Op 383 2019

What is the Op 383

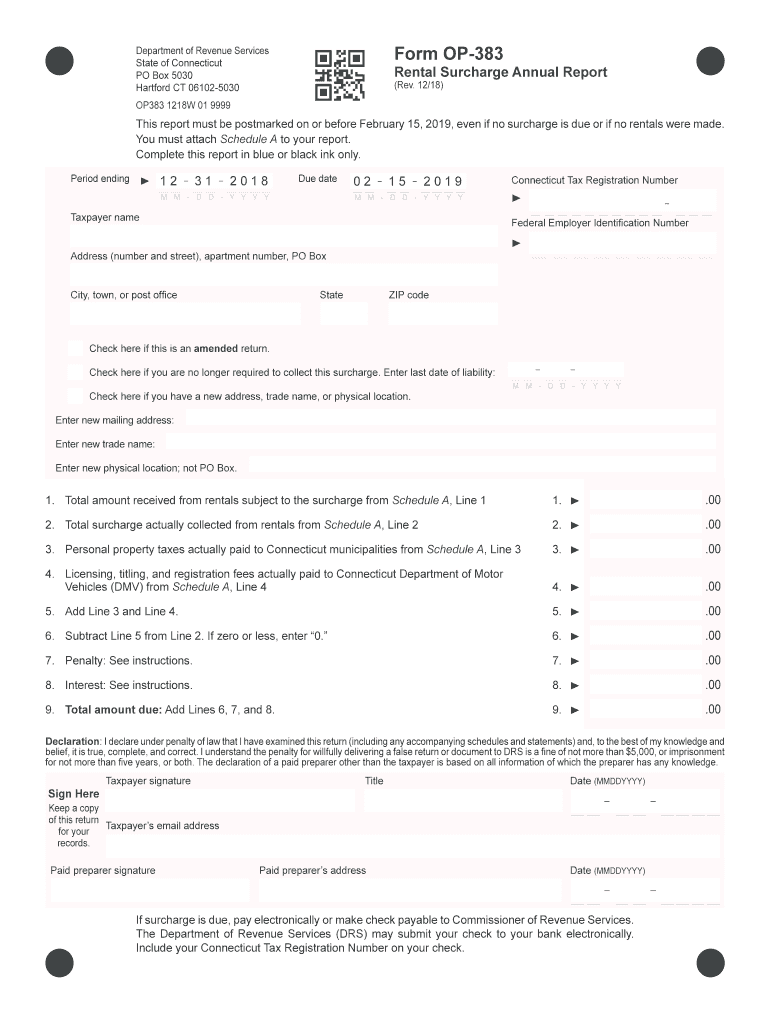

The 2017 CT Form OP 383, also known simply as the Op 383, is a form utilized in the state of Connecticut for specific tax-related purposes. This form is primarily designed for reporting and claiming certain tax credits or adjustments. Understanding the purpose of the Op 383 is essential for taxpayers who wish to ensure compliance with state tax regulations and maximize their eligible benefits.

How to use the Op 383

Using the 2017 CT Form OP 383 involves several steps that ensure accurate reporting of tax information. Taxpayers should begin by gathering necessary financial documents, including income statements and previous tax filings. Once the required information is collected, individuals can fill out the form, ensuring all sections are completed accurately. It is vital to double-check the entries for any errors before submission to avoid delays or penalties.

Steps to complete the Op 383

Completing the 2017 CT Form OP 383 requires careful attention to detail. Here are the steps to follow:

- Obtain the latest version of the form from the Connecticut Department of Revenue Services.

- Fill in personal information, including name, address, and Social Security number.

- Provide details regarding income and any applicable deductions or credits.

- Review all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Op 383

The legal use of the 2017 CT Form OP 383 is governed by state tax laws. To ensure that the form is legally binding, it must be filled out accurately and submitted by the designated deadlines. Additionally, taxpayers should maintain copies of the submitted form and any supporting documentation for their records. This practice is crucial in case of audits or inquiries from the Connecticut Department of Revenue Services.

Filing Deadlines / Important Dates

Filing deadlines for the 2017 CT Form OP 383 are critical for compliance. Generally, the form must be submitted by the due date of the taxpayer's annual income tax return. It is advisable to check the Connecticut Department of Revenue Services website for any updates or changes to filing deadlines, as these can vary based on specific circumstances or legislative changes.

Form Submission Methods

The 2017 CT Form OP 383 can be submitted through various methods, including:

- Online submission through the Connecticut Department of Revenue Services portal.

- Mailing the completed form to the appropriate address provided on the form.

- In-person submission at designated tax offices.

Choosing the right submission method can help ensure timely processing of the form.

Quick guide on how to complete 2019 op 383

Complete Op 383 effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely save it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents swiftly and without delays. Manage Op 383 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related workflow today.

The easiest way to modify and electronically sign Op 383 with ease

- Locate Op 383 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or obscure sensitive information with specialized tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method of sharing your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form retrieval, or errors requiring new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Op 383 to ensure smooth communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 op 383

Create this form in 5 minutes!

How to create an eSignature for the 2019 op 383

The way to make an eSignature for your PDF document online

The way to make an eSignature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The way to make an electronic signature straight from your smart phone

The way to make an electronic signature for a PDF document on iOS

The way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is the 2017 ct form op 383?

The 2017 ct form op 383 is a specific tax form used for reporting Connecticut income tax credits. This form is essential for individuals and businesses looking to claim applicable deductions on their state tax returns. Understanding its requirements is crucial for accurate tax filings.

-

How can airSlate SignNow help with the 2017 ct form op 383?

airSlate SignNow allows users to upload, fill out, and securely eSign the 2017 ct form op 383 digitally. This streamlines the submission process, ensuring that your tax documents are completed accurately and submitted on time, while also providing a convenient solution for document management.

-

What features does airSlate SignNow offer for managing the 2017 ct form op 383?

With airSlate SignNow, you can easily create templates for the 2017 ct form op 383, making future submissions quicker. The platform also includes features such as status tracking, reminders for important deadlines, and secure cloud storage for your completed forms.

-

Is using airSlate SignNow for the 2017 ct form op 383 cost-effective?

Yes, airSlate SignNow provides a cost-effective solution for handling documents like the 2017 ct form op 383. With affordable pricing plans and no hidden fees, you can access all necessary features without overspending, making it an ideal choice for businesses of all sizes.

-

Can airSlate SignNow integrate with other software for the 2017 ct form op 383?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, which can assist you in efficiently managing the 2017 ct form op 383. This integration helps streamline your workflow, reduces manual data entry, and minimizes the risk of errors.

-

What are the benefits of using airSlate SignNow for eSigning the 2017 ct form op 383?

Using airSlate SignNow for eSigning the 2017 ct form op 383 offers numerous benefits, including enhanced security and compliance. You can ensure that your signatures are legally binding, while also saving time and resources by avoiding traditional paper-based signing.

-

Is training available for using airSlate SignNow with the 2017 ct form op 383?

Yes, airSlate SignNow offers a variety of training resources and customer support options to help you effectively use the platform for the 2017 ct form op 383. Users can access tutorials, webinars, and a dedicated support team to answer any questions and enhance their document management skills.

Get more for Op 383

- Electrical contractor package utah form

- Sheetrock drywall contractor package utah form

- Flooring contractor package utah form

- Trim carpentry contractor package utah form

- Fencing contractor package utah form

- Hvac contractor package utah form

- Landscaping contractor package utah form

- Commercial contractor package utah form

Find out other Op 383

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template

- How Can I Electronic signature Missouri Unlimited Power of Attorney