Form 72 010 20 3 1 000 Rev 2020-2026

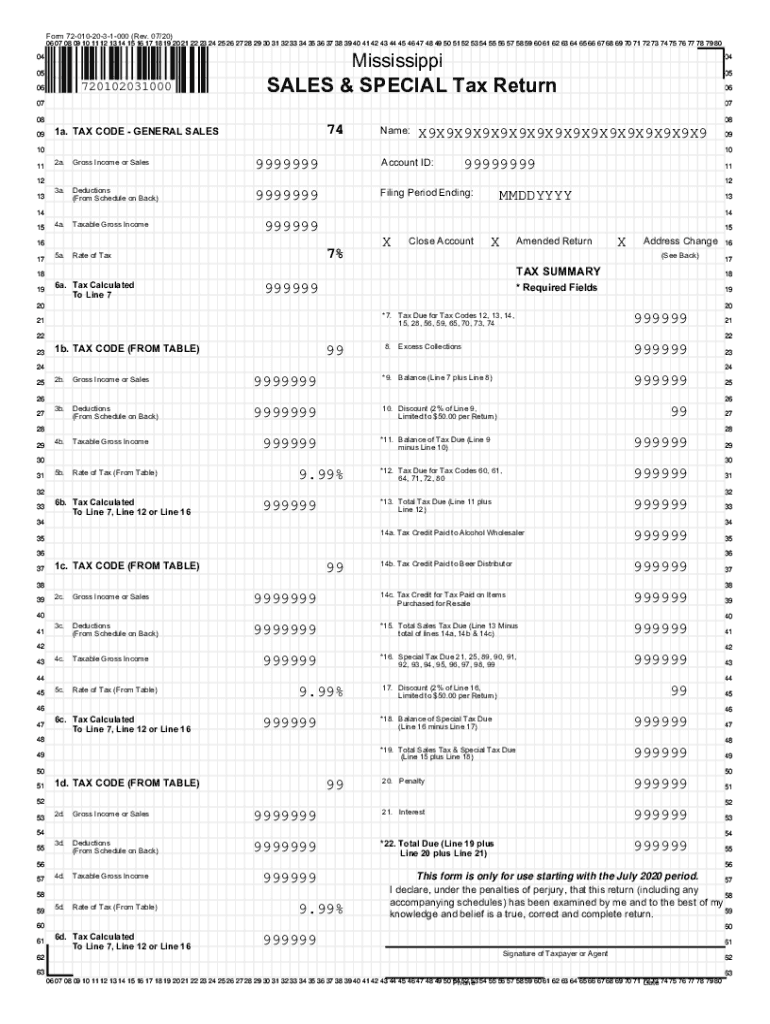

What is the Mississippi Sales Tax Form 72-010?

The Mississippi Sales Tax Form 72-010 is an essential document used by businesses to report and pay sales tax to the state of Mississippi. This form is specifically designed for businesses engaged in selling tangible personal property or taxable services within the state. It collects information on the total sales made, the amount of sales tax collected, and any deductions or exemptions that may apply. Understanding this form is crucial for maintaining compliance with state tax regulations.

Steps to Complete the Mississippi Sales Tax Form 72-010

Completing the Mississippi Sales Tax Form 72-010 involves several key steps:

- Gather all necessary sales records for the reporting period.

- Calculate the total sales made during the period, including any taxable and non-taxable sales.

- Determine the total amount of sales tax collected from customers.

- Apply any deductions or exemptions that are applicable to your business.

- Fill out the form accurately, ensuring all figures are correct.

- Submit the completed form by the designated filing deadline.

Legal Use of the Mississippi Sales Tax Form 72-010

The Mississippi Sales Tax Form 72-010 is legally binding when completed and submitted according to state regulations. It serves as an official record of sales tax collected and must be filed to comply with Mississippi tax laws. Businesses are required to keep a copy of the submitted form and any supporting documentation for their records. Failure to file this form accurately and on time may result in penalties or fines.

Form Submission Methods for the Mississippi Sales Tax Form 72-010

Businesses can submit the Mississippi Sales Tax Form 72-010 through various methods:

- Online Submission: Many businesses opt to file electronically through the Mississippi Department of Revenue's online portal.

- Mail Submission: The form can also be printed and mailed to the appropriate state office.

- In-Person Submission: Businesses may choose to deliver the form in person at their local tax office.

Filing Deadlines for the Mississippi Sales Tax Form 72-010

It is important for businesses to be aware of the filing deadlines associated with the Mississippi Sales Tax Form 72-010. Typically, the form is due on the 20th of the month following the reporting period. For example, sales made in January must be reported by February 20. Staying informed about these deadlines helps businesses avoid late fees and ensures compliance with state tax laws.

Key Elements of the Mississippi Sales Tax Form 72-010

The Mississippi Sales Tax Form 72-010 includes several key elements that businesses must complete:

- Business Information: Name, address, and tax identification number of the business.

- Total Sales: The total amount of sales made during the reporting period.

- Sales Tax Collected: The total sales tax collected from customers.

- Deductions: Any applicable deductions or exemptions that reduce the taxable amount.

Quick guide on how to complete form 72 010 20 3 1 000 rev

Complete Form 72 010 20 3 1 000 Rev effortlessly on any device

Digital document management has gained traction among organizations and individuals. It serves as an excellent sustainable alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, revise, and electronically sign your documents promptly without unnecessary delays. Handle Form 72 010 20 3 1 000 Rev using airSlate SignNow applications for Android or iOS and enhance any document-related process today.

How to revise and electronically sign Form 72 010 20 3 1 000 Rev without hassle

- Locate Form 72 010 20 3 1 000 Rev and click Get Form to initiate the process.

- Utilize the resources we provide to fill out your form.

- Emphasize pertinent sections of your documents or conceal sensitive data with the tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method for delivering your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced files, cumbersome form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Revise and electronically sign Form 72 010 20 3 1 000 Rev and ensure exceptional communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 72 010 20 3 1 000 rev

Create this form in 5 minutes!

How to create an eSignature for the form 72 010 20 3 1 000 rev

How to create an eSignature for your PDF file in the online mode

How to create an eSignature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

How to generate an eSignature from your smartphone

How to generate an electronic signature for a PDF file on iOS devices

How to generate an eSignature for a PDF file on Android

People also ask

-

What is an ms sales form and how can it benefit my business?

An ms sales form is a structured document used to gather sales information and facilitate transactions. Utilizing an ms sales form can streamline your sales process, ensuring all necessary data is collected efficiently. airSlate SignNow provides a simple way to create and send these forms, enhancing your team's productivity.

-

How does airSlate SignNow integrate with ms sales forms?

airSlate SignNow allows you to easily incorporate ms sales forms into your document workflows. You can create, send, and eSign these forms in a few clicks, saving you time and reducing errors. This seamless integration ensures that your sales process remains smooth and efficient.

-

What features does airSlate SignNow offer for managing ms sales forms?

airSlate SignNow offers features such as customizable templates, real-time tracking, and secure eSignature options for managing ms sales forms. These tools help you maintain control and visibility over your sales documentation. Additionally, you can automate reminders and follow-ups, ensuring timely responses.

-

Is airSlate SignNow cost-effective for using ms sales forms?

Yes, airSlate SignNow is a cost-effective solution for businesses looking to simplify the management of ms sales forms. With flexible pricing plans, you can choose a plan that aligns with your business size and needs. This allows you to save money while improving your sales workflow.

-

Can I customize my ms sales form in airSlate SignNow?

Absolutely! airSlate SignNow provides a user-friendly interface that allows you to fully customize your ms sales form. You can add your brand logo, modify fields, and tailor the document layout to suit your branding and specific requirements, enhancing your professionalism.

-

What security measures does airSlate SignNow have for ms sales forms?

airSlate SignNow prioritizes security when handling ms sales forms. It complies with industry-standard security protocols, including encryption and user authentication. This ensures that your sensitive sales data is protected throughout the signing and submission process.

-

How can I track the status of my ms sales forms sent via airSlate SignNow?

Tracking the status of your ms sales forms is simple with airSlate SignNow. The platform provides real-time updates, allowing you to see when a document is viewed, signed, or completed. This transparency helps you manage your sales processes more effectively.

Get more for Form 72 010 20 3 1 000 Rev

- Jury instruction 2241 pretrial detainee alleging excessive force form

- Jury instruction 2242 pretrial detainee alleging deliberate indifference to serious medical need form

- 3 rule 3 form

- Jury instruction 332 section 1 per se violation tying agreement defense of justification form

- Jury instruction 441 rule 10b 5a device scheme or artifice to defraud insider trading form

- Jury instruction 442 rule 10b 5b misrepresentations omissions of material facts form

- 4 4 5 c form

- Jury instruction 551 general instruction form

Find out other Form 72 010 20 3 1 000 Rev

- eSignature Oregon Housekeeping Contract Computer

- eSignature Montana Home Loan Application Online

- eSignature New Hampshire Home Loan Application Online

- eSignature Minnesota Mortgage Quote Request Simple

- eSignature New Jersey Mortgage Quote Request Online

- Can I eSignature Kentucky Temporary Employment Contract Template

- eSignature Minnesota Email Cover Letter Template Fast

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online