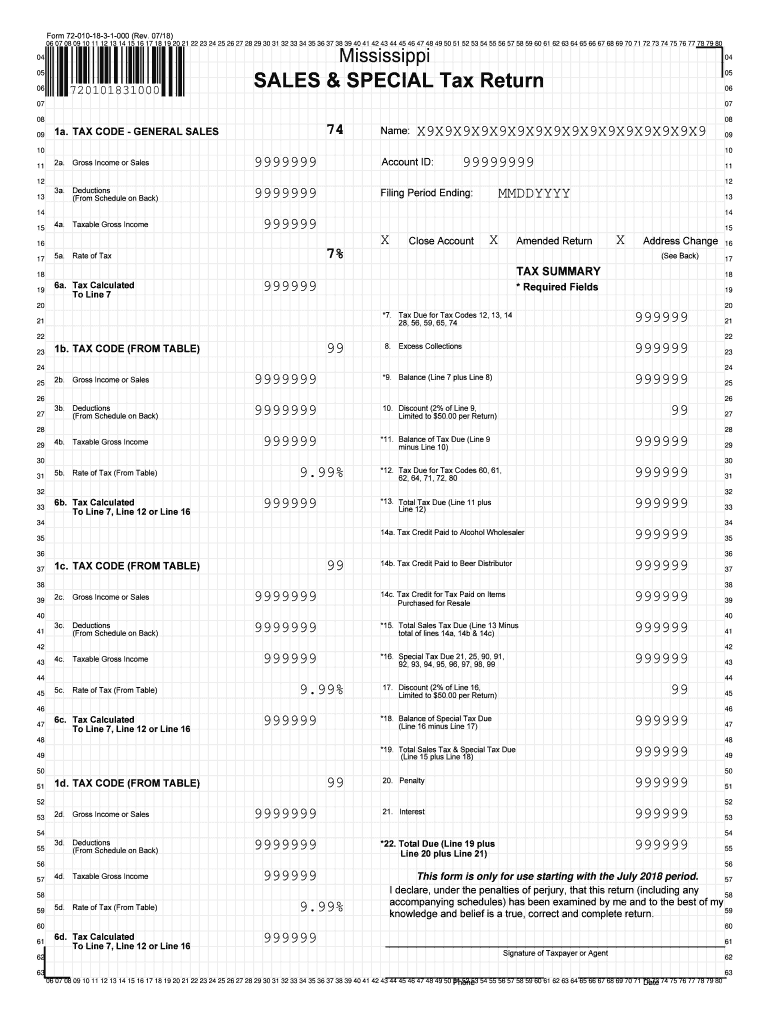

Mississippi Sales Tax Return Form 72 010 2018

What is the Mississippi Sales Tax Return Form 72 010

The Mississippi Sales Tax Return Form 72 010 is a crucial document used by businesses to report their sales and calculate the sales tax owed to the state. This form is designed for monthly or quarterly reporting, depending on the business's sales volume. It captures essential information, such as total sales, exempt sales, and the amount of tax collected. Completing this form accurately is vital for compliance with state tax laws and to avoid penalties.

Steps to Complete the Mississippi Sales Tax Return Form 72 010

Completing the Mississippi Sales Tax Return Form 72 010 involves several key steps:

- Gather Financial Records: Collect all sales records for the reporting period, including invoices and receipts.

- Calculate Total Sales: Determine the total sales made during the reporting period, including taxable and exempt sales.

- Determine Exempt Sales: Identify any sales that qualify for exemption under Mississippi tax law.

- Calculate Tax Due: Use the appropriate tax rate to calculate the total sales tax owed based on taxable sales.

- Fill Out the Form: Enter the calculated figures into the corresponding fields on Form 72 010.

- Review for Accuracy: Double-check all entries for accuracy to prevent errors that could lead to penalties.

- Submit the Form: File the completed form by the designated deadline, either online or via mail.

Legal Use of the Mississippi Sales Tax Return Form 72 010

The Mississippi Sales Tax Return Form 72 010 is legally required for businesses operating within the state that collect sales tax. It serves as a formal declaration of sales and tax obligations to the Mississippi Department of Revenue. Accurate and timely submission of this form ensures compliance with state laws and helps avoid potential legal issues, including fines or audits. Businesses should maintain copies of submitted forms for their records.

Filing Deadlines / Important Dates

Understanding filing deadlines for the Mississippi Sales Tax Return Form 72 010 is essential for compliance. The deadlines depend on the reporting frequency:

- Monthly Filers: The form is due on the 20th day of the month following the reporting period.

- Quarterly Filers: The form is due on the 20th day of the month following the end of the quarter.

Filing late can result in penalties and interest on any unpaid tax. Therefore, businesses should mark these dates on their calendars to ensure timely submissions.

Who Issues the Form

The Mississippi Sales Tax Return Form 72 010 is issued by the Mississippi Department of Revenue. This state agency is responsible for the administration and enforcement of sales tax laws in Mississippi. Businesses can obtain the form directly from the department's website or through authorized tax professionals. It is important to use the most current version of the form to ensure compliance with any updates to tax regulations.

Eligibility Criteria

Eligibility to file the Mississippi Sales Tax Return Form 72 010 typically applies to businesses that sell tangible personal property or certain services within the state. Businesses must have a valid sales tax permit issued by the Mississippi Department of Revenue. Additionally, any business that collects sales tax from customers is required to file this form, regardless of the amount of tax collected. Special rules may apply for non-profit organizations and certain exempt entities.

Quick guide on how to complete ms sales tax form 2018 2019

Your assistance manual on how to prepare your Mississippi Sales Tax Return Form 72 010

If you’re wondering how to construct and submit your Mississippi Sales Tax Return Form 72 010, here are some straightforward guidelines on how to simplify tax processing.

To begin, you just need to create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an extremely user-friendly and powerful document solution that allows you to modify, generate, and complete your income tax forms with ease. Using its editor, you can alternate between text, checkboxes, and eSignatures, and return to amend details as necessary. Enhance your tax management with advanced PDF editing, eSigning, and easy sharing options.

Adhere to the steps below to complete your Mississippi Sales Tax Return Form 72 010 in no time:

- Create your account and start working on PDFs immediately.

- Utilize our directory to obtain any IRS tax form; browse through versions and schedules.

- Click Get form to access your Mississippi Sales Tax Return Form 72 010 in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to insert your legally-binding eSignature (if required).

- Examine your document and correct any mistakes.

- Save changes, print your copy, submit it to your recipient, and download it to your device.

Utilize this guide to file your taxes electronically with airSlate SignNow. Please remember that submitting on paper might increase return errors and delay reimbursements. It goes without saying, before e-filing your taxes, review the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct ms sales tax form 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

How do I fill out forms for an MS at US universities for semesters starting in August - September 2018?

Go to the websites of respective universities.In that go under apply tab and see the dates available for application. Every single information is there about everything you will need.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

Create this form in 5 minutes!

How to create an eSignature for the ms sales tax form 2018 2019

How to make an eSignature for the Ms Sales Tax Form 2018 2019 online

How to generate an eSignature for your Ms Sales Tax Form 2018 2019 in Google Chrome

How to create an electronic signature for signing the Ms Sales Tax Form 2018 2019 in Gmail

How to generate an eSignature for the Ms Sales Tax Form 2018 2019 straight from your smartphone

How to make an electronic signature for the Ms Sales Tax Form 2018 2019 on iOS

How to generate an electronic signature for the Ms Sales Tax Form 2018 2019 on Android

People also ask

-

What is the Mississippi sales tax exemption form?

The Mississippi sales tax exemption form is a document that allows eligible individuals or organizations to purchase items without paying sales tax. By completing this form, businesses can save money on their purchases, making it a valuable tool for many. Understanding how to fill out the Mississippi sales tax exemption form correctly is crucial for compliance.

-

How can I obtain the Mississippi sales tax exemption form?

You can obtain the Mississippi sales tax exemption form from the Mississippi Department of Revenue's website or directly through airSlate SignNow. Our platform simplifies the process, allowing you to fill out and eSign the form quickly. Utilizing airSlate SignNow ensures that your form is completed accurately and efficiently.

-

What are the benefits of using airSlate SignNow for the Mississippi sales tax exemption form?

Using airSlate SignNow to handle your Mississippi sales tax exemption form offers numerous benefits, including a user-friendly interface and seamless eSigning capabilities. You'll save time and reduce errors with our automated processes. Additionally, our platform allows for secure document storage and tracking, ensuring your sensitive information is protected.

-

Is there a cost associated with using airSlate SignNow for the Mississippi sales tax exemption form?

Yes, there is a cost associated with using airSlate SignNow, but we offer competitive pricing that provides value for businesses. Our subscription plans are designed to accommodate various needs and budgets, ensuring that you have access to essential tools for managing the Mississippi sales tax exemption form. You'll find that the efficiency gained can outweigh the costs, resulting in savings.

-

Can I integrate airSlate SignNow with other applications for my Mississippi sales tax exemption form?

Absolutely! airSlate SignNow offers a variety of integrations with other popular applications to streamline your workflow. This means you can easily sync your Mississippi sales tax exemption form and other documents with tools you already use. Our platform supports seamless integration, boosting productivity and organization.

-

How does airSlate SignNow ensure the security of my Mississippi sales tax exemption form?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security features to protect your Mississippi sales tax exemption form and other sensitive documents. This commitment to security ensures that your data remains confidential and protected from unauthorized access.

-

Can multiple users collaborate on the Mississippi sales tax exemption form using airSlate SignNow?

Yes, airSlate SignNow supports multiple user collaboration on the Mississippi sales tax exemption form. This functionality allows team members to work together in real-time, streamlining the completion of the form. You can assign roles, track changes, and ensure everyone involved is on the same page.

Get more for Mississippi Sales Tax Return Form 72 010

- Online commercialtax gujarat gov in form

- Nrli form

- Tuition reimbursement form certificated longview school district

- Hub international insurance binder request form

- Me2014 form

- Obligation to serve infants in the cacfp form

- Skip a payskip your monthly spco loan payment and form

- Tdecu direct deposit formv1

Find out other Mississippi Sales Tax Return Form 72 010

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors