CITY of PHILADEPHIA 2019

Understanding the Philadelphia BIR Tax Form 2018

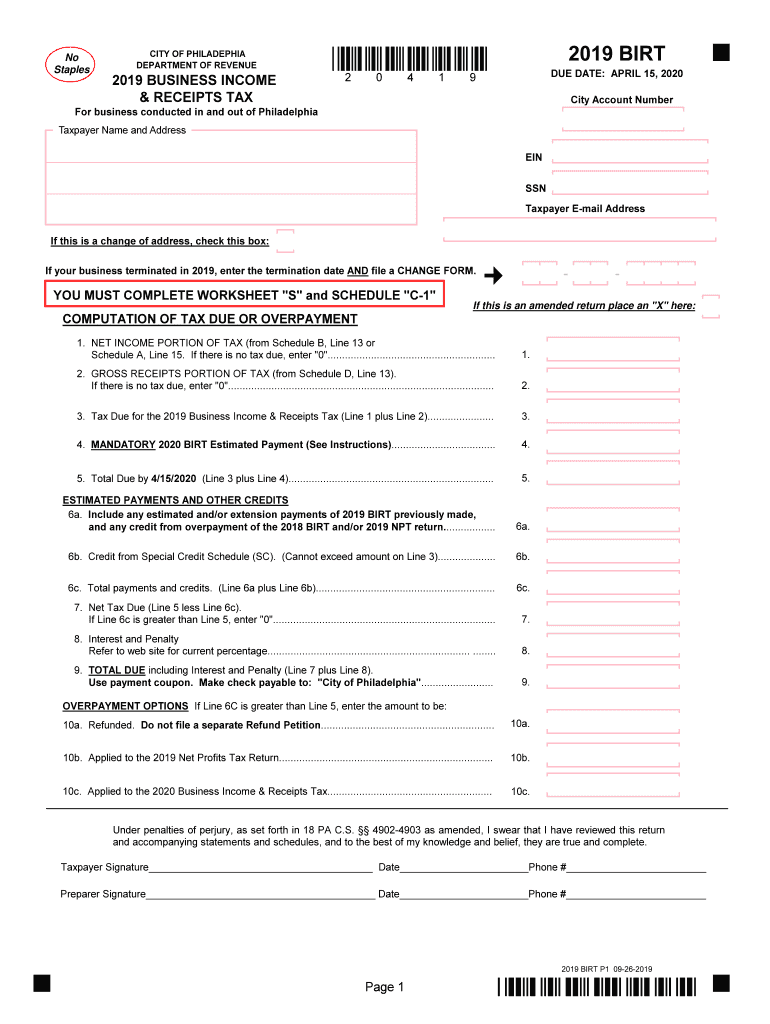

The Philadelphia BIR Tax Form 2018 is a crucial document for individuals and businesses operating within the city. This form is primarily used to report business income and determine the Business Income and Receipts Tax (BIRT) owed to the city. It is essential for compliance with local tax regulations and ensures that businesses contribute their fair share to the city’s revenue. Understanding the specific requirements and how to accurately complete this form can help avoid penalties and ensure timely filing.

Steps to Complete the Philadelphia BIR Tax Form 2018

Completing the Philadelphia BIR Tax Form 2018 involves several key steps:

- Gather all necessary financial documents, including income statements, receipts, and any previous tax filings.

- Fill out the form accurately, ensuring that all income and expenses are reported correctly. This includes gross receipts and allowable deductions.

- Double-check all entries for accuracy, as errors can lead to penalties or audits.

- Sign and date the form to certify that the information provided is true and correct.

Filing Deadlines for the Philadelphia BIR Tax Form 2018

Timely filing of the Philadelphia BIR Tax Form 2018 is essential to avoid penalties. The deadline for filing this form typically aligns with the federal tax return deadlines. For most businesses, this means the form must be submitted by April 15 of the following year. However, if you are unable to meet this deadline, it is advisable to file for an extension to avoid late fees.

Form Submission Methods for the Philadelphia BIR Tax Form 2018

The Philadelphia BIR Tax Form 2018 can be submitted through various methods:

- Online: Utilize the city’s online tax portal for electronic submission, which is often the quickest method.

- Mail: Send a printed copy of the completed form to the appropriate city tax office address.

- In-Person: Visit a local tax office to submit the form directly, which may provide immediate confirmation of submission.

Legal Use of the Philadelphia BIR Tax Form 2018

The Philadelphia BIR Tax Form 2018 is legally binding once submitted and accepted by the city’s revenue department. It is crucial to ensure that all information is accurate and complete to avoid any legal repercussions. Misrepresentation or failure to file can result in fines, penalties, or further legal action. Understanding the legal implications of this form is vital for all business owners operating in Philadelphia.

Required Documents for the Philadelphia BIR Tax Form 2018

When preparing to file the Philadelphia BIR Tax Form 2018, certain documents are necessary to support the information reported. These documents typically include:

- Financial statements, including profit and loss statements.

- Receipts and invoices related to business income and expenses.

- Previous tax returns, if applicable, to provide context for current filings.

Penalties for Non-Compliance with the Philadelphia BIR Tax Form 2018

Failure to file the Philadelphia BIR Tax Form 2018 on time or providing inaccurate information can lead to significant penalties. These may include:

- Late filing fees, which can accumulate over time.

- Interest on unpaid taxes, increasing the total amount owed.

- Potential audits by the city’s revenue department, leading to further scrutiny of business finances.

Quick guide on how to complete city of philadephia

Effortlessly prepare CITY OF PHILADEPHIA on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed papers, as you can access the necessary template and securely keep it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without hassles. Handle CITY OF PHILADEPHIA on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign CITY OF PHILADEPHIA effortlessly

- Obtain CITY OF PHILADEPHIA and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize important parts of the documents or redact confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, time-consuming form searches, or errors requiring new document prints. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you choose. Modify and electronically sign CITY OF PHILADEPHIA and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct city of philadephia

Create this form in 5 minutes!

How to create an eSignature for the city of philadephia

How to generate an eSignature for your PDF in the online mode

How to generate an eSignature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

How to make an eSignature straight from your smart phone

The best way to create an electronic signature for a PDF on iOS devices

How to make an eSignature for a PDF document on Android OS

People also ask

-

What is the Philadelphia BIR tax form 2018?

The Philadelphia BIR tax form 2018 is a document required by the City of Philadelphia for businesses to report their earnings and calculate their Business Income and Receipts Tax. Completing this form accurately ensures compliance with local tax regulations and helps avoid penalties.

-

How can I obtain the Philadelphia BIR tax form 2018?

You can obtain the Philadelphia BIR tax form 2018 by visiting the official Philadelphia Department of Revenue website, where it is available for download. Additionally, you can also print it directly from the website or request a physical copy to be mailed to you.

-

What features does airSlate SignNow offer for signing the Philadelphia BIR tax form 2018?

AirSlate SignNow offers a user-friendly interface that allows you to easily upload, sign, and send the Philadelphia BIR tax form 2018 electronically. With features like templates, reusable signatures, and document editing, SignNow streamlines your eSignature process for all tax-related documents.

-

Is airSlate SignNow cost-effective for managing the Philadelphia BIR tax form 2018?

Yes, airSlate SignNow provides a cost-effective solution for managing the Philadelphia BIR tax form 2018. With flexible pricing plans that cater to businesses of all sizes, you can save time and resources while ensuring your documents are signed and stored securely.

-

Can I integrate airSlate SignNow with my accounting software for the Philadelphia BIR tax form 2018?

Absolutely! AirSlate SignNow integrates seamlessly with various accounting and financial software, which can simplify the process of filling and filing the Philadelphia BIR tax form 2018. These integrations help you maintain accuracy and efficiency in managing your business finances.

-

What are the benefits of using airSlate SignNow for the Philadelphia BIR tax form 2018?

Using airSlate SignNow for the Philadelphia BIR tax form 2018 allows you to save time, reduce paperwork, and improve your document management workflow. The platform enhances collaboration and security, making it easier for businesses to comply with tax regulations efficiently.

-

How secure is airSlate SignNow when handling the Philadelphia BIR tax form 2018?

AirSlate SignNow prioritizes security and compliance, implementing advanced encryption and authentication methods to protect your documents, including the Philadelphia BIR tax form 2018. You can confidently manage sensitive tax information without worrying about data bsignNowes.

Get more for CITY OF PHILADEPHIA

- Jury instruction lesser offense form

- Instruction entrapment form

- Jury instruction charge 497334356 form

- Affidavit of request consent and guarantee weg docx form

- Trade licence application checklist form

- Northern tier high adventure boy scouts of america ntier form

- Option form christ church foundation school

- Fillable online omega psi phi fraternity inc form

Find out other CITY OF PHILADEPHIA

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form