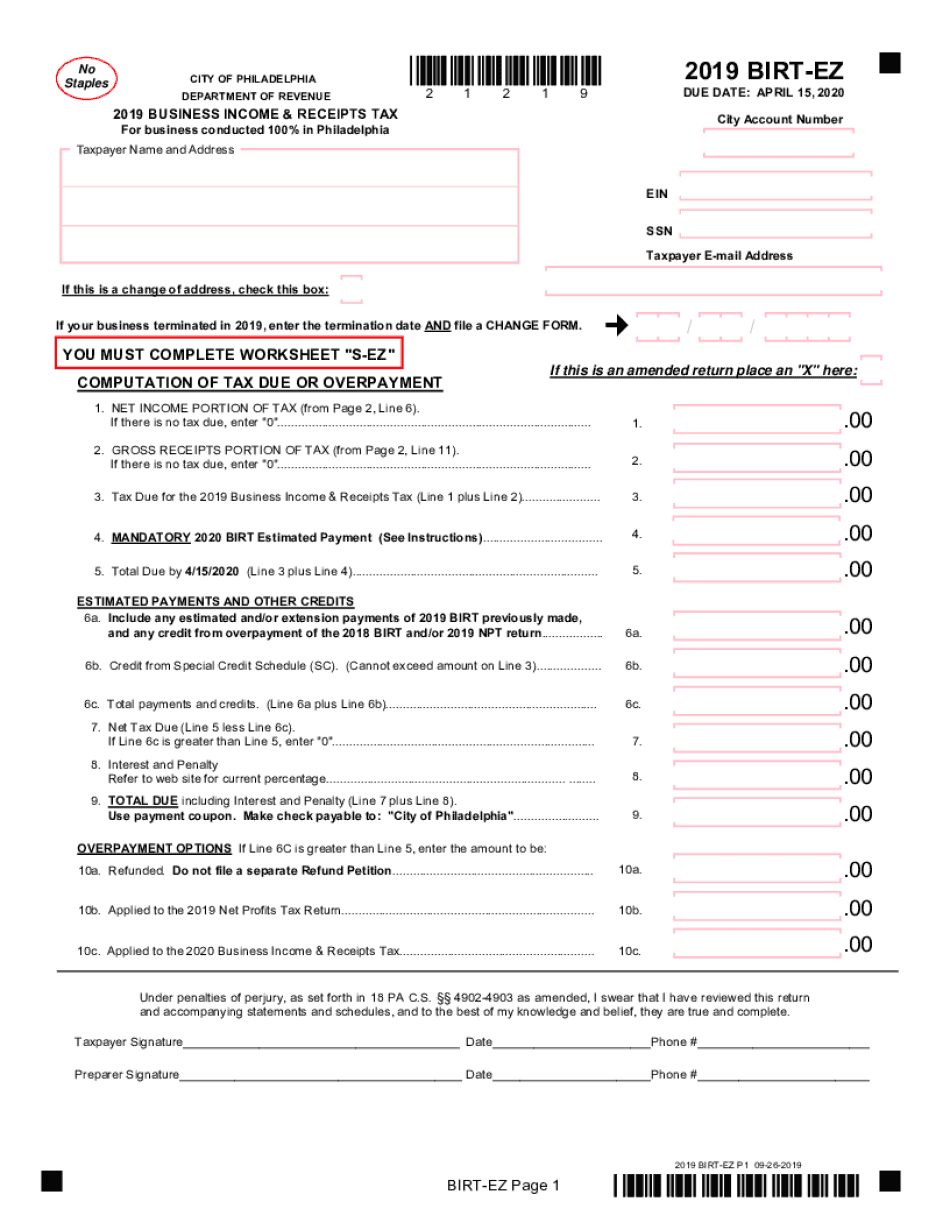

The Business Income & Receipts Tax (BIRT) is a tax imposed on businesses operating within Philadelphia. This tax applies to various forms of business entities, including corporations, partnerships, and sole proprietorships. The BIRT is calculated based on the gross receipts and net income of the business, ensuring that all businesses contribute fairly to the local economy. Understanding this tax is essential for compliance and effective financial planning.

Steps to Complete the Business Income & Receipts Tax

Completing the Business Income & Receipts Tax involves several key steps:

- Gather Required Documents: Collect financial records, including income statements and receipts, to accurately report your business's earnings.

- Determine Your Taxable Income: Calculate your gross receipts and net income to understand your tax liability.

- Fill Out the BIRT Form: Use the appropriate form, such as the 2017 BIRT EZ, ensuring all sections are completed accurately.

- Review and Verify: Double-check all entries for accuracy to avoid potential penalties.

- Submit the Form: Choose your preferred submission method, whether online, by mail, or in person.

Legal Use of the Business Income & Receipts Tax

The BIRT is legally mandated under Philadelphia's tax regulations. Businesses must comply with this tax requirement to avoid penalties and ensure their operations remain lawful. The tax revenue generated supports essential city services, contributing to community welfare. Understanding the legal implications of the BIRT is crucial for all business owners operating in Philadelphia.

Filing Deadlines / Important Dates

Adhering to filing deadlines is vital for compliance with the Business Income & Receipts Tax. The annual tax return is typically due on the 15th day of the fourth month following the end of your fiscal year. For most businesses operating on a calendar year, this means the deadline is April 15. Late submissions may incur penalties and interest, so it is important to mark these dates on your calendar.

Required Documents

To complete the Business Income & Receipts Tax, certain documents are necessary:

- Financial statements, including profit and loss statements

- Records of gross receipts

- Any applicable deductions or credits

- Prior year tax returns for reference

Having these documents ready will streamline the filing process and help ensure accuracy.

Form Submission Methods

Businesses have several options for submitting the Business Income & Receipts Tax form:

- Online Submission: Utilize the city’s online portal for a quick and efficient filing process.

- Mail: Send the completed form and any required documents via postal service to the appropriate tax office.

- In-Person: Deliver the form directly to the tax office for immediate processing.

Choosing the right submission method can depend on your business's needs and preferences.

Quick guide on how to complete 2019 business income amp receipts tax

Effortlessly Prepare BUSINESS INCOME & RECEIPTS TAX on Any Gadget

Digital document management has become increasingly favored by both businesses and individuals. It serves as an ideal eco-conscious alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the necessary tools to quickly create, modify, and electronically sign your documents without delays. Manage BUSINESS INCOME & RECEIPTS TAX on any system using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The Easiest Method to Modify and Electronically Sign BUSINESS INCOME & RECEIPTS TAX Stress-Free

- Find BUSINESS INCOME & RECEIPTS TAX and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign tool, which only takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors requiring new document reproductions. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and electronically sign BUSINESS INCOME & RECEIPTS TAX and guarantee outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 business income amp receipts tax

Create this form in 5 minutes!

How to create an eSignature for the 2019 business income amp receipts tax

The way to make an electronic signature for a PDF in the online mode

The way to make an electronic signature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The way to generate an electronic signature from your smart phone

The way to generate an eSignature for a PDF on iOS devices

The way to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is birtez and how does it relate to airSlate SignNow?

Birtez is a unique feature offered by airSlate SignNow that streamlines the process of sending and eSigning documents. With birtez, users can effortlessly manage document workflows while ensuring security and compliance. This tool simplifies the eSignature journey, making it suitable for businesses of all sizes.

-

How does pricing work for birtez within airSlate SignNow?

The birtez feature is included in the pricing plans of airSlate SignNow, which are designed to be cost-effective for all businesses. Different tiers offer varying levels of access to features like birtez, so you can choose a plan that best fits your needs. This flexible pricing ensures you can optimize your document workflows without overspending.

-

What are the key features of birtez in airSlate SignNow?

Birtez in airSlate SignNow includes features such as easy document editing, secure eSigning, and customizable templates. Additionally, birtez provides real-time tracking and notifications, keeping users informed at every step of the process. These features enhance user experience and boost productivity for businesses.

-

What are the benefits of using birtez for eSigning documents?

Using birtez for eSigning documents offers numerous benefits, including increased efficiency and reduced turnaround time. Businesses can streamline their operations by eliminating manual processes, allowing for quicker approvals and transactions. Additionally, birtez ensures compliance with legal standards, making it a reliable choice for document management.

-

Can birtez integrate with other software tools?

Absolutely! Birtez integrates seamlessly with a variety of software tools, enhancing its functionality. Users can connect birtez with CRM systems, cloud storage solutions, and productivity applications, creating a robust document management ecosystem. This integration capability ensures that businesses can optimize their existing workflows without hassle.

-

Is birtez secure for handling sensitive documents?

Yes, birtez within airSlate SignNow is designed with security in mind, ensuring that sensitive documents are protected. The platform employs encryption, secure access controls, and compliance with industry standards to safeguard your information. Businesses can trust birtez to handle their sensitive data securely and with integrity.

-

How does birtez enhance the user experience in airSlate SignNow?

Birtez enhances user experience by providing an intuitive interface that simplifies the eSigning process. With user-friendly features and clear navigation, individuals can efficiently manage their documents without technical difficulties. This focus on user experience means that businesses can adopt birtez with minimal training and maximize productivity.

Get more for BUSINESS INCOME & RECEIPTS TAX

Find out other BUSINESS INCOME & RECEIPTS TAX

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile