RESIDENTIAL RETROFIT CREDIT 2019-2026

What is the residential retrofit credit?

The residential retrofit credit is a tax incentive designed to encourage homeowners to make energy-efficient improvements to their residences. This credit can help offset the costs associated with upgrading heating, cooling, and insulation systems, as well as other energy-saving installations. By taking advantage of this credit, homeowners can reduce their overall tax liability while contributing to energy conservation efforts.

How to use the residential retrofit credit

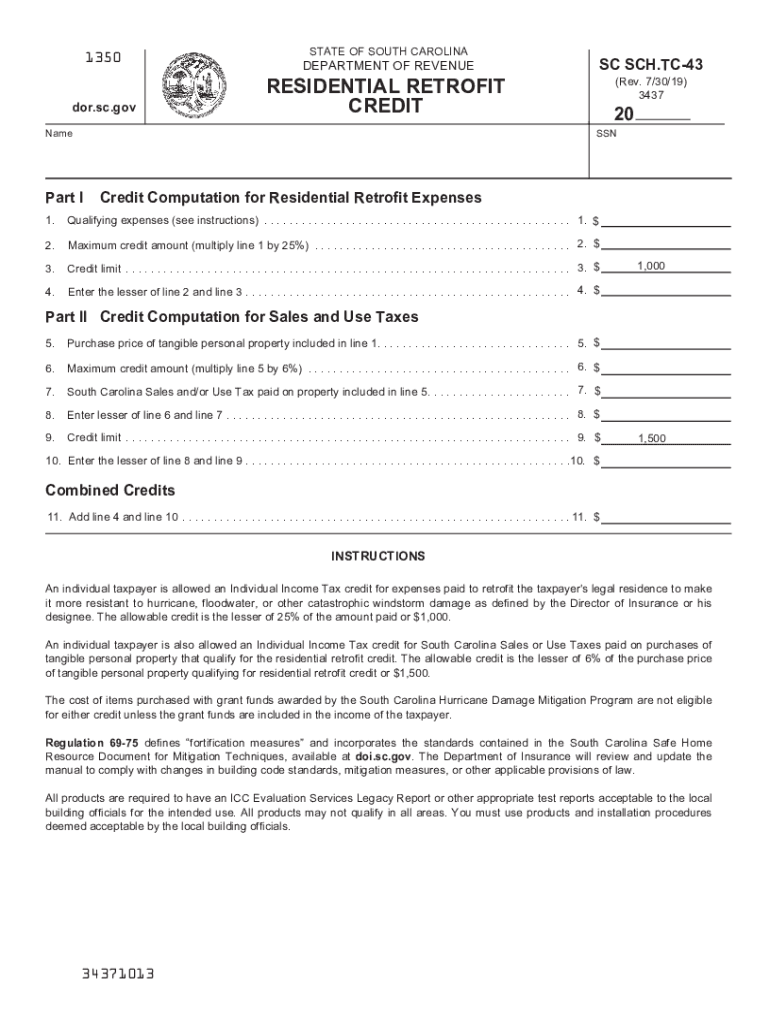

To utilize the residential retrofit credit, homeowners must first ensure that the improvements made qualify under the current tax guidelines. After confirming eligibility, they should keep detailed records of all expenses related to the retrofit, including receipts and invoices. When filing taxes, the homeowner will need to complete the appropriate forms, such as the SC TC 43, and provide documentation of the improvements made. This process allows for the credit to be applied directly against the tax owed.

Key elements of the residential retrofit credit

Several key elements define the residential retrofit credit, including:

- Eligibility criteria: Homeowners must meet specific requirements regarding the types of improvements made and the energy efficiency standards achieved.

- Credit amount: The amount of credit available can vary based on the improvements made and the total expenditures incurred.

- Documentation: Proper documentation is essential to substantiate claims for the credit, including receipts and proof of installation.

Steps to complete the residential retrofit credit

Completing the residential retrofit credit involves several steps:

- Identify eligible improvements that qualify for the credit.

- Complete the necessary installations and keep all related documentation.

- Fill out the SC TC 43 form accurately, ensuring all required information is included.

- Submit the completed form along with your tax return to claim the credit.

Required documents

Homeowners must gather and submit specific documents when applying for the residential retrofit credit. These typically include:

- Receipts for all materials and services related to the energy-efficient improvements.

- Warranties or guarantees for installed systems, if applicable.

- The completed SC TC 43 form, which details the improvements made and the credit claimed.

Eligibility criteria

To qualify for the residential retrofit credit, homeowners must meet certain eligibility criteria. These may include:

- The property must be a primary residence located within the state.

- Improvements must be made to systems that enhance energy efficiency, such as insulation, windows, or HVAC systems.

- All installations must comply with local building codes and regulations.

Quick guide on how to complete residential retrofit credit

Easily prepare RESIDENTIAL RETROFIT CREDIT on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow provides all the resources you need to create, edit, and electronically sign your documents swiftly and without hold-ups. Manage RESIDENTIAL RETROFIT CREDIT on any platform using the airSlate SignNow apps for Android or iOS and enhance your document-centric processes today.

How to modify and electronically sign RESIDENTIAL RETROFIT CREDIT effortlessly

- Obtain RESIDENTIAL RETROFIT CREDIT and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Create your electronic signature with the Sign feature, which only takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to apply your modifications.

- Choose your preferred method for sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

No more concerns about lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you select. Modify and electronically sign RESIDENTIAL RETROFIT CREDIT to ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct residential retrofit credit

Create this form in 5 minutes!

How to create an eSignature for the residential retrofit credit

How to generate an electronic signature for a PDF file online

How to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

How to generate an eSignature straight from your mobile device

How to make an eSignature for a PDF file on iOS

How to generate an eSignature for a PDF document on Android devices

People also ask

-

What is the sch tc43 blank and how is it used?

The sch tc43 blank is a specific tax form used for reporting certain deductions. By utilizing airSlate SignNow, you can easily complete and eSign the sch tc43 blank digitally. This streamlines the filing process and minimizes the chances of error, ensuring that your tax submission is accurate and compliant.

-

How does airSlate SignNow simplify the completion of the sch tc43 blank?

AirSlate SignNow provides an intuitive interface that makes completing the sch tc43 blank straightforward. With features like templates and pre-filled fields, users can quickly fill out information without hassle. This reduces the time spent on paperwork and helps ensure that your documents are completed correctly.

-

Is there a cost associated with using airSlate SignNow for the sch tc43 blank?

While airSlate SignNow offers various pricing plans, the specific cost may vary based on features and usage. However, investing in airSlate SignNow for managing forms like the sch tc43 blank can lead to signNow savings in time and hassle. We recommend checking the pricing page for the most accurate and current information.

-

Can I integrate airSlate SignNow with other applications to manage the sch tc43 blank?

Yes, airSlate SignNow offers integrations with a wide range of applications, enabling users to manage the sch tc43 blank within their preferred workflow tools. This seamless integration allows for better data management and enhances efficiency. Ensure that your team can collaborate effectively on the sch tc43 blank by utilizing these integration options.

-

What features does airSlate SignNow provide for eSigning the sch tc43 blank?

AirSlate SignNow includes secure eSigning capabilities for the sch tc43 blank, ensuring that your documents are legally binding and compliant. Features such as timestamping and audit trails provide additional security and verification for your eSignatures. This ensures peace of mind when submitting important tax documents.

-

How can airSlate SignNow help ensure compliance when completing the sch tc43 blank?

Using airSlate SignNow for the sch tc43 blank helps ensure compliance with tax regulations through its secure and structured process. The platform guides you through the necessary steps and provides prompts to avoid missing critical information, thus reducing the risk of errors. This commitment to accuracy supports your compliance efforts.

-

What support options are available for airSlate SignNow users completing the sch tc43 blank?

AirSlate SignNow offers various support options, including a comprehensive help center and customer service representatives ready to assist with any questions about the sch tc43 blank. Whether you need technical assistance or guidance on document preparation, their support team is there to help. Utilizing these resources ensures a smooth experience.

Get more for RESIDENTIAL RETROFIT CREDIT

- Jury instruction charge form

- Jury instruction conspiracy 497334214 form

- Jury instruction pinkerton instruction form

- Jury instruction conspiracy 497334216 form

- Middlesex community college transcript request form

- Loan note guarantee forms sc egov usda

- Rc 1 form

- Form rc 1 federal reserve bank subscriber access request

Find out other RESIDENTIAL RETROFIT CREDIT

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word