D 76 Estate Tax Instructions 2020

What is the D-76 Estate Tax Instructions

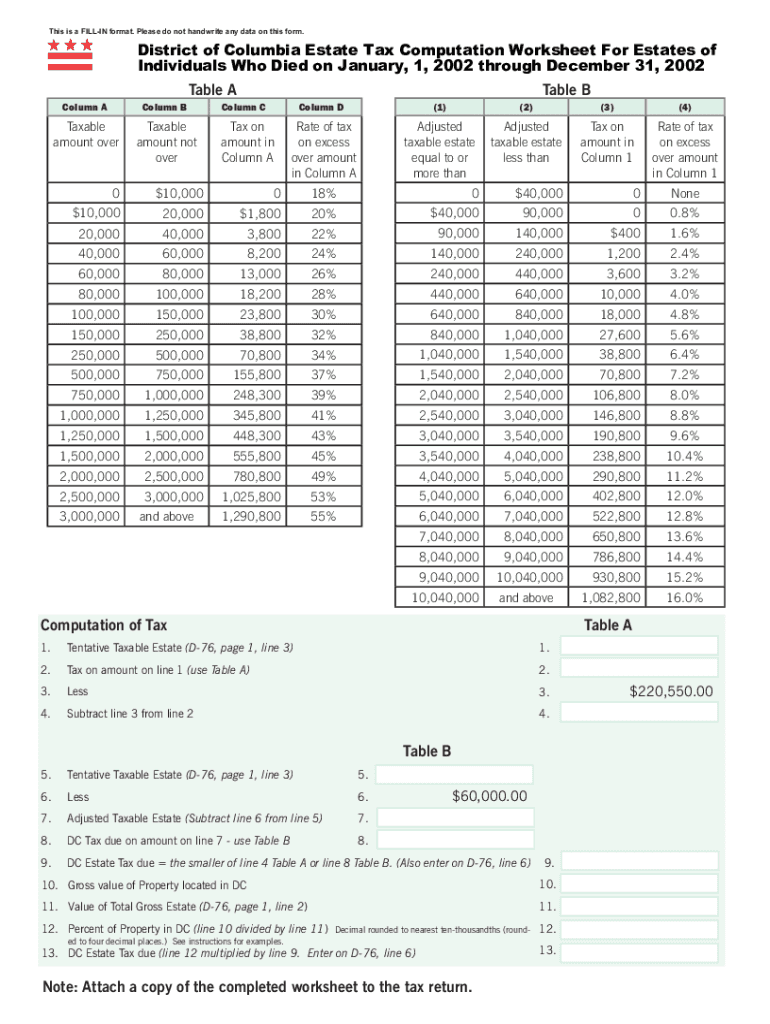

The D-76 Estate Tax Instructions provide detailed guidance on how to complete the District of Columbia estate tax return. This form is essential for estates with a gross value exceeding a specific threshold, which may vary annually. The instructions outline the necessary steps to calculate the estate tax owed, including the identification of taxable assets and allowable deductions. Understanding these instructions is crucial for executors and administrators managing the estate to ensure compliance with local tax laws.

Steps to Complete the D-76 Estate Tax Instructions

Completing the D-76 Estate Tax Instructions involves several key steps:

- Gather all relevant financial documents, including asset valuations and debts.

- Determine the gross estate value by adding all assets owned by the deceased.

- Identify allowable deductions, such as funeral expenses and debts, to calculate the net taxable estate.

- Apply the appropriate estate tax rates as outlined in the instructions.

- Complete the D-76 form accurately, ensuring all information is correct and complete.

- Review the form for accuracy before submission.

Required Documents

To complete the D-76 Estate Tax Instructions, several documents are necessary:

- Death certificate of the deceased.

- Asset valuations, including real estate, bank accounts, and investments.

- Documentation of debts and liabilities.

- Receipts for funeral expenses and other allowable deductions.

- Any prior tax returns that may affect the estate's tax obligations.

Form Submission Methods

The D-76 form can be submitted through various methods, ensuring flexibility for the executor or administrator:

- Online: The form can be completed and submitted electronically through the District of Columbia's tax portal.

- By Mail: Completed forms can be printed and mailed to the appropriate tax office.

- In-Person: Filers may also choose to submit the form in person at designated tax offices in the District of Columbia.

Penalties for Non-Compliance

Failure to comply with the D-76 Estate Tax Instructions can result in significant penalties. These may include:

- Late filing penalties, which accrue based on the amount of tax owed.

- Interest on unpaid taxes, compounded daily until the balance is settled.

- Potential legal action for willful non-compliance, leading to further financial and legal repercussions.

Eligibility Criteria

Eligibility to file the D-76 Estate Tax Instructions generally depends on the gross value of the estate. Estates exceeding the threshold set by the District of Columbia are required to file. Additionally, the executor or administrator must be legally designated to manage the estate, ensuring that all tax obligations are met according to local laws.

Quick guide on how to complete d 76 estate tax instructions

Complete D 76 Estate Tax Instructions effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the resources required to create, modify, and electronically sign your documents quickly and efficiently. Handle D 76 Estate Tax Instructions on any platform with the airSlate SignNow apps for Android or iOS and enhance any document-related operation today.

The simplest way to alter and electronically sign D 76 Estate Tax Instructions with ease

- Obtain D 76 Estate Tax Instructions and click Get Form to begin.

- Utilize the tools available to submit your document.

- Emphasize important sections of the documents or obscure sensitive details with the tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Select your preferred method to deliver your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors requiring new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign D 76 Estate Tax Instructions and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct d 76 estate tax instructions

Create this form in 5 minutes!

How to create an eSignature for the d 76 estate tax instructions

The way to make an electronic signature for a PDF file in the online mode

The way to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your smartphone

The way to generate an eSignature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF document on Android

People also ask

-

What is the dc form d 76 estate tax instructions?

The dc form d 76 estate tax instructions are guidelines provided by the District of Columbia for filing estate taxes. This document outlines the necessary steps and information required to complete the estate tax return properly. Understanding these instructions is crucial for accurate compliance and timely submission.

-

How can airSlate SignNow help with dc form d 76 estate tax instructions?

airSlate SignNow offers an efficient way to create, sign, and manage your dc form d 76 estate tax instructions digitally. With our solution, you can quickly fill out the form, embed your electronic signature, and share the document securely. This streamlines the process, making it easier for you to focus on other important matters.

-

What features does airSlate SignNow provide for managing tax documents?

airSlate SignNow includes features such as customizable templates, secure cloud storage, electronic signatures, and real-time document tracking. These capabilities ensure your dc form d 76 estate tax instructions and other tax documents are processed efficiently and securely. Plus, you can access and manage your documents from anywhere.

-

Is there a cost associated with using airSlate SignNow for estate tax documents?

Yes, airSlate SignNow offers various pricing plans to meet your business needs. Our plans provide access to all essential tools, including those needed for managing dc form d 76 estate tax instructions, at a competitive price point. You can select the plan that best fits your requirements, whether for individual use or business needs.

-

Can I integrate airSlate SignNow with other software for easier tax management?

Absolutely! airSlate SignNow supports numerous integrations with popular business software, enhancing your workflow for managing dc form d 76 estate tax instructions. This allows you to seamlessly pull in necessary data, improving efficiency and reducing errors during the document preparation process.

-

Why should I choose airSlate SignNow for my estate tax document needs?

Choosing airSlate SignNow empowers you with an easy-to-use platform to handle your dc form d 76 estate tax instructions efficiently. Our cost-effective solution not only streamlines document handling but also enhances collaboration and compliance, ensuring you meet all regulatory requirements effectively.

-

How secure is airSlate SignNow when handling tax documents?

Security is a top priority at airSlate SignNow. Our platform complies with industry standards, ensuring that your dc form d 76 estate tax instructions and other important documents are encrypted and securely stored. You can trust that your sensitive information is protected while utilizing our services.

Get more for D 76 Estate Tax Instructions

Find out other D 76 Estate Tax Instructions

- Electronic signature Colorado Non disclosure agreement sample Computer

- Can I Electronic signature Illinois Non disclosure agreement sample

- Electronic signature Kentucky Non disclosure agreement sample Myself

- Help Me With Electronic signature Louisiana Non disclosure agreement sample

- How To Electronic signature North Carolina Non disclosure agreement sample

- Electronic signature Ohio Non disclosure agreement sample Online

- How Can I Electronic signature Oklahoma Non disclosure agreement sample

- How To Electronic signature Tennessee Non disclosure agreement sample

- Can I Electronic signature Minnesota Mutual non-disclosure agreement

- Electronic signature Alabama Non-disclosure agreement PDF Safe

- Electronic signature Missouri Non-disclosure agreement PDF Myself

- How To Electronic signature New York Non-disclosure agreement PDF

- Electronic signature South Carolina Partnership agreements Online

- How Can I Electronic signature Florida Rental house lease agreement

- How Can I Electronic signature Texas Rental house lease agreement

- eSignature Alabama Trademark License Agreement Secure

- Electronic signature Maryland Rental agreement lease Myself

- How To Electronic signature Kentucky Rental lease agreement

- Can I Electronic signature New Hampshire Rental lease agreement forms

- Can I Electronic signature New Mexico Rental lease agreement forms