DC OTR D 76 Form 2022-2026

What is the DC OTR D 76 Form

The DC OTR D 76 Form is the official document used for reporting estate taxes in Washington, D.C. This form is essential for individuals who are responsible for settling an estate and must calculate the estate tax owed to the District. The form provides a structured way to disclose the value of the estate, including all assets and liabilities, ensuring compliance with local tax laws. Understanding the purpose of the D 76 is crucial for executors and administrators of estates, as it directly impacts the financial obligations of the estate.

How to use the DC OTR D 76 Form

Using the DC OTR D 76 Form involves several steps to ensure accurate completion and submission. First, gather all necessary documentation related to the estate, including asset valuations, debts, and any previous tax returns. Next, carefully fill out the form, ensuring that all sections are completed accurately. It is important to follow the specific instructions provided with the form to avoid errors that could lead to penalties. Once completed, the form can be submitted either electronically or via mail, depending on the preferred method of filing.

Steps to complete the DC OTR D 76 Form

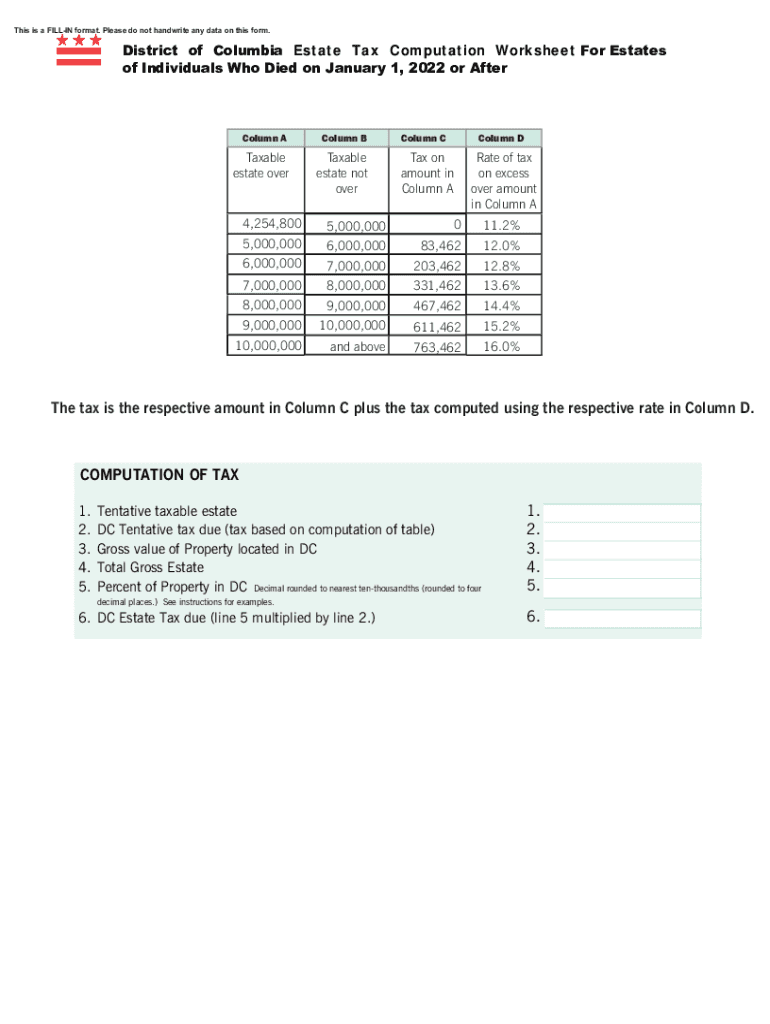

Completing the DC OTR D 76 Form requires attention to detail. Begin by entering the decedent's information, including name, date of death, and Social Security number. Next, list all assets, such as real estate, bank accounts, and investments, along with their fair market values. Deduct any liabilities, such as outstanding debts or funeral expenses, to arrive at the net taxable estate value. Finally, calculate the estate tax owed using the appropriate tax rates and include any necessary schedules or additional documentation as required. Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

Filing deadlines for the DC OTR D 76 Form are critical to ensure compliance and avoid penalties. Generally, the estate tax return must be filed within nine months of the decedent's date of death. However, extensions may be available under certain circumstances. It is important to stay informed about any changes to tax laws or deadlines that could affect the filing process. Marking important dates on a calendar can help ensure timely submission and compliance with all requirements.

Required Documents

When completing the DC OTR D 76 Form, several documents are required to support the information provided. These documents typically include the decedent's will, death certificate, asset valuations, and any relevant financial statements. Additionally, documentation of debts and liabilities must be included to accurately determine the net taxable estate. Gathering these documents in advance can streamline the completion process and help ensure that the form is filled out correctly.

Form Submission Methods (Online / Mail / In-Person)

The DC OTR D 76 Form can be submitted through various methods, providing flexibility for users. The form can be filed electronically through the District's online tax portal, which offers a convenient option for many taxpayers. Alternatively, individuals may choose to mail the completed form to the appropriate tax office or deliver it in person. Each submission method has its own guidelines, so it is essential to follow the instructions carefully to ensure successful filing.

Quick guide on how to complete dc otr d 76 form

Manage DC OTR D 76 Form with ease on any device

Digital document management has become increasingly favored by enterprises and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents promptly without delays. Handle DC OTR D 76 Form across any platform with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to edit and eSign DC OTR D 76 Form effortlessly

- Obtain DC OTR D 76 Form and click on Get Form to begin.

- Make use of the tools we provide to complete your form.

- Mark important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for these tasks.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign DC OTR D 76 Form while ensuring effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dc otr d 76 form

Create this form in 5 minutes!

How to create an eSignature for the dc otr d 76 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a DC estate tax return?

A DC estate tax return is a legal document required to report the value of an estate for tax purposes after someone's death in Washington, D.C. This return includes details about the assets, liabilities, and beneficiaries involved, ensuring compliance with DC estate tax regulations. It's essential for determining the tax obligations of the estate.

-

Who is required to file a DC estate tax return?

Filing a DC estate tax return is mandatory for estates that exceed a certain value threshold set by the D.C. Office of Tax and Revenue. Executors or personal representatives are responsible for submitting this return on behalf of the estate. Failing to file can result in penalties or interest owed on the estate taxes.

-

How can airSlate SignNow assist in preparing a DC estate tax return?

airSlate SignNow provides a user-friendly platform for signing and sending necessary documents electronically, making the preparation of a DC estate tax return more efficient. You can collaborate with professionals and share documents securely to ensure all required information is present in your return. This streamlines the process while maintaining compliance with local regulations.

-

What features does airSlate SignNow offer for eSigning documents related to a DC estate tax return?

airSlate SignNow offers features such as customizable templates, real-time tracking, and secure eSignature capabilities for documents like a DC estate tax return. These tools simplify the workflow by allowing users to obtain signatures quickly and efficiently, reducing the time it takes to finalize necessary forms. Additionally, documents are stored securely for easy access.

-

Is airSlate SignNow cost-effective for individuals managing a DC estate tax return?

Yes, airSlate SignNow offers competitive pricing plans suitable for individuals and businesses managing a DC estate tax return. The platform provides a cost-effective solution to streamline document management without compromising essential functionalities. Users can choose plans that best fit their needs without incurring unnecessary expenses.

-

Can I integrate airSlate SignNow with other tools while preparing a DC estate tax return?

Absolutely, airSlate SignNow supports integration with a variety of tools and applications, enhancing your ability to manage a DC estate tax return efficiently. Integrating with platforms like Google Drive or Dropbox enables easy file sharing and document management. This compatibility ensures a seamless workflow, allowing you to streamline processes among different software.

-

What are the benefits of using airSlate SignNow for my DC estate tax return paperwork?

Using airSlate SignNow for your DC estate tax return paperwork offers numerous benefits, such as improved efficiency, clarity, and secure document handling. The platform minimizes the potential for errors through its intuitive design and automated features. Moreover, the cloud-based system ensures that your documents are accessible from anywhere, simplifying collaboration with tax professionals.

Get more for DC OTR D 76 Form

Find out other DC OTR D 76 Form

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed